IBM 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ................................................................................................18

ROAD MAP ............................................................................................................ 18

FORWARD-LOOKING AND CAUTIONARY STATEMENTS ...................................... 18

MANAGEMENT DISCUSSION SNAPSHOT ............................................................ 19

DESCRIPTION OF BUSINESS................................................................................ 20

YEAR IN REVIEW ..................................................................................................25

PRIOR YEAR IN REVIEW .......................................................................................39

DISCONTINUED OPERATIONS ..............................................................................44

OTHER INFORMATION ..........................................................................................44

GLOBAL FINANCING .............................................................................................53

Report Of Management ............................................................................................... 58

Report Of Independent Registered Public Accounting Firm ................................. 59

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

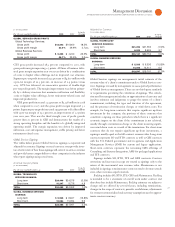

WORKING CAPITAL

($ )

At December : 2008 2007

Current assets $49,004 $53,177

Current liabilities 42,435 44,310

WORKING CAPITAL $ 6,568 $ 8,867

Current ratio 1.15 1.20

Working capital decreased $, million compared to the prior year

primarily as a result of a net decrease in current assets. The key drivers

are described below:

Current assets decreased $, million due to:

• A decrease of $, million in cash and cash equivalents and

marketable securities (see Cash Flow analysis below and on

page );

• A decrease of $, million in short-term receivables driven by

currency impacts of $, million;

Partially offset by:

• An increase of $ million in prepaid expenses and other current

assets primarily resulting from:

– an increase of $ million in prepaid taxes;

– an increase of $ million in derivative assets primarily due

to changes in foreign currency rates for certain economic

hedges; and

– approximately $ million negative currency impact.

Current liabilities decreased $, million as a result of:

• A decrease of $, million (including $ million of negative

impact due to currency) in accounts payable primarily due to lower

purchasing volumes;

• A decrease of $ million in short-term debt primarily driven by

the reduction in commercial paper balances; and

• A decrease of $ million (including $ million negative cur-

rency impact) in taxes payable;

Partially offset by:

• An increase of $ million in other accrued liabilities primarily

due to:

– an increase of $ million in derivative liabilities as a result of

changes in foreign currency rates;

– an increase of $ million in workforce reduction accruals; and

– approximately $ million negative currency impact.

• An increase of $ million (net of a $ million negative

currency impact) in deferred income mainly driven by Software

($ million) and Global Services ($ million).

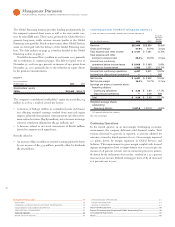

CASH FLOW

The company’s cash flow from operating, investing and financing

activities, as reflected in the Consolidated Statement of Cash Flows on

page , is summarized in the following table. These amounts include

the cash flows associated with the Global Financing business.

($ )

For the year ended December : 2008 2007

Net cash provided by/(used in)

continuing operations:

Operating activities $ 18,812 $16,094

Investing activities (9,285) (4,675)

Financing activities (11,834) (4,740)

Effect of exchange rate changes on cash

and cash equivalents 58 294

Net cash used in discontinued

operations — operating activities — (5)

NET CHANGE IN CASH AND CASH EQUIVALENTS $ (2,250) $ 6,969

Net cash from operating activities for increased $, million

as compared to driven by the following key factors:

• An increase in net income of $, million;

• Decreases in accounts receivable drove an increase in cash of

$, million, driven by Global Financing receivables ($,

million) and non-Global Financing receivables ($ million)

primarily resulting from reduced fourth-quarter revenue

and im proved collections; and

• A decrease year to year in retirement-related plan funding of

$ million;

Partially offset by:

• Accounts payable drove a use of cash of $ million; and

• A decrease in cash of $ million driven by growth in inventory.

Net cash used in investing activities increased $, million on a

year-to-year basis driven by:

• An increase of $, million utilized for acquisitions (see note C,

“Acquisi tions/Divestitures,” on pages through for additional

information); and

• A decrease of $ million received from divestitures;