IBM 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ................................................................................................18

ROAD MAP ............................................................................................................ 18

FORWARD-LOOKING AND CAUTIONARY STATEMENTS ...................................... 18

MANAGEMENT DISCUSSION SNAPSHOT ............................................................ 19

DESCRIPTION OF BUSINESS................................................................................20

YEAR IN REVIEW ..................................................................................................25

PRIOR YEAR IN REVIEW .......................................................................................39

DISCONTINUED OPERATIONS ................................................................................44

OTHER INFORMATION ..........................................................................................44

GLOBAL FINANCING .............................................................................................53

Report Of Management ............................................................................................... 58

Report Of Independent Registered Public Accounting Firm ................................. 59

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

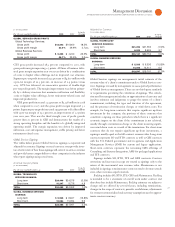

In , Global Services and Software increased as a percentage of total

segment revenue and total segment pre-tax income. Global Services

increased its revenue and profit contribution by . points and .

points, respectively, while the Software business increased by . points

and . points, respectively. These improvements reflect the compa-

ny’s portfolio actions and targeted investment strategies — both aimed

at market segments that present the best long-term opportunities.

GLOBAL SERVICES

The Global Services segments, Global Technology Services (GTS)

and Global Business Services (GBS), had combined revenue of

$, million, an increase of . percent ( percent adjusted for

currency) in when compared to . Revenue performance was

broad based across the segments, lines of business and geographic

units, driven primarily by a strong annuity base and growth in short-

term signings.

In , total Global Services signings increased percent year to

year to $, million ($, million adjusted for currency, flat

year to year). Short-term signings were $, million, an increase of

percent ( percent adjusted for currency) versus . Short-term

signings increased in both the growth markets and the major markets.

Long-term signings were $, million, a decrease of percent

( percent adjusted for currency) compared to . Long-term sign-

ings declined in both the major and growth markets. The total

Global Services backlog decreased $ billion from the prior year to

an estimated $ billion at December , .

The Global Services segments leveraged very strong margin

performance and delivered combined pre-tax profit of $, million

in , an improvement of . percent versus . The services

business contributed approximately percent of the company’s seg-

ment pre-tax profit in . Through its transformation initiatives,

the Global Services business has focused on higher value offerings

with a more flexible labor model that can adapt to changing market

environments.

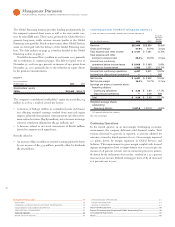

($ )

Yr.-to-Yr.

For the year ended December : 2008 2007 Change

GLOBAL SERVICES REVENUE: $58,891 $54,144 8.8%

Global Technology Services $39,264 $36,103 8.8%

Strategic Outsourcing 20,183 18,701 7.9

Integrated Technology Services 9,283 8,438 10.0

Business Transformation Outsourcing 2,550 2,294 11.2

Maintenance 7,250 6,670 8.7

Global Business Services $19,628 $18,041 8.8%

Global Technology Services revenue increased . percent ( percent

adjusted for currency) in versus with strong performance

across all lines of business. Total signings in GTS increased percent

(flat adjusted for currency) led by short-term signings growth of

percent ( percent adjusted for currency). Long-term signings

decreased percent ( percent adjusted for currency).

Strategic Outsourcing (SO) revenue was up . percent ( percent

adjusted for currency) with growth in all geographies, driven by prior

year’s signings and continued growth in the base accounts. SO sign-

ings in increased percent ( percent adjusted for currency)

when compared to . Signings were very strong in the fourth

quarter (up percent), as clients focused on the value of the SO

offerings in the current environment. The initiatives around stan-

dardization, global integration and improved efficiency are driving

improvements in quality and customer satisfaction which are reflected

in the signings performance and in improved profitability.

Information Technology Services (ITS) revenue increased .

percent ( percent adjusted for currency) in versus led

by growth in key infrastructure offerings such as Green Data Cen-

ter and Converged Communications. ITS infrastructure offerings

deliver high-value, standardized, asset-based services that leverage

the company’s services, hardware and software capabilities, providing

clients end-to-end solutions and processes that transform their busi-

nesses. ITS signings increased percent ( percent adjusted for

currency) in .

Business Transformation Outsourcing (BTO) revenue increased

. percent ( percent adjusted for currency) with growth in all

geographies, led by Asia Pacific. The Daksh business, which is focused

on business process outsourcing, delivered strong growth. BTO sign-

ings decreased percent ( percent adjusted for currency) in

compared to .

Maintenance revenue increased . percent ( percent adjusted

for currency) with growth in availability services on both IBM and

non-IBM IT equipment.

Global Business Services revenue increased . percent ( percent

adjusted for currency) in , with balanced growth across all three

geographies. Revenue performance was led by growth in Application

Management Services (. percent) and Core Consulting (. per-

cent). Total signings in GBS increased percent (decreased percent

adjusted for currency), led by a percent ( percent adjusted for

currency) growth in short-term signings. Short-term signings growth

was driven by offerings that enable clients to reduce cost and conserve

capital. In the second half of the year, signings for transformational

and compliance offerings also increased. Long-term signings decreased

percent ( percent adjusted for currency) year over year.