IBM 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

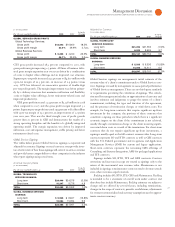

($ )

Yr.-to-Yr.

For the year ended December : 2008 2007 Change

GLOBAL SERVICES GROSS PROFIT:

Global Technology Services:

Gross profit $12,802 $10,800 18.5%

Gross profit margin 32.6% 29.9% 2.7 pts.

Global Business Services:

Gross profit $ 5,238 $ 4,240 23.5%

Gross profit margin 26.7% 23.5% 3.2 pts.

GTS gross profit increased . percent compared to , with

gross profit margin improving . points. All lines of business deliv-

ered gross margin expansion year over year driven by a combination

of a mix to higher value offerings and an improved cost structure.

Segment pre-tax profit increased . percent to $, million with

a pre-tax margin of . percent, an increase of . points versus

. GTS has delivered six consecutive quarters of double-digit

pre-tax profit growth. The margin improvement was driven primar-

ily by a delivery structure that maximizes utilization and flexibility,

a mix to higher value offerings, lower retirement-related costs and

improved productivity.

GBS gross profit increased . percent to $, million in

when compared to , and the gross profit margin improved .

points. Segment pre-tax profit increased . percent to $, million

with a pre-tax margin of . percent, an improvement of . points

year over year. This was the third straight year of profit growth

greater than percent in GBS and demonstrates the results of a

strong operating discipline and the benefits of a globally integrated

operating model. The margin expansion was driven by improved

utilization, cost and expense management, stable pricing and lower

retirement-related costs.

Global Services Signings

The tables below present Global Services signings as reported and

adjusted for currency. Signings at actual currency rates provide inves-

tors a better view of how these signings will convert to services revenue

and provide better comparability to other companies in the industry

who report signings using actual rates.

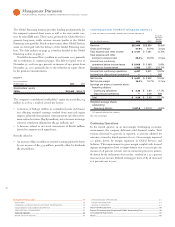

At Actual Currency Rates

($ )

Yr.-to-Yr.

For the year ended December : 2008 2007 Change

GLOBAL TECHNOLOGY

SERVICES SIGNINGS:

Long term $24,446 $24,576 (0.5)%

Short term 10,247 9,776 4.8

TOTAL $34,693 $34,352 1.0%

GLOBAL BUSINESS SERVICES

SIGNINGS:

Long term $ 5,905 $ 6,847 (13.8)%

Short term 16,584 15,094 9.9

TOTAL $22,488 $21,941 2.5%

Adjusted for Currency

($ )

Yr.-to-Yr.

For the year ended December : 2008 2007 Change

GLOBAL TECHNOLOGY

SERVICES SIGNINGS:

Long term $21,220 $21,550 (1.5)%

Short term 8,920 8,604 3.7

TOTAL $30,141 $30,154 0.0%

GLOBAL BUSINESS SERVICES

SIGNINGS:

Long term $ 5,333 $ 6,330 (15.8)%

Short term 14,264 13,411 6.4

TOTAL $19,597 $19,741 (0.7)%

Global Services signings are management’s initial estimate of the

revenue value of a client’s commitment under a Global Services con-

tract. Signings are used by management to assess period performance

of Global Services management. There are no third-party standards

or requirements governing the calculation of signings. The calcula-

tion used by management includes an approximation of currency and

involves estimates and judgments to gauge the extent of a client’s

commitment, including the type and duration of the agreement,

and the presence of termination charges or wind-down costs. For

example, for long-term contracts that require significant up-front

investment by the company, the portions of these contracts that

constitute a signing are those periods in which there is a significant

economic impact on the client if the commitment is not achieved,

usually through a termination charge or the client incurring signifi-

cant wind-down costs as a result of the termination. For short-term

contracts that do not require significant up-front investments, a

signing is usually equal to the full contract revenue value. Long-term

contracts represent SO and BTO contracts as well as GBS contracts

with the U.S. Federal government and its agencies and Application

Management Services (AMS) for custom and legacy applications.

Short-term contracts represent the remaining GBS offerings of

Consulting and Systems Integration, AMS for packaged applications

and ITS contracts.

Signings include SO, BTO, ITS and GBS contracts. Contract

extensions and increases in scope are treated as signings only to the

extent of the incremental new revenue value. Maintenance is not

included in signings as maintenance contracts tend to be more steady

state, where revenues equal renewals.

Backlog includes SO, BTO, ITS, GBS and Maintenance. Backlog

is intended to be a statement of overall work under contract and

therefore does include Maintenance. Backlog estimates are subject to

change and are affected by several factors, including terminations,

changes in the scope of contracts, periodic revalidations, adjustments

for revenue not materialized and currency assumptions used to approx-

imate constant currency.