IBM 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ............................................................................................. 18

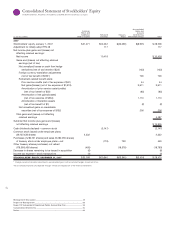

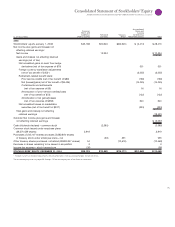

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

A – E ........................................................................................................................66

A. SIGNIFICANT ACCOUNTING POLICIES ..........................................................66

B. ACCOUNTING CHANGES .................................................................................76

C. ACQUISITIONS/DIVESTITURES ........................................................................78

D. FAIR VALUE ......................................................................................................84

E. FINANCIAL INSTRUMENTS (EXCLUDING DERIVATIVES) .................................85

F – J ........................................................................................................................86

K– Q .......................................................................................................................88

R –W ..................................................................................................................... 102

designated as net investment hedges and derivatives that do not

qualify as hedges are reported in investing activities. For currency

swaps designated as hedges of foreign currency denominated debt

(included in the company’s debt risk management program as addressed

in note L, “Derivatives and Hedging Transactions,” on pages to

), cash flows directly associated with the settlement of the principal

element of these swaps are reported in payments to settle debt in the

cash flow from financing activities section of the Consolidated State-

ment of Cash Flows.

In determining the fair value of its financial instruments, the com-

pany uses a variety of methods and assumptions that are based on

market conditions and risks existing at each balance sheet date. Refer

to note E, “Financial Instruments (Excluding Derivatives),” on pages

and for further information. All methods of assessing fair value

result in a general approximation of value, and such value may never

actually be realized.

Exit prices are used to measure assets and liabilities that fall within

the scope of SFAS No. , “Fair Value Measurements.” Under SFAS

No. , the company is required to classify certain assets and liabili-

ties based on the following fair value hierarchy:

• Level — Quoted prices in active markets that are unadjusted and

accessible at the measurement date for identical, unrestricted

assets or liabilities;

• Level — Quoted prices for identical assets and liabilities in

markets that are not active, quoted prices for similar assets and

liabilities in active markets or financial instruments for which

significant inputs are observable, either directly or indirectly; and

• Level — Prices or valuations that require inputs that are both

significant to the fair value measurement and unobservable.

SFAS No. requires the use of observable market data if such data

is available without undue cost and effort.

When available, the company uses unadjusted quoted market prices

to measure the fair value and classifies such items within Level .

If quoted market prices are not available, fair value is based upon

internally developed models that use current market-based or inde-

pendently sourced market parameters such as interest rates and

currency rates. Items valued using internally generated models are

classified according to the lowest level input or value driver that is

significant to the valuation.

The determination of fair value considers various factors includ-

ing interest rate yield curves and time value underlying the financial

instruments. For derivatives and debt securities, the company uses a

discounted cash flow analysis using discount rates commensurate

with the duration of the instrument. In the event of an other-than-

temporary impairment of a nonpublic equity method investment, the

company uses the net asset value of its investment in the investee

adjusted using discounted cash flows for the company’s estimate of

the price that it would receive to sell the investment to a market

participant that would consider all factors that would impact the

investment’s fair value.

In determining the fair value of financial instruments, the company

considers certain market valuation adjustments to the ‘base valua-

tions’ calculated using the methodologies described below for several

parameters that market participants would consider in determining

fair value.

•

Counterparty credit risk adjustments are applied to financial instru-

ments, where the base valuation uses market parameters based on

an AA (or equivalent) credit rating. Due to the fact that not all

counterparties have a AA (or equivalent) credit rating, it is neces-

sary to take into account the actual credit risk of a counterparty

as observed in the credit default swap market to determine the

true fair value of such an instrument.

• Credit risk adjustments are applied to reflect the company’s own

credit risk when valuing all liabilities measured at fair value. The

methodology is consistent with that applied in developing coun-

terparty credit risk adjustments, but incorporates the company’s

own credit risk as observed in the credit default swap market.

Certain assets are measured at fair value on a nonrecurring basis.

These assets include equity method investments that are recognized

at fair value at the end of the period to the extent that they are deemed

to be other-than-temporarily impaired. Certain assets that are mea-

sured at fair value on a recurring basis can be subject to nonrecurring

fair value measurements. These assets include public cost method

investments that are deemed to be other-than-temporarily impaired.

All highly liquid investments with maturities of three months or less

at the date of purchase are considered to be cash equivalents.