IBM 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ................................................................................................18

ROAD MAP ............................................................................................................ 18

FORWARD-LOOKING AND CAUTIONARY STATEMENTS ...................................... 18

MANAGEMENT DISCUSSION SNAPSHOT ............................................................ 19

DESCRIPTION OF BUSINESS................................................................................ 20

YEAR IN REVIEW ...................................................................................................25

PRIOR YEAR IN REVIEW ......................................................................................39

DISCONTINUED OPERATIONS ..............................................................................44

OTHER INFORMATION ..........................................................................................44

GLOBAL FINANCING .............................................................................................53

Report Of Management ............................................................................................... 58

Report Of Independent Registered Public Accounting Firm ................................. 59

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

Systems and Technology segment revenue decreased . percent

( percent adjusted for currency). On June , , the company

completed the divestiture of its printing business to Ricoh. This

resulted in the loss of approximately $ million of Systems and

Technology revenue in when compared to . Systems and

Tech nology revenue, excluding the printing business, was flat

(declined

percent adjusted for currency) in versus .

System z revenue decreased . percent ( percent adjusted for

currency). System z MIPS shipments increased percent. System z

revenue declined in the second half of following a long and suc-

cessful technology cycle of over two-and-a-half years. Converged

System p revenue increased . percent ( percent adjusted for cur-

rency). The increase was primarily driven by strength in midrange

POWER+ and POWER servers, which increased percent.

Legacy System i revenue decreased . percent ( percent adjusted

for currency). Although legacy System i revenue declined year over

year, fourth-quarter revenue increased percent with growth in

POWER servers which were introduced late in the third quarter of

. System x revenue increased . percent ( percent adjusted for

currency). Revenue performance was driven by System x server

products which grew percent and System x blades which increased

percent in versus . System Storage revenue increased

. percent ( percent adjusted for currency). The increase was pri-

marily driven by percent growth in tape products, while external

disk products increased percent. Enterprise tape products had

strong double-digit revenue growth, while midrange tape products

had mid single-digit revenue growth. Retail Store Solutions revenue

increased . percent ( percent adjusted for currency) primarily

due to the continued roll out of new programmable point-of-sale

solutions to large retail clients.

Microelectronics OEM revenue decreased . percent driven

by reduced demand for game processors. Printing Systems revenue

decreased as a result of the divestiture of the business. The

results included five months of revenue while the results

included months of revenue.

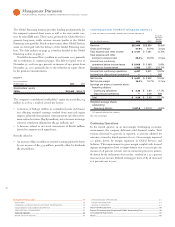

($ )

Yr.-to -Yr.

For the year ended December : 2007 2006 Change

SYSTEMS AND TECHNOLOGY

GROSS PROFIT:

Gross profit $8,468 $8,284 2.2%

Gross profit margin 39.7% 37.7% 2.0

pts.

The increase in Systems and Technology gross profit dollars was

primarily due to higher gross profit margins in System z, converged

System p and System x servers. The Systems and Technology gross

profit

margin increased . points to . percent. Converged

System p performance contributed . points to the overall margin

improvement, while System z and System x contributed . points

and . points, respectively. These increases were partially offset by

lower gross margins in legacy System i of . points and System

Storage of . points.

Systems and Technology segment pre-tax margin expanded

. points to . percent driven primarily by a strong combination of

operational cost management and the value that virtualization has

driven in the enterprise space.

Global Financing

See pages and for a discussion of the Global Financing segment.

Geographic Revenue

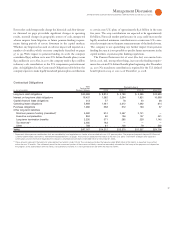

($ )

Yr.-to -Yr.

For the year ended December : 2007 2006 Change

TOTAL REVENUE: $98,786 $91,424 8.1%

Geographies: $95,320 $87,564 8.9%

Americas 41,122 39,511 4.1

Europe/Middle East/Africa 34,699 30,491 13.8

Asia Pacific 19,501 17,566 11.0

OEM $ 3,465 $ 3,856 (10.1)%

From a geographic perspective, revenue increased in all geographies

in when compared to . Adjusted for currency, revenue

growth was led by Asia Pacific and steady performance throughout

the year in EMEA.

Americas revenue increased . percent ( percent adjusted for

currency) in . Revenue increased in all regions with the U.S. up

. percent, Canada . percent ( percent adjusted for currency) and

Latin America . percent ( percent adjusted for currency).

EMEA revenue increased . percent ( percent adjusted for

currency) in when compared to . Within the European

market, IT spending grew at a moderate rate, and the company’s

mid single-digit revenue growth rates throughout reflected

that environment. Revenue increased in all major countries with

Spain up . percent ( percent adjusted for currency), Germany

. percent ( percent adjusted for currency), the U.K. . percent

( percent adjusted for currency), France . percent ( percent

adjusted for currency) and Italy . percent (decreased percent

adjusted for currency).