IBM 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

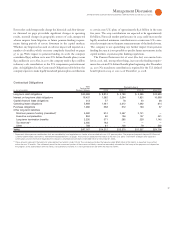

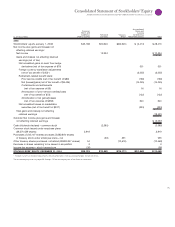

($ ) December 31, 2008 December 31, 2007

Global Financing Segment: $24,360 $24,532

Debt to support external clients $20,892 $21,072

Debt to support internal clients 3,468 3,460

Non-Global Financing Segments: 9,566 10,743

Debt supporting operations 13,034 14,203

Intercompany activity (3,468) (3,460)

TOTAL COMPANY DEBT $33,926 $35,274

Liquidity and Capital Resources

Global Financing is a segment of the company and as such, is sup-

ported by the company’s overall liquidity position and access to capital

markets. Cash generated by Global Financing was primarily deployed

to pay intercompany payables and dividends to the company in order

to maintain an appropriate debt-to-equity ratio.

($ )

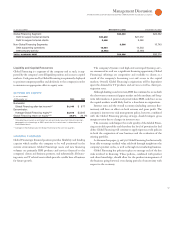

At December : 2008 2007

Numerator:

Global Financing after-tax income

(a)* $1,049 $ 877

Denominator:

Average Global Financing equity

(b)** $3,572 $3,365

Global Financing return on equity

(a) /(b) 29.4% 26.1%

* Calculated based upon an estimated tax rate principally based on Global Financing’s

geographic mix of earnings as IBM’s provision for income taxes is determined on a

consolidated basis.

** Average of the ending equity for Global Financing for the last five quarters.

Global Financing’s financial position provides flexibility and funding

capacity which enables the company to be well positioned in the

current environment. Global Financing’s assets and new financing

volumes are primarily IBM products and services financed to the

company’s clients and business partners, and substantially all financ-

ing assets are IT related assets which provide a stable base of business

for future growth.

The company’s System z and high-end converged System p serv-

ers announced in are a significant financing opportunity. Global

Financing’s offerings are competitive and available to clients as a

result of the company’s borrowing cost and access to the capital

markets. Overall, Global Financing’s originations will be dependent

upon the demand for IT products and services as well as client par-

ticipation rates.

Although funding costs have risen, IBM has continued to access both

the short-term commercial paper market and the medium and long-

term debt markets. A protracted period where IBM could not access

the capital markets would likely lead to a slowdown in originations.

Interest rates and the overall economy (including currency fluc-

tuations) will have an effect on both revenue and gross profit. The

company’s interest rate risk management policy, however, combined

with the Global Financing pricing strategy, should mitigate gross

margin erosion due to changes in interest rates.

The economy could impact the credit quality of the Global Finan-

cing receivables portfolio and therefore the level of provision for bad

debts. Global Financing will continue to apply rigorous credit policies

in both the origination of new business and the evaluation of the

existing portfolio.

As discussed on pages and , Global Financing has historically

been able to manage residual value risk both through insight into the

company’s product cycles, as well as through its remarketing business.

Global Financing has policies in place to manage each of the key

risks involved in financing. These policies, combined with product

and client knowledge, should allow for the prudent management of

the business going forward, even during periods of uncertainty with

respect to the economy.