IBM 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

growth from through a combination of revenue growth, margin

improvement, growth initiatives, acquisitions and effective capital

deployment to fund growth and provide returns to shareholders

through dividends and common stock repurchases.

In addition to these elements, the company’s roadmap to the $

to $ per share range includes the projected benefit of retire ment-

related costs based on December , assumptions. Actual

retirement-related costs will depend on several factors including

financial market performance, the interest rate environment and

actuarial assumptions. In March , the company met again with

investors and analysts and discussed the progress the company is

making on its roadmap.

The company’s performance in highlighted the benefits of

its global reach and the strength of its business model. The financial

results reflected solid progress on major elements of the long-term

goals, however, the company measures the success of its business

model over the long term, not any individual quarter or year. Earnings

per share growth is dependent on a number of factors and may not

be consistent throughout the periods. The company’s strategies,

investments and actions are all taken with an objective of optimizing

long-term performance.

The continued investments in Software have led to this segment’s

emergence as a strong source of revenue growth and the largest con-

tributor to the company’s profit in and . The Software

business is differentiated in the industry by both the strength of its

individual products and the breadth of the software offerings. Clients

continue to rely on the extensive middleware portfolio to help them

transform their business, streamline costs and seek new business

opportunities. The key to continued Software growth stems from the

ability to maintain and grow this industry-leading software business,

and by continuing to capitalize on industry trends. Investments will

be aligned to advance the company’s growth strategy through new

client acquisition, with specific focus on key industries and local busi-

nesses. The company will also continue to focus on expanding its

software capabilities through a combination of internal development

and strategic acquisitions.

Within the Global Services business, revenue and profit growth

improved and the company saw significant results from the targeted

actions and investments it has made in the last few years. The busi-

ness has been transformed into one that is more flexible and more

focused on higher value segments of the market. The Global Services

business enters with a revenue backlog of $ billion. The port-

folio is strong with a complement of offerings and capabilities that

deliver both high value and productivity to clients. Going forward

the Global Services business will look to build upon its momentum

from the strong performance by continuing its “clients first

approach” and by focusing on further enhancements to its offerings/

integrated solutions portfolio, continuing to improve both the skills

and structure of the business and accelerating the deployment of the

Global Delivery Framework, a set of delivery practices that will

enable consistent global delivery excellence.

In the Systems and Technology business, the company will continue

to focus its investments on differentiating technologies with leader-

ship and high-growth potential including POWER, high-performance

computing, virtualization, nanotechnology and energy efficiency. In

this market, the value has shifted to the high end to address clients’

needs to consolidate and virtualize their environments. The company

will focus on providing clients with a clear path to a fully dynamic infra-

structure that not only reduces cost, but is both intelligent and secure.

In , Global Financing will seek to expand its core business by

accelerating growth in the participation rates for IBM products and

services transactions. In addition, the business will be focused on

optimizing its global infrastructure, resources and processes through

the deployment of its single operating model initiative.

The company expects pre-tax retirement-related plan cost

to be approximately $. billion, an increase of approximately $

million compared to . This estimate reflects current pension plan

assumptions and the impacts of recent pension plan redesign efforts.

See note U, “Retirement-Related Benefits,” on pages to for

additional information.

The company expects in the normal course of business that its

effective tax rate in will be approximately . percent. The rate

will change year to year based on non-recurring events, such as the

settlement of income tax audits, as well as recurring factors including

the geographic mix of income before taxes, the timing and amount of

foreign dividend repatriation, state and local taxes and the effects of

various global income tax strategies.

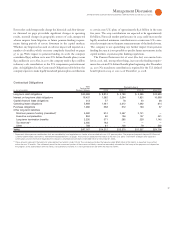

The company has consistently generated strong cash flow from

operations, providing a source of funds ranging between $. billion

and $. billion per year over the past five years. The company

provides for additional liquidity through several sources: maintaining

a sizable cash balance, access to global funding sources, a committed

global credit facility and other committed and uncommitted lines

of credit worldwide. At December , , the company had total

unused lines of credit of $, million. The following table pro-

vides a summary of these major sources of liquidity for the years

ended December , through .

Cash Flow and Liquidity Trends

($ ) 2008 2007 2006 2005 2004

Net cash from

operating activities $18.8 $16.1 $15.0 $14.9 $15.3

Cash and short-term

marketable securities $12.9 $16.1 $10.7 $13.7 $10.6

Committed global credit

facilities $10.0 $10.0 $10.0 $10.0 $10.0

Trade receivables

securitization facility $ — $ — $ — $ 0.5 $ 0.5