IBM 2008 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

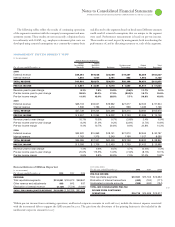

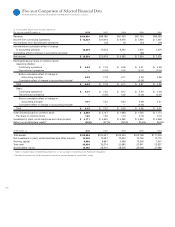

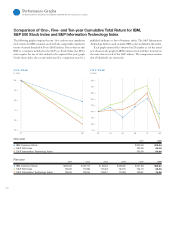

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ............................................................................................. 18

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

A – E ........................................................................................................................66

F – J ........................................................................................................................86

K– Q .......................................................................................................................88

R –W ..................................................................................................................... 102

R. EARNINGS PER SHARE OF COMMON STOCK .............................................. 102

S. RENTAL EXPENSE AND LEASE COMMITMENTS ........................................... 103

T. STOCK-BASED COMPENSATION ................................................................... 103

U. RETIREMENT-RELATED BENEFITS ............................................................... 10 6

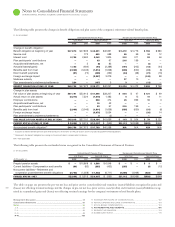

V. SEGMENT INFORMATION .............................................................................. 116

W. SUBSEQUENT EVENT .................................................................................... 119

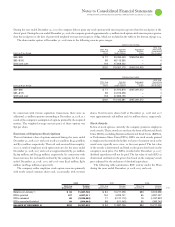

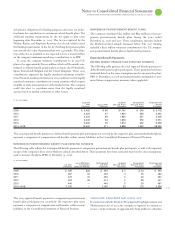

Non-U.S. Plans (Weighted-Average)

Plan Assets 2009

at December 31: Target

2008 2007 Allocation

Asset Category:

Equity securities 46.0% 58.2% 47%

Debt securities 48.5 37.7 46

Real estate 1.6 1.9 2

Other 4.0 2.2 6

TOTAL 100.0% 100.0% 100%

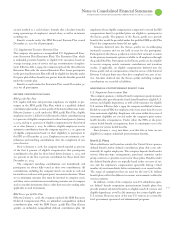

The investment objectives of the Qualified PPP portfolio are designed

to generate returns that will enable the Qualified PPP to meet its

future obligations. The precise amount for which these obligations

will be settled depends on future events, including the retirement

dates and life expectancy of the plan’s participants. The obligations are

estimated using actuarial assumptions, based on the current economic

environment. The Qualified PPP portfolio’s investment strategy bal-

ances the requirement to generate returns, using potentially higher

yielding assets such as equity securities, with the need to control risk

in the portfolio with less volatile assets, such as fixed-income securi-

ties. Risks include, among others, inflation, volatility in equity values

and changes in interest rates that could cause the plans to become

underfunded, thereby increasing their dependence on contributions

from the company. Within each asset class, careful consideration is

given to balancing the portfolio among industry sectors, geographies,

interest rate sensitivity, dependence on economic growth, currency

and other factors that affect investment returns. During , the

company modified the asset allocation of the Qualified PPP portfolio

primarily by reducing public equity securities, by increasing debt

securities from percent to percent of total plan assets, and by

increasing the duration of debt securities and increasing the use of

derivatives, including interest rate swaps in debt securities, to further

mitigate the effects of future interest rate changes. These changes

were designed to reduce the potential negative impact that equity

markets or interest rates might have on the funded status of the

Qualified PPP. These changes did not impact the expected long-term

return on plan assets assumption, which remained at . percent for

. The effect on expected long-term return on plan assets of

increasing the duration of debt securities substantially offset the effect

of reducing public equity securities. Derivatives are also used to hedge

currency, adjust portfolio duration and reduce specific market risks.

The assets are managed by professional investment firms, as well

as by investment professionals who are employees of the company.

They are bound by mandates and are measured against specific bench-

marks. Among these managers, consideration is given, but not limited

to, balancing security concentration, issuer concentration, investment

style and reliance on particular active and passive investment strategies.

Market liquidity risks are tightly controlled, with only a modest per-

centage of the Qualified PPP portfolio invested in private market

assets consisting of private equities and private real estate investments,

which are less liquid than publicly traded securities.

The Qualified PPP portfolio included private market assets com-

prising approximately . percent and . percent of total assets at

December , and , respectively. The target allocation for

private market assets in is . percent. As of December , ,

the Qualified PPP portfolio had $, million in commitments for

future private market investments to be made over a number of years.

These commitments are expected to be funded from plan assets.

Other assets in the Qualified PPP portfolio include commodities

and non-traditional investments designed to further diversify the

returns of the portfolio.

Equity securities include IBM common stock of $ million, rep-

resenting . percent of the Qualified PPP plan assets at December ,

and $ million, representing . percent of the plan assets at

December , .

Outside the U.S., the investment objectives are similar, subject to

local regulations. In some countries, a higher percentage allocation to

fixed income securities is required. In others, the responsibility for

managing the investments typically lies with a board that may include

up to percent of members elected by employees and retirees. This

can result in slight differences compared with the strategies previously

described. Generally, these non-U.S. funds do not invest in illiquid

assets and their use of derivatives is usually limited to currency hedg-

ing, adjusting portfolio durations and reducing specific market risks.

There was no significant change in the investment strategies of these

plans during either or .

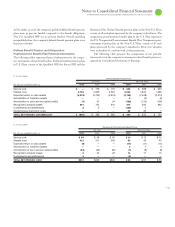

Expected Contributions

DEFINED BENEFIT PENSION PLANS

It is the company’s general practice to fund amounts for pensions suf-

ficient to meet the minimum requirements set forth in applicable

employee benefits laws and local tax laws. From time to time, the

company contributes additional amounts as it deems appropriate.

The company contributed $ million and $ million in cash

to non-U.S. plans, including non-U.S. multi-employer plans, during

the years ended December , and , respectively.

In , the company is not legally required to make any contribu-

tions to the U.S. defined benefit pension plans. However, depending

on market conditions, or other factors, the company may elect to make

discretionary contributions to the Qualified PPP during the year.

The Pension Protection Act of (the Act), enacted into law in

, is a comprehensive reform package that, among other provi-

sions, increases pension funding requirements for certain U.S. defined

benefit plans, provides guidelines for measuring pension plan assets