IBM 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

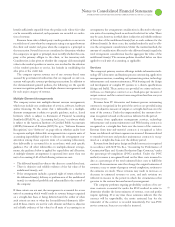

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

•

•

Amounts paid to clients in excess of the fair value of acquired assets

used in outsourcing arrangements are deferred and amortized on a

straight-line basis as a reduction of revenue over the expected period

of benefit not to exceed the term of the contract. The company

performs periodic reviews to assess the recoverability of deferred

contract transition and setup costs. This review is done by compar-

ing the estimated minimum remaining undiscounted cash flows of

a contract to the unamortized contract costs. If such minimum

undiscounted cash flows are not sufficient to recover the unamor-

tized costs, a loss is recognized.

Deferred services transition and setup costs were $, million

and $, million at December , and December , ,

respectively. The primary driver of the increase was the

continued

growth of the Global Services business. Amortization expense

of

deferred services transition and setup costs is estimated at December

, to be $ million in , $ million in , $ million

in , $ million in and $ million thereafter.

Deferred amounts paid to clients in excess of the fair value of

acquired assets used in outsourcing arrangements were $ million

and $ million at December , and December , ,

respectively. Amortization of deferred amounts paid to clients in

excess of the fair value of acquired assets is recorded as an offset of

revenue and is estimated at December , to be $ million in

, $ million in , $ million in , $ million in and

$ million thereafter.

In situations in which an outsourcing contract is terminated, the

terms of the contract may require the client to reimburse the com-

pany for the recovery of unbilled accounts receivable, unamortized

deferred costs incurred to purchase specific assets utilized in the

delivery of services and to pay any additional costs incurred by the

company to transition the services.

Costs that are related to the conceptual formulation and design of

licensed programs are expensed as incurred to research, development

and engineering expense; costs that are incurred to produce the fin-

ished product after technological feasibility has been established are

capitalized as an intangible asset. Capitalized amounts are amortized

using the straight-line method, which is applied over periods ranging

up to three years. The company performs periodic reviews to ensure

that unamortized program costs remain recoverable from future

revenue. Costs to support or service licensed programs are charged

to software cost as incurred.

The company capitalizes certain costs that are incurred to pur-

chase or to create and implement internal-use computer software,

which includes software coding, installation, testing and certain data

conversions. These capitalized costs are amortized on a straight-line

basis over two years and are recorded in selling, general and admin-

istrative expense. See note J, “Intangible Assets Including Goodwill,”

on pages and .

The company offers warranties for its hardware products that range

up to three years, with the majority being either one or three years.

Estimated costs for warranty terms standard to the deliverable are

recognized when revenue is recorded for the related deliverable. The

company estimates its warranty costs standard to the deliverable

based on historical warranty claim experience and applies this esti-

mate to the revenue stream for products under warranty. Estimated

future costs for warranties applicable to revenue recognized in the

current period are charged to cost of revenue. The warranty accrual

is reviewed quarterly to verify that it properly reflects the remaining

obligation based on the anticipated expenditures over the balance of

the obligation period. Adjustments are made when actual warranty

claim experience differs from estimates. Costs from fixed-price support

or maintenance contracts, including extended warranty contracts, are

recognized as incurred.

Revenue from extended warranty contracts, for which the company

is obligated to perform, is recorded as deferred income and subse-

quently recognized on a straight-line basis over the delivery period.

Changes in the company’s deferred income for extended warranty

contracts and warranty liability for standard warranties, which are

included in other accrued expenses and liabilities and other liabilities

on the Consolidated Statement of Financial Position, are presented

in the following tables:

Standard Warranty Liability

($ ) 2008 2007

Balance at January 1 $ 412 $ 582

Current period accruals 390 466

Accrual adjustments to reflect actual experience 16 (29)

Charges incurred (460) (607)

BALANCE AT DECEMBER 31 $ 358 $ 412

Extended Warranty Liability

($ ) 2008 2007

Aggregate deferred revenue at January 1 $ 409 $131

Revenue deferred for new extended

warranty contracts 335 331

Amortization of deferred revenue (134) (61)

Other(a) (21) 7

BALANCE AT DECEMBER 31 $ 589 $409

Current portion $ 234 $161

Noncurrent portion 355 247

BALANCE AT DECEMBER 31 $ 589 $409

(a)

Other consists primarily of foreign currency translation adjustments.