IBM 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ............................................................................................. 18

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

A – E ........................................................................................................................66

F – J ........................................................................................................................86

K– Q .......................................................................................................................88

K. BORROWINGS ................................................................................................. 88

L. DERIVATIVES AND HEDGING TRANSACTIONS ................................................90

M. OTHER LIABILITIES ..........................................................................................94

N. STOCKHOLDERS’ EQUITY ACTIVITY ...............................................................95

O. CONTINGENCIES AND COMMITMENTS ..........................................................97

P. TAXES ...............................................................................................................99

Q. RESEARCH, DEVELOPMENT AND ENGINEERING ........................................ 101

R –W ..................................................................................................................... 10 2

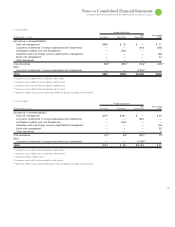

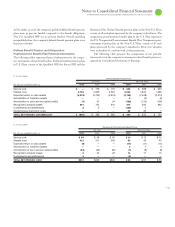

The components of the continuing operations provision for income

taxes by taxing jurisdiction are as follows:

($ )

For the year ended December : 2008 2007 2006

U.S. federal:

Current $ 338 $1,085 $ 602

Deferred 1,263 683 1,326

1,601 1,768 1,928

U.S. state and local:

Current 216 141 11

Deferred 205 (19) 198

421 122 209

Non-U.S.:

Current 1,927 2,105 1,564

Deferred 432 76 200

2,359 2,181 1,764

Total continuing operations

provision for income taxes 4,381 4,071 3,901

Provision for social security,

real estate, personal property

and other taxes 4,076 3,832 3,461

TOTAL TAXES INCLUDED IN INCOME

FROM CONTINUING OPERATIONS $8,457 $7,903 $7,362

A reconciliation of the statutory U.S. federal tax rate to the company’s

continuing operations effective tax rate is as follows:

For the year ended December : 2008 2007 2006

Statutory rate 35% 35% 35%

Foreign tax differential (8) (6) (5)

State and local 11 1

Other (2) (2) (2)

EFFECTIVE RATE 26% 28% 29%

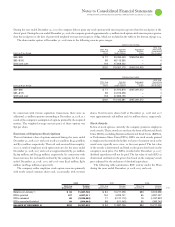

During the second quarter of , the company reached agreement

with the Internal Revenue Service (IRS) regarding claims for certain

tax incentives. The resolution of this matter resulted in a net tax

benefit of $ million. Also, during the second quarter, the company

completed its analysis with respect to certain issues associated with

newly published U.S. tax regulations. The review resulted in a tax

benefit of $ million. The above benefits were predominately offset

by the second-quarter tax cost associated with the intercompany

transfer of certain intellectual property during the quarter.

During the fourth quarter of , the IRS concluded its examina-

tion of the company’s income tax returns for and and issued

a final Revenue Agent’s Report (RAR). The company has agreed with

all of the adjustments contained in the RAR, with the exception of a

proposed adjustment, with a pre-tax amount in excess of $ billion,

relating to valuation matters associated with the intercompany trans-

fer of certain intellectual property in and computational issues

related to certain tax credits. The company disagrees with the IRS on

these specific matters and intends to contest the proposed adjustments

through the IRS appeals process and the courts, if necessary. The

company has redetermined its unrecognized tax benefits, including

all similar items during open tax years, based on the agreed and dis-

puted adjustments contained in the RAR and associated information

and analysis. As a result, the company has recorded a net increase in

tax reserves and an associated charge to the provision for income

taxes of $ million.

In addition, in , the company’s effective tax rate also benefited

from a net increase in the utilization of foreign tax credits.

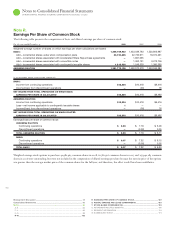

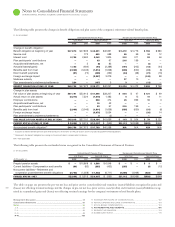

The significant components of deferred tax assets and liabilities

that are recorded in the Consolidated Statement of Financial Position

were as follows:

($ )

At December : 2008 2007*

Retirement-related benefits $ 5,215 $ 2,505

Stock-based and other compensation 2,579 2,920

Federal/State tax loss/state credit carryforwards 862 781

Capitalized research and development

795 1,050

Foreign tax loss/credit carryforwards

642 498

Deferred income 739 645

Bad debt, inventory and warranty reserves 561 647

Other 2,061 1,962

Gross deferred tax assets 13,454 11,008

Less: valuation allowance 720 772

NET DEFERRED TAX ASSETS $12,734 $10,236

* Reclassified to conform with 2008 presentation.

($ )

At December : 2008 2007*

Leases $1,913 $1,635

Depreciation 941 478

Software development costs 449 462

Retirement-related benefits 104 4,964

Other 1,059 856

GROSS DEFERRED TAX LIABILITIES $4,466 $8,395

* Reclassified to conform with 2008 presentation.