IBM 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Total expense and other income decreased . percent compared to

the fourth quarter of . The decrease was driven by approximately

points due to the effects of currency, partially offset by points due

to the impact of acquisitions with the remainder attributed to lower

operational expenses. The company continues to focus on structural

changes that reduce spending and improve productivity. Within sell-

ing, general and administrative expense, workforce reduction charges

increased approximately $ million in the fourth quarter, reflecting

workforce actions in Japan and other ongoing skills rebalancing.

Other (income) and expense was $ million of income, a decrease of

. percent compared to fourth-quarter . Interest income was

down approximately $ million reflecting the current interest rate

environment. While the effects of foreign currency transaction losses

also negatively impacted other (income) and expense in the fourth

quarter, they were partially offset by a benefit from the impact of the

company’s hedging programs, which was a gain in the fourth quarter

of compared to a loss in the prior year.

The company’s effective tax rate in the fourth-quarter was

. percent compared with . percent in the fourth quarter of

. The . point decrease in the fourth-quarter tax rate was

primarily attributable to the net effect of several items in the quarter.

In , the fourth-quarter tax rate was favorably impacted by the net

increase in the utilization of foreign and state tax credits as well as the

retroactive reinstatement of the U.S. research tax credit in the fourth

quarter of . These benefits were partially offset by the net tax

cost related to the completion of the U.S. federal income tax exami-

nation for the years and including the associated income

tax reserve redeterminations.

Share repurchases totaled $ million in the fourth quarter. The

weighted-average number of diluted common shares outstanding in

the fourth quarter of was ,. million compared with ,.

million in the fourth quarter of .

The company ended the quarter with $, million of cash and

cash equivalents and generated $, million in cash flow provided

by operating activities driven primarily by net income. Net cash from

investing activities was a use of cash of $ million in fourth quarter

of versus a source of cash of $, million in the fourth quarter

of , resulting primarily from the disposition of higher levels of

short-term marketable securities in .

Prior Year in Review

The Prior Year in Review section provides a summary of the company’s

financial performance in as compared to . For a detailed dis-

cussion of performance, see the company’s Annual Report.

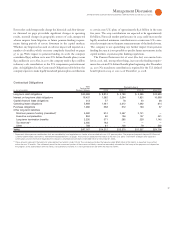

($ )

Yr.-to-Yr.

Percent/

Margin

For the year ended December : 2007 2006 Change

Revenue $ 98,786 $ 91,424 8.1%*

Gross profit margin 42.2% 41.9% 0.4

pts.

Total expense and other income $ 27,240 $ 24,978 9.1%

Total expense and other

income-to-revenue ratio 27.6% 27.3% 0.3

pts.

Income from continuing

operations before income taxes $ 14,489 $ 13,317 8.8%

Provision for income taxes 4,071 3,901 4.4%

Income from continuing operations 10,418 9,416 10.6%

Income/(loss) from

discontinued operations — 76 NM

Net income $ 10,418 $ 9,492 9.7%

Net income margin 10.5% 10.4% 0.2

pts.

Earnings per share of

common stock:

Assuming dilution:

Continuing operations $ 7.18 $ 6.06 18.5%

Discontinued operations (0.00) 0.05 NM

Total $ 7.18 $ 6.11 17.5%

Weighted-average shares

outstanding:

Assuming dilution 1,450.6 1,553.5 (6.6)%

Assets** $120,431 $103,234 16.7%

Liabilities** $ 91,962 $ 74,728 23.1%

Equity** $ 28,470 $ 28,506 (0.1)%

* 4.2 percent adjusted for currency.

** At December 31.

NM—Not meaningful

The company’s performance in reflected the strength of its global

model. Revenue increased in all geographies, with strong growth in

emerging markets worldwide. The company capitalized on the oppor-

tunities in the global economies, generating percent of its revenue

outside the United States, in delivering full-year growth of . percent

( percent adjusted for currency).

Gross profit margins improved reflecting a shift to higher value

offerings, continued benefits from productivity initiatives and the

transformation to a globally integrated enterprise. Pre-tax income

from continuing operations grew . percent and net income from

continuing operations increased . percent versus . Diluted

earnings per share improved . percent, reflecting the strong

growth in net income and the benefits of the common stock repur-

chase program. In , the company repurchased approximately

$. billion of its common stock, including a $. billion accelerated

share repurchase in the second quarter.