IBM 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

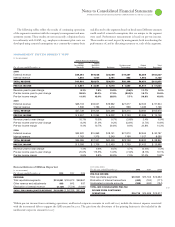

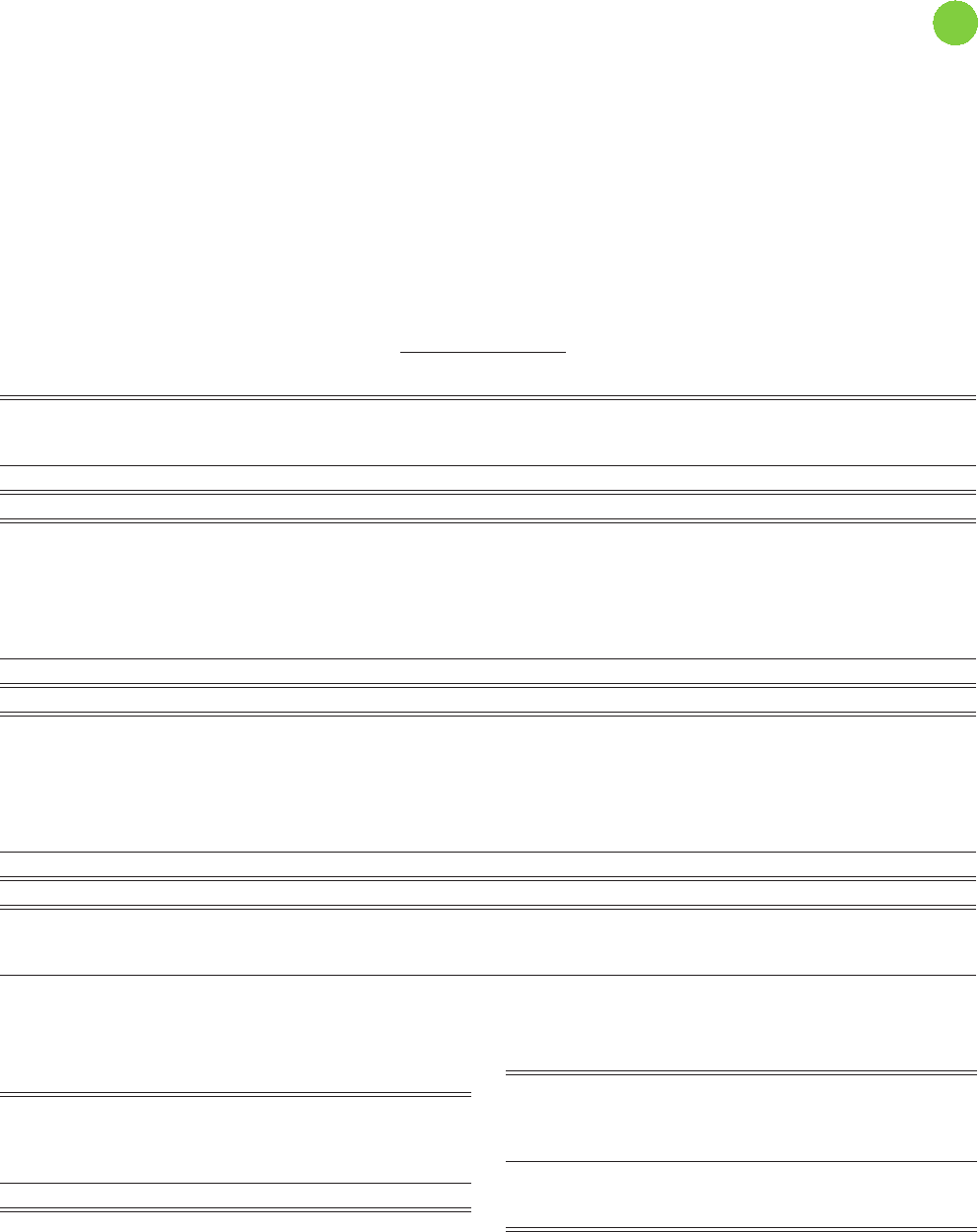

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

($ )

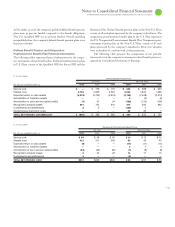

Global Services Segments

Global Global

Technology Business Systems and Global Total

For the year ended December : Services Services Software Technology Financing Segments

