IBM 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

The workforce accruals primarily relate to terminated employees

who are no longer working for the company who were granted

annual payments to supplement their incomes in certain countries.

Depending

on the individual country’s legal requirements, these

required payments

will continue until the former employee begins

receiving pension benefits or dies. Included in the December ,

workforce accruals above is $ million associated with the HDD

divestiture discussed in note A, “Significant Accounting Policies,” on

page . The space accruals are for ongoing obligations to pay rent

for vacant space that could not be sublet or space that was sublet at

rates lower than the committed lease arrangement. The length of

these obligations varies by lease with the longest extending through

. Other accruals are primarily the remaining liabilities (other

than workforce or space) associated with the HDD divestiture.

The company employs extensive internal environmental protec-

tion programs that primarily are preventive in nature. The company

also participates in environmental assessments and cleanups at a

number of locations, including operating facilities, previously owned

facilities and Superfund sites. The company’s maximum exposure for

all environmental liabilities cannot be estimated and no amounts

have been recorded for non-ARO environmental liabilities that are

not probable or estimable. The total amounts accrued for non-ARO

environmental liabilities, including amounts classified as current in

the Consolidated Statement of Financial Position, that do not reflect

actual or anticipated insurance recoveries, were $ million and

$ million at December , and , respectively. Estimated

environmental costs are not expected to materially affect the con-

solidated financial position or consolidated results of the company’s

operations in future periods. However, estimates of future costs are

subject to change due to protracted cleanup periods and changing

environmental remediation regulations.

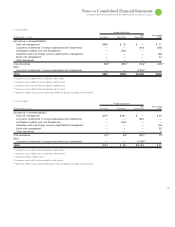

Note N.

Stockholders’ Equity Activity

The authorized capital stock of IBM consists of ,,, shares

of common stock with a $. per share par value, of which ,,,

shares were outstanding at December , and ,, shares

of preferred stock with a $. per share par value, none of which were

outstanding at December , .

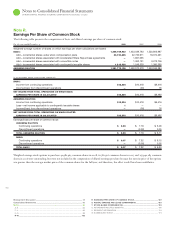

The Board of Directors authorizes the company to repurchase IBM

common stock. The company repurchased ,, common shares

at a cost of $, million, ,, common shares at a cost of

$, million and ,, common shares at a cost of $,

million in , and , respectively.

Included in the repurchases highlighted above, in May ,

IBM International Group (IIG), a wholly owned foreign subsidiary

of the company, repurchased . million shares of common stock

for $. billion under accelerated share repurchase (ASR) agree-

ments with three banks.

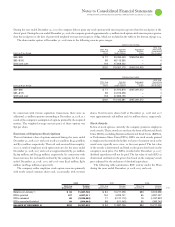

Pursuant to the ASR agreements, executed on May , , IIG

paid an initial purchase price of $. per share for the repurchase.

The initial purchase price was subject to adjustment based on the

volume weighted-average price of IBM common stock over a settle-

ment period of three months for each of the banks. The adjustment

also reflected certain other amounts including the banks’ carrying

costs, compensation for ordinary dividends declared by the company

during the settlement period and interest benefits for receiving the

$. billion payment in advance of the anticipated purchases by

each bank of shares in the open market during the respective settle-

ment periods. The adjustment amount could be settled in cash,

registered shares or unregistered shares at IIG’s option. Under the

ASR agreements, IIG had a separate settlement with each of the

three banks. The first settlement occurred on September , ,

resulting in a settlement payment to the bank of $. million. The

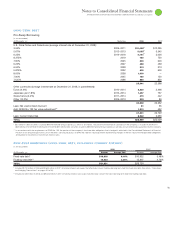

Liability Liability

as of Other as of

($ ) Dec. 31, 2007 Payments Adjustments* Dec. 31, 2008

Current:

Workforce $130 $(127) $ 93 $ 95

Space 30 (55) 47 23

Other 7 — — 7

TOTAL CURRENT $167 $(182) $ 140 $125

Noncurrent:

Workforce $557 $ — $(104) $453

Space 74 — (50) 23

TOTAL NONCURRENT $631 $ — $(154) $476

* The other adjustments column in the table above principally includes the reclassification of noncurrent to current, foreign currency translation adjustments and interest accretion.