IBM 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

•

•

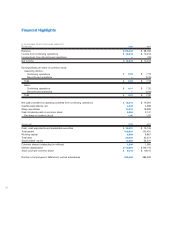

Management Discussion Snapshot

($ )

Yr.-to -Yr.

Percent/

Margin

For the year ended December : 2008 2007 Change

Revenue $103,630 $ 98,786 4.9%*

Gross profit margin 44.1% 42.2% 1.8 pts.

Total expense and other income $ 28,945 $ 27,240 6.3%

Total expense and other

income-to-revenue ratio 27.9% 27.6% 0.4 pts.

Income from continuing

operations before income taxes $ 16,715 $ 14,489 15.4%

Provision for income taxes 4,381 4,071 7.6%

Income from continuing

operations $ 12,334 $ 10,418 18.4%

Net income $ 12,334 $ 10,418 18.4%

Net income margin 11.9% 10.5% 1.4 pts.

Earnings per share of

common stock:

Assuming dilution:

Continuing operations $ 8.93 $ 7.18 24.4%

Discontinued operations —(0.00) NM

Total $ 8.93 $ 7.18 24.4%

Weighted-average shares

outstanding:

Assuming dilution 1,381.8 1,450.6 (4.7)%

Assets** $109,524 $120,431 (9.1)%

Liabilities** $ 96,058 $ 91,962 4.5%

Equity** $ 13,465 $ 28,470 (52.7)%

* 2.3 percent adjusted for currency.

** At December 31.

NM—Not meaningful

In , the company performed extremely well in a difficult econ-

omic environment, delivering record levels of revenue, pre-tax profit,

earnings per share and cash flow from operations. The financial per-

formance reflected the continuing strength of the company’s global

model and the results of the ongoing transformation of the business.

The key elements of the company’s transformation include:

• A continuing shift to higher value businesses;

• Investing for growth in the emerging markets;

• Global integration;

• Investing in innovation; and

•

Ongoing productivity resulting in higher profit margins.

Overall, the company capitalized on the opportunities in the global

economies, generating approximately percent of its revenue outside

the United States (U.S.), in delivering full year growth of . percent

( percent adjusted for currency). Revenue increased in all geogra-

phies, both on an as reported basis and adjusted for currency — the

revenue performance, adjusted for currency, was stable throughout

the year as the company focused on solutions that meet clients’ needs.

Revenue from the company’s growth markets organization increased

. percent ( percent adjusted for currency). In these markets,

where the growth is driven by the infrastructure build-out, the com-

pany invested aggressively to capture these opportunities. For the full

year and in the fourth quarter, growth in these markets, adjusted for

currency, was points greater than the major markets.

Gross profit margins improved, reflecting the shift to higher

value businesses, pricing for value and the continued focus on pro-

ductivity and cost management. Pre-tax income from continuing

operations grew . percent and net income from continuing

operations increased . percent reflecting an improvement in the

company’s tax rate. Diluted earnings per share improved . percent

reflecting the strong growth in net income and the benefits of the

common stock repurchase program. In , the company repur-

chased approximately million shares of its common stock.

The increase in revenue was primarily due to:

• Continued strong performance from Global Technology Services

and Global Business Services with growth in all business lines and

geographic units;

• Continued strong demand in the Software business, driven by Key

Branded Middleware products, with strong contributions from

strategic acquisitions; and

• Continued strength in the growth markets.

The increase in income from continuing operations before income

taxes in was primarily due to the revenue growth and gross profit

margin improvements in the Global Services and Software segments.

The consolidated gross profit margin increased . points versus

to . percent. Gross margin performance by segment and the

impact to the consolidated gross margin was as follows:

Gross Yr.-to-Yr. Consolidated

Margin Change Impact

Global Technology Services 32.6% 2.7 pts. 0.8 pts.

Global Business Services 26.7% 3.2 pts. 0.5 pts.

Software 85.4% 0.2 pts. 0.5 pts.

Systems & Technology 38.1% (1.7) pts. (0.2) pts.

Global Financing 51.3% 4.6 pts. 0.1 pts.