IBM 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

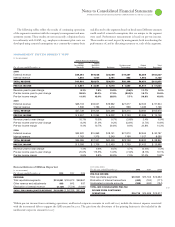

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

At December , , the company’s qualified defined benefit pension

plans were percent funded compared to the benefit obligations.

The U.S. Qualified PPP was percent funded. Overall, including

nonqualifed plans, the company’s defined benefit pension plans were

percent funded.

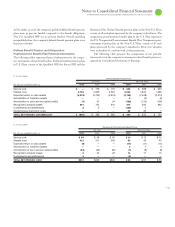

Defined Benefit Pension and Nonpension

Postretirement Benefit Plan Financial Information

The following tables represent financial information for the compa-

ny’s retirement-related benefit plans. Defined benefit pension plans

in U.S. Plans consist of the Qualified PPP, the Excess PPP and the

Retention Plan. Defined benefit pension plans in the Non-U.S. Plans

consist of all such plans sponsored by the company’s subsidiaries. The

nonpension postretirement benefit plan in the U.S. Plan represents

the U.S. Non pension Postretirement Benefit Plan. Nonpension post-

retirement benefit plans in the Non-U.S. Plans consist of all such

plans sponsored by the company’s subsidiaries. Prior-year amounts

were reclassified to conform with presentation.

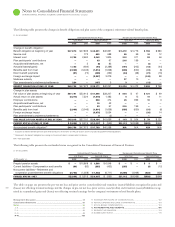

The following table presents the components of net periodic

(income)/cost of the company’s retirement-related benefit plans rec-

ognized in Consoli dated Statement of Earnings.

($ )

Defined Benefit Pension Plans

U.S. Plans Non-U.S. Plans

For the year ended December : 2008 2007 2006 2008 2007 2006

Service cost $ — $ 773 $ 791 $ 660 $ 688 $ 640

Interest cost 2,756 2,660 2,525 2,042 1,825 1,626

Expected return on plan assets (3,978) (3,703) (3,613) (2,725) (2,528) (2,314)

Amortization of transition assets —— — 0(3) (6)

Amortization of prior service costs/(credits) (7) 57 54 (129) (125) (105)

Recognized actuarial losses 291 703 810 612 934 883

Curtailments and settlements 25 — (139) 2 —

Multiemployer plan/other costs —— — 59 29 1

TOTAL NET PERIODIC (INCOME)/COST $ (936) $ 496 $ 569 $ 380 $ 822 $ 724

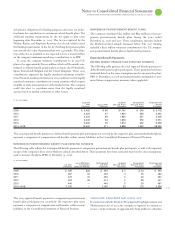

($ )

Nonpension Postretirement Benefit Plans

U.S. Plan Non-U.S. Plans

For the year ended December : 2008 2007 2006 2008 2007 2006

Service cost $ 55 $ 69 $ 62 $ 10 $ 12 $ 12

Interest cost 312 311 306 53 46 45

Expected return on plan assets (8) — — (10) (11) (10)

Amortization of transition assets — — — 0 1 0

Amortization of prior service costs/(credits) (62) (62) (62) (7) (8) (8)

Recognized actuarial losses 9 24 29 14 17 15

Curtailments and settlements 3 — — (6) — —

TOTAL NET PERIODIC COST $310 $342 $335 $ 53 $ 57 $ 53