IBM 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

INTERNATIONAL BUSINESS MACHINES CORPORATION and Subsidiary Companies

Management Discussion ................................................................................................18

ROAD MAP ............................................................................................................ 18

FORWARD-LOOKING AND CAUTIONARY STATEMENTS ...................................... 18

MANAGEMENT DISCUSSION SNAPSHOT ............................................................ 19

DESCRIPTION OF BUSINESS................................................................................20

YEAR IN REVIEW ...................................................................................................25

PRIOR YEAR IN REVIEW ....................................................................................... 39

DISCONTINUED OPERATIONS ..............................................................................44

OTHER INFORMATION ..........................................................................................44

GLOBAL FINANCING .............................................................................................53

Report Of Management ............................................................................................... 58

Report Of Independent Registered Public Accounting Firm ................................. 59

Consolidated Statements ............................................................................................ 60

Notes ............................................................................................................................... 66

The major rating agencies’ ratings on the company’s debt securities at

December , appear in the following table. All ratings remain

unchanged from December , . The company has no contractual

arrangements that, in the event of a change in credit rating, would

result in a material adverse effect on its financial position or liquidity.

The company believes its earnings and cash flow growth provide

sufficient flexibility within the existing credit ratings to continue to

execute its current investment, dividend and acquisition strategies, as

well as refinance maturing debt when required.

Moody’s

Standard Investors

& Poor’s Service Fitch

Senior long-term debt A+ A1 A+

Commercial paper A-1 Prime-1 F1

The company prepares its Consolidated Statement of Cash Flows in

accordance with Statement of Financial Accounting Standards (SFAS)

No. , “Statement of Cash Flows,” on page and highlights causes

and events underlying sources and uses of cash in that format on

pages and . For purposes of running its business, the company

manages, monitors and analyzes cash flows in a different format.

As discussed on page , a key objective of the company’s Global

Financing business is to generate strong return on equity. Increas ing

receivables is the basis for growth in a financing business. Accordingly,

management considers Global Financing receivables as a profit-gen-

erating investment, not as working capital that should be minimized

for efficiency. After classifying Global Financing accounts receivables

as an investment, the remaining net operational cash flow less capital

expenditures is viewed by the company as the free cash flow available

for investment and distribution to shareholders.

From the perspective of how management views cash flow, in

, free cash flow was $. billion, an increase of $. billion com-

pared to . This cash performance was driven primarily by the

growth in net income from continuing operations, controls on capital

spending and lower retirement-related funding year over year.

Over the past five years, the company generated over $ billion

in free cash flow available for investment and distribution to share-

holders. During that period, the company invested $. billion in

strategic acquisitions and returned over $ billion to shareholders

through dividends and share repurchases. The amount of prospective

returns to shareholders in the form of dividends and share repurchases

will vary based upon several factors including each year’s operating

results, capital expenditure requirements, research and development

and acquisitions, as well as the factors discussed on page .

The company’s Board of Directors meets quarterly to consider

the dividend payment. The company expects to fund dividend pay-

ments through cash from operations. In the second quarter of ,

the Board of Directors increased the company’s quarterly common

stock dividend from $. to $. per share.

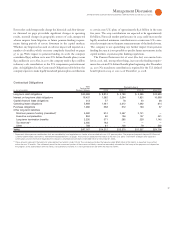

The table below represents the way in which management reviews cash flow as described above.

($ )

For the year ended December : 2008 2007 2006 2005 2004

Net cash from operating activities (Continuing Operations) $ 18.8 $ 16.1 $15.0 $14.9 $15.3

Less: Global Financing accounts receivable (0.0) (1.3) (0.3) 1.8 2.5

Net cash from operating activities (Continuing Operations),

excluding Global Financing receivables 18.8 17.4 15.3 13.1 12.9

Capital expenditures, net (4.5) (5.0) (4.7) (3.5) (3.7)

Free cash flow (excluding Global Financing accounts receivable) 14.3 12.4 10.5 9.6 9.1

Acquisitions (6.3) (1.0) (3.8) (1.5) (1.7)

Divestitures 0.1 0.3 — 0.9 —

Share repurchase (10.6) (18.8) (8.1) (7.7) (7.1)

Dividends (2.6) (2.1) (1.7) (1.2) (1.2)

Non-Global Financing debt (3.2) 10.9 (1.1) 1.2 0.7

Other (includes Global Financing accounts receivable

and Global Financing debt) 5.0 3.8 1.1 1.9 3.1

CHANGE IN CASH, CASH EQUIVALENTS

AND SHORT-TERM MARKETABLE SECURITIES $ (3.2) $ 5.5 $ (3.0) $ 3.1 $ 2.9