IBM 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Fourth quarter revenue performance was impacted by currency

and the changing economic environment, but the modest decline of

. percent adjusted for currency reflects the company’s broad busi-

ness capabilities and contribution from the annuity content of the

business model. Adjusted for currency, revenue performance was led

by growth in the Software and Global Services segments offset by a

decline in Systems and Technology.

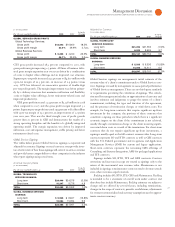

The Global Services segments combined had $, million of

revenue in the fourth quarter, a decrease of . percent (increase of

percent adjusted for currency) and delivered pre-tax profit of

$, million, an increase of . percent year to year. The services

business performed exceptionally well in the current economic envi-

ronment through disciplined execution on resource optimization and

improved operating efficiencies, while at the same time delivering

services with a high level of quality and customer satisfaction. Total

signings for Global Services in the fourth quarter were $, million,

a decrease of percent (increase of percent adjusted for currency)

versus the fourth quarter of . Signings in the quarter included

deals larger than $ million. Long-term signings of $, million

decreased percent (increased percent adjusted for currency) with

a percent growth in Strategic Outsourcing signings. Short-term

signings decreased percent ( percent adjusted for currency) to

$, million, compared to a very strong fourth quarter of .

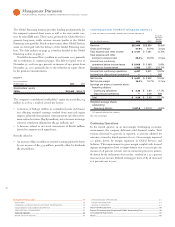

GTS revenue of $, million decreased . percent (increased

percent adjusted for currency) versus the fourth quarter of .

GTS signings of $, million decreased percent (increased

percent adjusted for currency) with long-term signings increasing

percent ( percent adjusted for currency) to $, million, offset

by a percent decrease ( percent adjusted for currency) in short-

term signings. SO revenue decreased . percent (increased percent

adjusted for currency). SO signings increased percent ( percent

adjusted for currency) led by strong signings in the U.S. and Europe

as clients turn to outsourcing’s value proposition as an effective way

to attain their financial objectives in this economic climate. ITS

revenue increased . percent ( percent adjusted for currency). ITS

signings decreased percent ( percent adjusted for currency),

although signings in the key infrastructure offerings continued to be

good. BTO revenue decreased . percent ( percent adjusted for

currency) and signings decreased percent ( percent adjusted for

currency). GTS gross profit increased . percent in the quarter and

the gross margin improved . points with margin expansion in all

lines of business. The GTS segment fourth-quarter pre-tax profit was

up . percent and the margin improved . points to . percent

from fourth-quarter . This was the sixth consecutive quarter of

double-digit pre-tax profit growth in GTS. The margin improve-

ment was driven primarily by a delivery structure that maximizes

utilization and flexibility, a mix to higher value offerings, lower total

managed labor costs and a global skills mix that efficiently moves

resources to opportunities.

GBS revenue of $, million decreased . percent (flat

adjusted for currency) compared to fourth-quarter . In the cur-

rent economy, offerings that deliver cost savings continued to drive

the majority of business, although demand for transformational and

compliance offerings also increased. GBS signings of $, mil-

lion, decreased percent ( percent adjusted for currency), driven by

a percent decline ( percent adjusted for currency) in long-term

signings. Short-term signings of $, million decreased percent

(increased percent adjusted for currency) in the quarter. Cost savings

offerings accounted for the majority of the new signings. GBS gross

profit increased . percent in the quarter with the gross margin

improving . points. The GBS segment pre-tax profit increased

. percent in the quarter and the margin expanded . points to

. percent. The margin performance reflects a strong operating

discipline and the benefits of a globally integrated operating model.

Despite slower revenue growth, utilization improved year to year

resulting from resource optimization throughout the globally inte-

grated capacity model as well as effective balancing of domestic, global

and subcontracted resources. GBS also benefited from continued deal

selectivity, stable pricing, lower managed labor costs and ongoing

operational efficiencies.

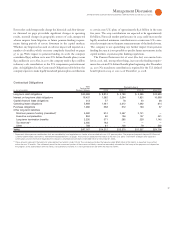

Software segment revenue of $, million, increased . percent

( percent adjusted for currency), driven by solid sales execution and

growth in mission critical production software. Customers continue

to utilize infrastructure software in their production environments to

optimize their data centers. Many large customers signed multi-year

deals in the fourth quarter demonstrating continued commitment to

the company’s technology. Revenue growth was led by Americas with

an increase of percent, adjusted for currency. Revenue from Key

Branded Middleware increased . percent ( percent adjusted for

currency) and represented percent of total software revenue.

Revenue from the WebSphere Family of products declined . per-

cent (increased percent adjusted for currency) in the quarter.

Information Management revenue increased . percent ( percent

adjusted for currency) driven by contribution from Cognos as well as

organic growth. Revenue from Distributed Relational Database prod-

ucts increased over percent, adjusted for currency. Lotus revenue

decreased . percent (increased percent adjusted for currency)

capitalizing on the strong performance of collaboration software.

Tivoli software revenue decreased . percent (increased percent

adjusted for currency). Rational revenue decreased . percent

(increased percent adjusted for currency) compared to a strong

fourth-quarter with revenue performance led by Telelogic.

Software gross profit increased . percent with margin improve-

ment of . points. The Software segment delivered pre-tax profit of

$, million, an increase of . percent. The pre-tax margin of

. percent increased . points compared to fourth-quarter .

The large annuity base in the software business continues to provide

a predictable and growing stream of profit and cash.