IBM 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ............................................................................................. 18

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

A – E ........................................................................................................................66

F – J ........................................................................................................................86

K– Q .......................................................................................................................88

K. BORROWINGS .................................................................................................88

L. DERIVATIVES AND HEDGING TRANSACTIONS ................................................90

M. OTHER LIABILITIES ..........................................................................................94

N. STOCKHOLDERS’ EQUITY ACTIVITY ...............................................................95

O. CONTINGENCIES AND COMMITMENTS .........................................................97

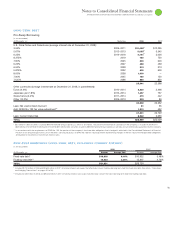

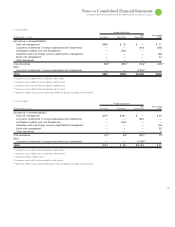

P. TAXES ...............................................................................................................99

Q. RESEARCH, DEVELOPMENT AND ENGINEERING ......................................... 101

R –W ..................................................................................................................... 102

officials of government-controlled entities in Korea and bid rigging.

IBM Korea and LG IBM cooperated fully with authorities in these

matters. A number of individuals, including former IBM Korea and

LG IBM employees, were subsequently found guilty and sentenced.

IBM Korea and LG IBM were also required to pay fines. Debarment

orders were imposed at different times, covering a period of no more

than a year from the date of issuance, which barred IBM Korea from

doing business directly with certain government-controlled entities

in Korea. All debarment orders have since expired and when they

were in force did not prohibit IBM Korea from selling products and

services to business partners who sold to government-controlled

entities in Korea. In addition, the U.S. Department of Justice and the

SEC have both contacted the company in connection with this mat-

ter. In March , the company received a request from the SEC for

additional information.

On March , , the company was temporarily suspended

from participating in new business with U.S. Federal government

agencies. The notice of temporary suspension was issued by the

Environmental Protection Agency (EPA) and related to an investiga-

tion by the EPA of possible violations of the Procurement Integrity

provisions of the Office of Federal Procurement Policy Act regarding

a specific bid for business with the EPA originally submitted in March

. In addition, the U.S. Attorney’s Office for the Eastern District

of Virginia served the company and certain employees with grand jury

subpoenas related to the bid, requesting testimony and documents

regarding interactions between employees of the EPA and certain

company employees. On April , , the company announced an

agreement with the EPA that terminated the temporary suspension

order. In January , the U.S. Attorney’s Office for the Eastern

District of Virginia confirmed that it was closing its investigation and

would bring no charges in this matter. The company is continuing to

cooperate with the EPA.

The company is a defendant in a civil lawsuit brought in Tokyo

District Court by Tokyo Leasing Co., Ltd., which seeks to recover

losses that it allegedly suffered after IXI Co., Ltd. initiated civil reha-

bilitation (bankruptcy) proceedings in Japan and apparently failed to

pay Tokyo Leasing amounts for which Tokyo Leasing now seeks to

hold IBM and others liable. The claims in this suit include tort and

breach of contract.

The company is a defendant in numerous actions filed after

January , in the Supreme Court for the State of New York,

county of Broome, on behalf of hundreds of plaintiffs. The com-

plaints allege numerous and different causes of action, including for

negligence and recklessness, private nuisance and trespass. Plaintiffs

in these cases seek medical monitoring and claim damages in unspec-

ified amounts for a variety of personal injuries and property damages

allegedly arising out of the presence of groundwater contamination

and vapor intrusion of groundwater contaminants into certain struc-

tures in which plaintiffs reside or resided, or conducted business,

allegedly resulting from the release of chemicals into the environment

by the company at its former manufacturing and development facility

in Endicott. These complaints also seek punitive damages in an

unspecified amount.

The company is party to, or otherwise involved in, proceedings

brought by U.S. federal or state environmental agencies under the

Comprehensive Environmental Response, Compensation and Liability

Act (CERCLA), known as “Superfund,” or laws similar to CERCLA.

Such statutes require potentially responsible parties to participate in

remediation activities regardless of fault or ownership of sites. The

company is also conducting environmental investigations, assessments

or remediations at or in the vicinity of several current or former

operating sites globally pursuant to permits, administrative orders or

agreements with country, state or local environmental agencies, and

is involved in lawsuits and claims concerning certain current or for-

mer operating sites.

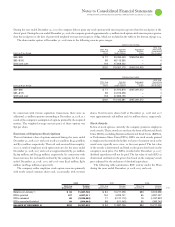

The company is also subject to ongoing tax examinations and

governmental assessments in various jurisdictions. Along with many

other U.S. companies doing business in Brazil, the company is involved

in various challenges with Brazilian authorities regarding non-income

tax assessments and non-income tax litigation matters. These matters

principally relate to claims for taxes on the importation of computer

software. The total amounts related to these matters are approxi-

mately $. billion, including amounts currently in litigation and

other amounts. In November , the company won a significant

case in the Superior Chamber of the federal administrative tax court

in Brazil and is awaiting the published decision of the case. Assuming

this decision is upheld, the remaining total potential amount related to

these matters for all applicable years is approximately $ million.

In addition, the company has received an income tax assessment from

Mexican authorities relating to the deductibility of certain warranty

payments. In response, the company has filed an appeal in the Mexican

Federal Fiscal court. The total potential amount related to this matter

for all applicable years is approximately $ million. The company

believes it will prevail on these matters and that these amounts are

not meaningful indicators of liability.

In accordance with SFAS No. , “Accounting for Contingencies,”

(SFAS No. ), the company records a provision with respect to a claim,

suit, investigation or proceeding when it is probable that a liability

has been incurred and the amount of the loss can be reasonably esti-

mated. Provisions related to income tax matters are recorded in

accordance with FIN . Claims and proceedings are reviewed at