IBM 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ............................................................................................. 18

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

A – E ........................................................................................................................66

F – J ........................................................................................................................86

K– Q .......................................................................................................................88

K. BORROWINGS .................................................................................................88

L. DERIVATIVES AND HEDGING TRANSACTIONS ..............................................90

M. OTHER LIABILITIES ..........................................................................................94

N. STOCKHOLDERS’ EQUITY ACTIVITY ...............................................................95

O. CONTINGENCIES AND COMMITMENTS ..........................................................97

P. TAXES ...............................................................................................................99

Q. RESEARCH, DEVELOPMENT AND ENGINEERING ......................................... 101

R –W ..................................................................................................................... 102

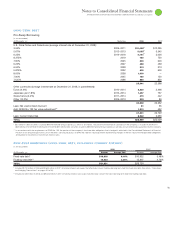

Pre-swap annual contractual maturities of long-term debt outstand-

ing at December , , are as follows:

($ )

2009 $ 8,931

2010 2,170

2011 3,097

2012 3,078

2013 2,557

2014 and beyond 10,668

TOTAL $30,502

($ )

For the year ended December : 2008 2007 2006

Cost of financing $ 788 $ 811 $ 692

Interest expense 687 753 398

Net investment derivative activity (13) (142) (120)

Interest capitalized 15 9 11

TOTAL INTEREST PAID AND ACCRUED $1,477 $1,431 $ 981

Refer to the related discussion on page in note V, “Segment Infor-

mation,” for total interest expense of the Global Financing segment.

See note L, “Derivatives and Hedging Transactions,” on pages to

for a discussion of the use of currency and interest rate swaps in

the company’s debt risk management program.

The company maintains a five-year, $ billion Credit Agreement

(the Credit Agreement), which expires on June , . The total

expense recorded by the company related to this facility was $. mil-

lion in , $. million in and $. million in . The

amended Credit Agreement permits the company and its Subsidiary

Borrowers to borrow up to $ billion on a revolving basis.

Borrowings of the Subsidiary Borrowers will be unconditionally

backed by the company. The company may also, upon the agreement

of either existing lenders, or of the additional banks not currently

party to the Credit Agreement, increase the commitments under the

Credit Agreement up to an additional $. billion. Subject to cer-

tain terms of the Credit Agreement, the company and Subsidiary

Borrowers may borrow, prepay and reborrow amounts under the

Credit Agreement at any time during the Credit Agreement. Interest

rates on borrowings under the Credit Agreement will be based on

prevailing market interest rates, as further described in the Credit

Agreement. The Credit Agreement contains customary representations

and warranties, covenants, events of default, and indemnification

provisions. The company believes that circumstances that might give

rise to breach of these covenants or an event of default, as specified in

the Credit Agreement are remote. The company’s other lines of credit,

most of which are uncommitted, totaled approximately $, mil-

lion and $, million at December , and , respectively.

Interest rates and other terms of borrowing under these lines of credit

vary from country to country, depending on local market conditions.

($ )

At December : 2008 2007

Unused lines:

From the committed global credit facility

$ 9,888 $ 9,792

From other committed and uncommitted lines 8,376 7,895

TOTAL UNUSED LINES OF CREDIT $18,264 $17,687

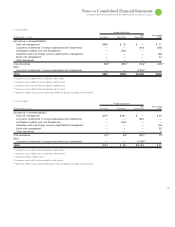

Note L.

Derivatives and Hedging Transactions

The company operates in multiple functional currencies and is a

significant borrower and lender in the global markets. In the normal

course of business, the company is exposed to the impact of interest

rate changes and foreign currency fluctuations, and to a lesser extent

equity price changes and client credit risk. The company limits these

risks by following established risk management policies and proce-

dures, including the use of derivatives, and, where cost effective,

financing with debt in the currencies in which assets are denominated.

For interest rate exposures, derivatives are used to align rate move-

ments between the interest rates associated with the company’s lease

and other financial assets and the interest rates associated with its

financing debt. Derivatives are also used to manage the related cost

of debt. For foreign currency exposures, derivatives are used to limit

the effects of foreign exchange rate fluctuations on financial results.

As a result of the use of derivative instruments, the company is

exposed to the risk that counterparties to derivative contracts will fail

to meet their contractual obligations. To mitigate the counterparty

credit risk, the company has a policy of only entering into contracts

with carefully selected major financial institutions based upon their

credit ratings and other factors, and maintains strict dollar limits

that correspond to each institution’s credit rating. The company’s

established policies and procedures for mitigating credit risk on

principal transactions include reviewing and establishing limits for

credit exposure and continually assessing the creditworthiness of

counterparties. Master agreements with counterparties include mas-

ter netting arrangements as further mitigation of credit exposure to