IBM 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ................................................................................................18

ROAD MAP ............................................................................................................ 18

FORWARD-LOOKING AND CAUTIONARY STATEMENTS ...................................... 18

MANAGEMENT DISCUSSION SNAPSHOT ............................................................ 19

DESCRIPTION OF BUSINESS................................................................................20

YEAR IN REVIEW ..................................................................................................25

PRIOR YEAR IN REVIEW ....................................................................................... 39

DISCONTINUED OPERATIONS ..............................................................................44

OTHER INFORMATION ..........................................................................................44

GLOBAL FINANCING .............................................................................................53

Report Of Management ............................................................................................... 58

Report Of Independent Registered Public Accounting Firm ................................. 59

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

The Global Financing business provides funding predominantly for

the company’s external client assets as well as for assets under con-

tract by other IBM units. These assets, primarily for Global Services,

generate long-term, stable revenue streams similar to the Global

Financing asset portfolio. Based on their nature, these Global Services

assets are leveraged with the balance of the Global Financing asset

base. The debt analysis on page is further detailed in the Global

Finan cing section on page .

Total debt decreased $, million in

versus

, primarily

due to reductions in commercial paper. The debt-

to-capital ratio at

December , was . percent, an increase of . points from

December , , primarily due to the reduction in equity driven

by the pension remeasurements.

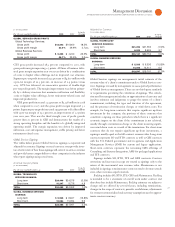

EQUITY

($ )

At December : 2008 2007

Stockholders’ equity

TOTAL $13,465 $28,470

The company’s consolidated stockholders’ equity decreased $,

million in as a result of several key factors:

• A decrease of $, million in accumulated gains and

(l

osses)

not affecting retained earnings resulted from non-cash equity

impacts, primarily from pension remeasurement and other retire-

ment-related activities ($, million), and a decrease in foreign

currency translation adjustments ($, million); and

• A decrease related to net stock transactions of $, million,

driven by common stock repurchases;

Partially offset by:

• An increase of $, million in retained earnings primarily driven

by net income of $, million, partially offset by dividends

($, million).

-

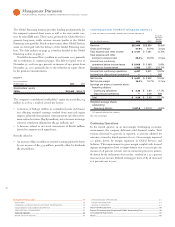

($ )

Yr.-to-Yr.

Percent/

Margin

For the fourth quarter: 2008 2007 Change

Revenue $27,006 $28,866 (6.4)%*

Gross profit margin 47.9% 44.9% 3.0 pts.

Total expense and other income $ 7,127 $ 7,481 (4.7)%

Total expense and other

income-to-revenue ratio 26.4% 25.9% 0.5 pts.

Income from continuing

operations before income taxes $ 5,808 $ 5,489 5.8%

Provision for income taxes 1,382 1,537 (10.1)%

Income from continuing operations 4,427 3,951 12.0%

Income from discontinued operations — 1 NM

Net income $ 4,427 $ 3,952 12.0%

Net income margin 16.4% 13.7% 2.7 pts.

Earnings per share of common stock:

Assuming dilution:

Continuing operations $ 3.28 $ 2.80 17.1%

Discontinued operations — 0.00 NM

Total $ 3.28 $ 2.80 17.1%

Weighted-average shares

outstanding:

Assuming dilution 1,347.9 1,412.9 (4.6)%

* (1.0 ) percent adjusted for currency.

NM—Not meaningful

Continuing Operations

In the fourth quarter, in an increasingly challenging economic

environment, the company delivered solid financial results. Total

revenue decreased . percent as reported, . percent adjusted for

currency, versus the fourth quarter of . Gross margin improved

. points driven by margin expansion in Global Services and

Software. This improvement in gross margin coupled with focused

expense management drove an improvement year to year in pre-tax

income of . percent. A lower tax rate versus the prior year, primar-

ily driven by the utilization of tax credits , resulted in a . percent

increase in net income. Diluted earning per share of $. increased

. percent year to year.