IBM 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

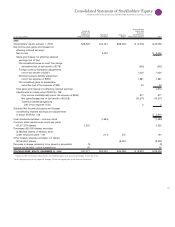

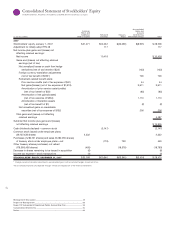

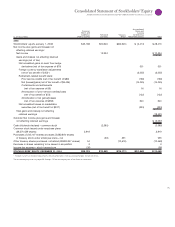

Consolidated Statement of Stockholders’ Equity

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Accumulated

Common Gains and

Stock and (Losses)

Additional Retained Treasury not Affecting

($ ) Paid-in Capital Earnings Stock Retained Earnings Total

2008

Stockholders’ equity, January 1, 2008 $35,188 $60,640 $(63,945) $ (3,414) $ 28,470

Net income plus gains and (losses) not

affecting retained earnings:

Net income 12,334 $ 12,334

Gains and (losses) not affecting retained

earnings (net of tax):

Net unrealized gains on cash flow hedge

derivatives (net of tax expense of $79) 301 301

Foreign currency translation adjustments

(net of tax benefit of $153*) (3,552) (3,552)

Retirement-related benefit plans:

Prior service credits (net of tax benefit of $86) (136) (136)

Net (losses)/gains (net of tax benefit of $8,436) (15,245) (15,245)

Curtailments and settlements

(net of tax expense of $9) 16 16

Amortization of prior service (credits)/costs

(net of tax benefit of $73) (132) (132)

Amortization of net gains/(losses)

(net of tax expense of $358) 640 640

Net unrealized losses on marketable

securities (net of tax benefit of $207) (324) (324)

Total gains and (losses) not affecting

retained earnings (18,431)

Subtotal: Net income plus gains and (losses)

not affecting retained earnings $ (6,097)

Cash dividends declared—common stock (2,585) (2,585)

Common stock issued under employee plans

(39,374,439 shares) 3,919 3,919

Purchases (1,505,107 shares) and sales (5,882,800 shares)

of treasury stock under employee plans — net (36) 391 355

Other treasury shares purchased, not retired (89,890,347 shares) 54 (10,618) (10,563)

Decrease in shares remaining to be issued in acquisition 3 3

Income tax expense — stock transactions (36) (36)

STOCKHOLDERS’ EQUITY, DECEMBER 31, 2008 $39,129 $70,353 $(74,171) $(21,845) $ 13,465

* Foreign currency translation adjustments are presented gross with associated hedges shown net of tax.

The accompanying notes on pages 66 through 119 are an integral part of the financial statements.