IBM 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ............................................................................................. 18

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

A – E ........................................................................................................................66

F – J ........................................................................................................................86

K– Q .......................................................................................................................88

R –W ..................................................................................................................... 102

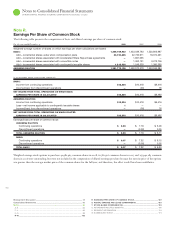

R. EARNINGS PER SHARE OF COMMON STOCK .............................................. 102

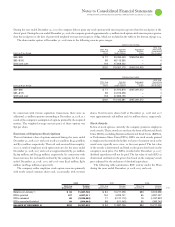

S. RENTAL EXPENSE AND LEASE COMMITMENTS ........................................... 103

T. STOCK-BASED COMPENSATION .................................................................. 103

U. RETIREMENT-RELATED BENEFITS ............................................................... 10 6

V. SEGMENT INFORMATION .............................................................................. 116

W. SUBSEQUENT EVENT .................................................................................... 119

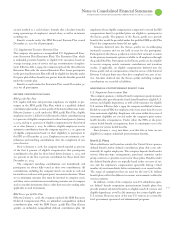

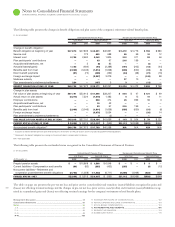

The remaining weighted-average contractual term of RSUs at

December , , and is the same as the period over

which the remaining cost of the awards will be recognized, which is

approximately three years. The fair value of RSUs granted during the

years ended December , , and was $ million,

$ million and $ million, respectively. The total fair value of

RSUs vested and released during the years ended December , ,

and was $ million, $ million and $ million. As of

December , , and , there was $ million, $

million and $ million, respectively, of unrecognized compensation

cost related to nonvested RSUs. The company received no cash from

employees as a result of employee vesting and release of RSUs for the

years ended December , , and .

PSUs are stock awards where the number of shares ultimately

received by the employee depends on the company’s performance

against specified targets and typically vest over a three-year period.

The fair value of each PSU is determined on the grant date, based on

the company’s stock price, and assumes that performance targets will

be achieved. Over the performance period, the number of shares of

stock that will be issued is adjusted upward or downward based upon

the probability of achievement of performance targets. The ulti-

mate number of shares issued and the related compensation cost

recognized as expense will be based on a comparison of the final

performance metrics to the specified targets. The fair value of PSUs

granted during the years ended December , , and

was $ million, $ million and $ million, respectively. Total

fair value of PSUs vested and released during the years ended

December , , and was $ million, $ million and

$ million, respectively.

In connection with vesting and release of RSUs and PSUs, the tax

benefits realized by the company for the years ended December ,

, and were $ million, $ million and $ million,

respectively.

The company maintains a non-compensatory Employees Stock Pur-

chase Plan (ESPP). The ESPP enables eligible participants to purchase

full or fractional shares of IBM common stock at a five-percent

discount off the average market price on the day of purchase through

payroll deductions of up to percent of eligible compensation.

Eligible compensation includes any compensation received by the

employee during the year. The ESPP provides for offering periods

during which shares may be purchased and continues as long as

shares remain available under the ESPP, unless terminated earlier at

the discretion of the Board of Directors. Individual ESPP partici-

pants are restricted from purchasing more than $, of common

stock in one calendar year or , shares in an offering period.

Employees purchased . million, . million and . million shares

under the ESPP during the years ended December , , and

, respectively. Cash dividends declared and paid by the company

on its common stock also include cash dividends on the company

stock purchased through the ESPP. Dividends are paid on full and

fractional shares and can be reinvested in the ESPP. The company

stock purchased through the ESPP is considered outstanding and is

included in the weighted-average outstanding shares for purposes of

computing basic and diluted earnings per share.

Approximately . million, . million and . million shares

were available for purchase under the ESPP at December , ,

and , respectively.

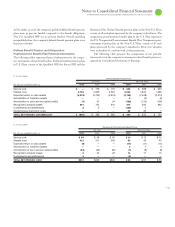

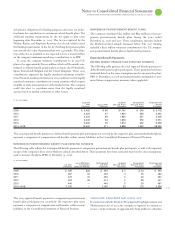

Note U.

Retirement-Related Benefits

IBM sponsors defined benefit pension plans and defined contribution

plans that cover substantially all regular employees, a supplemental

retention plan that covers certain U.S. executives and nonpension

postretirement benefit plans primarily consisting of retiree medical

and dental benefits for eligible retirees and dependents.

U.S. Plans

DEFINED BENEFIT PENSION PLANS

IBM Personal Pension Plan

IBM provides U.S. regular, full-time and part-time employees hired

prior to January , with noncontributory defined benefit pen-

sion benefits via the IBM Personal Pension Plan. Prior to , the

IBM Personal Pension Plan consisted of a tax qualified (qualified)

plan and a non-tax qualified (nonqualified) plan. Effective January ,

, the nonqualified plan was renamed the Excess Personal Pension

Plan (Excess PPP) and the qualified plan is now referred to as the

Qualified PPP. The combined plan is now referred to as the PPP. The

Qualified PPP is funded by company contributions to an irrevocable

trust fund, which is held for the sole benefit of participants and ben-

eficiaries. The Excess PPP, which is unfunded, provides benefits in

excess of IRS limitations for qualified plans.

Benefits provided to the PPP participants are calculated using

benefit formulas that vary based on the participant. Pension benefits

are calculated using one of two methods based upon specified criteria

used to determine each participant’s eligibility. The first method uses

a five-year, final pay formula that determines benefits based on salary,

years of service, mortality and other participant-specific factors. The