IBM 2008 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

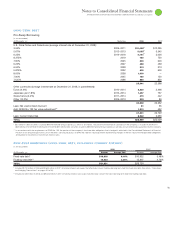

Note I.

Investments and Sundry Assets

($ )

At December : 2008 2007*

Deferred transition and setup costs

and other deferred arrangements**

$1,548 $1,475

Derivatives — noncurrent

+ 1,117 259

Alliance investments:

Equity method 167 271

Non-equity method 285 879

Prepaid software 370 221

Long-term deposits 277 285

Marketable securities 6531

Other assets 1,289 1,327

TOTAL $5,058 $5,248

* Reclassified to conform with 2008 presentation of deferred taxes, previously combined

in investments and sundry assets.

** Deferred transition and setup costs and other deferred arrangements are related to

Global Services client arrangements. Also see note A, “Significant Accounting Policies,”

on pages 68 and 69 for additional information.

+ See note L, “Derivatives and Hedging Transactions,” on pages 90 to 94 for the fair

value of all derivatives reported in the Consolidated Statement of Financial Position.

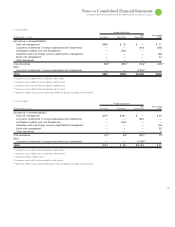

Note J.

Intangible Assets Including Goodwill

The following table details the company’s intangible asset balances

by major asset class.

($ )

At December 31, 2008

Gross Net

Carrying Accumulated Carrying

Intangible Asset Class Amount Amortization Amount

Capitalized software $1,861 $ (839) $1,022

Client-related 1,532 (663) 869

Completed technology 1,167 (327) 840

Strategic alliances — — —

Patents/trademarks 188 (76) 112

Other* 154 (121) 35

TOTAL $4,901 $(2,023) $2,878

* Other intangibles are primarily acquired proprietary and nonproprietary business

processes, methodologies and systems, and impacts from currency translation.

($ )

At December 31, 2007

Gross Net

Carrying Accumulated Carrying

Intangible Asset Class Amount Amortization Amount

Capitalized software $1,926 $ (826) $1,100

Client-related 1,054 (495) 559

Completed technology 536 (194) 342

Strategic alliances 103 (103) —

Patents/trademarks 128 (61) 67

Other* 154 (115) 39

TOTAL $3,901 $(1,794) $2,107

* Other intangibles are primarily acquired proprietary and nonproprietary business

processes, methodologies and systems, and impacts from currency translation.

The company amortizes intangible assets over their estimated useful

lives unless such lives are deemed indefinite. Amortizable intangible

assets are tested for impairment based on undiscounted cash flows,

and, if impaired, written down to fair value based on either discounted

cash flows or appraised values. Intangible assets with indefinite lives

are tested annually for impairment and written down to fair value as

required. No impairment of intangible assets has been recorded dur-

ing any of the periods presented.

The net carrying amount of intangible assets increased by $

million for the year ended December , , primarily due to acqui-

sitions of intangibles offset by amortization.

Total amortization was $, million and $, million for the

years ended December , and , respectively. The aggregate

amortization expense for acquired intangibles (excluding capitalized

software) was $ million and $ million for the years ended

December , and , respectively. In addition, in the

company retired $, million of fully amortized intangible assets,

impacting both the gross carrying amount and accumulated amorti-

zation for this amount.

The future amortization expense for each of the five succeeding

years related to all intangible assets that are currently recorded in the

Consolidated Statement of Financial Position is estimated to be as

follows at December , :

Capitalized Acquired

($ ) Software Intangibles Total

2009 $634 $500 $1,135

2010 314 407 722

2011 74 358 432

2012 — 290 290

2013 — 211 211