2008:

External revenue $39,264 $19,628 $22,089 $ 19,287 $2,559 $102,827

Internal revenue 1,546 1,044 2,761 882 1,892 8,125

TOTAL REVENUE $40,810 $20,671 $24,850 $20,169 $4,451 $110,951

PRE-TAX INCOME $ 4,607 $ 2,681 $ 7,075 $ 1,550 $1,617 $ 17,531

Revenue year-to-year change 8.1% 7.5% 10.9% (9.6)% 11.7% 5.0%

Pre-tax income year-to-year change 29.5% 29.9% 17.9% (28.0)% 16.7% 15.6%

Pre-tax income margin 11.3% 13.0% 28.5% 7.7% 36.3% 15.8%

2007:

External revenue $36,103 $18,041 $19,982 $21,317 $2,502 $ 97,944

Internal revenue 1,636 1,193 2,416 998 1,482 7,726

TOTAL REVENUE $37,739 $19,234 $22,398 $22,315 $3,984 $105,670

PRE-TAX INCOME $ 3,557 $ 2,064 $ 6,002 $ 2,153 $1,386 $ 15,163

Revenue year-to-year change 10.7% 10.9% 9.7% (3.6)% 2.4% 6.9%

Pre-tax income year-to-year change 8.2% 21.0% 9.3% 23.8% (4.7)% 10.8%

Pre-tax income margin 9.4% 10.7% 26.8% 9.6% 34.8% 14.3%

2006:

External revenue $32,322 $15,969 $18,161 $ 21,970 $2,365 $ 90,787

Internal revenue 1,763 1,373 2,249 1,168 1,527 8,080

TOTAL REVENUE $34,086 $17,341 $20,409 $23,138 $3,892 $ 98,867

PRE-TAX INCOME $ 3,288 $ 1,706 $ 5,493 $ 1,739 $1,455 $ 13,682

Revenue year-to-year change 1.4% 0.6% 8.5% 4.7% (0.4)% 0.3%

Pre-tax income year-to-year change 25.6% 116.9% 14.9% (7.6)% (8.1)% 19.1%

Pre-tax income margin 9.6% 9.8% 26.9% 7.5% 37.4% 13.8%

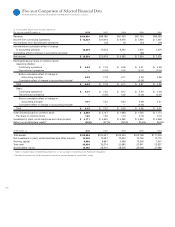

Reconciliations of IBM as Reported

($ )

For the year ended December : 2008 2007 2006

REVENUE:

Total reportable segments $110,951 $105,670 $98,867

Other revenue and adjustments 803 842 637

Elimination of internal revenue (8,125) (7,726) (8,080)

TOTAL IBM CONSOLIDATED REVENUE $103,630 $ 98,786 $91,424

($ )

For the year ended December : 2008 2007 2006

PRE-TAX INCOME:

Total reportable segments $17,531 $15,163 $13,682

Elimination of internal transactions (433) (194) (171)

Unallocated corporate amounts (382) (480) (194)

TOTAL IBM CONSOLIDATED PRE-TAX

INCOME FROM CONTINUING

OPERATIONS $16,715 $14,489 $13,317

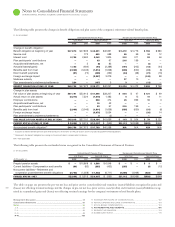

The following tables reflect the results of continuing operations

of the segments consistent with the company’s management and mea-

surement system. These results are not necessarily a depiction that is

in conformity with GAAP; e.g., employee retirement plan costs are

developed using actuarial assumptions on a country-by-country basis

and allocated to the segments based on headcount. Different amounts

could result if actuarial assumptions that are unique to the segment

were used. Performance measurement is based on pre-tax income.

These results are used, in part, by management, both in evaluating the

performance of, and in allocating resources to, each of the segments.

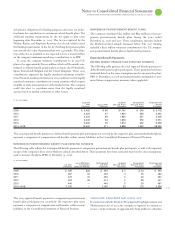

Within pre-tax income from continuing operations, unallocated corporate amounts in and include the interest expense associated

with the incremental debt to support the ASR executed in . The gain from the divestiture of the printing business is also included in the

unallocated corporate amount for .