Vodafone 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report on remuneration (continued)

2016 remuneration

Details of how the remuneration policy will be implemented for the 2016 nancial year are set out below.

2016 base salaries

The Remuneration Committee considered business performance, salary increases for other UK employees and external market information and

decided to increase the salary of the Chief Financial Ofcer by 3.7% (Nick Read). This constitutes Nick Read’s rst increase since appointment

to the role of designate-CFO in January 2014, and reects how he is performing well in the role and has now completed a full year in the position.

The salaries of the Chief Executive (Vittorio Colao) and Chief Technology Ofcer (Stephen Pusey) will remain unchanged. The average salary

increase for Executive Committee members will be 1.7%; this compares to the salary increase budget in the UK of 2.0%.

The annual salaries for 2016 (effective 1 July 2015) are as follows:

a Chief Executive: Vittorio Colao £1,150,000;

a Chief Financial Ofcer: Nick Read £700,000; and

a Chief Technology Ofcer: Stephen Pusey £600,000.

2016 annual bonus (‘GSTIP’)

In line with our strategic focus, customer appreciation KPIs will replace competitive performance assessment as the strategic measure for the 2016

GSTIP and, given the importance of this measure in the current phase of our strategy, will constitute 40% of the total bonus.

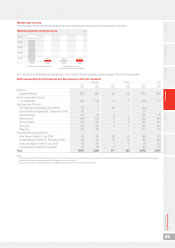

The performance measures and weightings for 2016 are as follows:

a Service revenue (20%);

a EBITDA (20%);

a adjusted free cash ow (20%); and

a customer appreciation KPIs (40%). This includes an assessment of net promoter score (‘NPS’) and brand consideration measures.

In respect of the measures included under the customer appreciation KPIs, NPS is used as a measure of customer advocacy whilst brand

consideration acts as a measure of the percentage of people who would consider using a certain brand as their telecoms provider. Both measures

utilise data collected in our local markets which is validated for quality and consistency by independent third party agencies. The data is sourced

from studies involving both our own customers and customers of our competitors for the NPS measure, and both Vodafone users and non-users for

the brand consideration measure. In formulating a nal assessment of performance under the customer appreciation KPIs, the Committee will also

consider other relevant customer factors such as churn, customer growth and service levels.

Annual bonus targets are commercially sensitive and therefore will be disclosed in the 2016 remuneration report following the completion of the

nancial year.

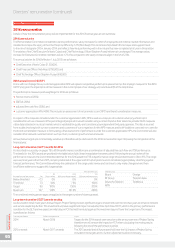

Long-term incentive (‘GLTI’) awards for 2016

As described in our policy on pages 78 to 80 the performance conditions are a combination of adjusted free cash ow and TSR performance.

The details for the 2016 award are provided in the table below (with linear interpolation between points). Following the annual review of the

performance measure, the Committee decided that for the 2016 award the TSR outperformance range should revert back to 0% to 9%. This range

was used in all years other than 2015, remains positioned at the upper end of market practice and is considered appropriately stretching against

forecast performance. The Committee will keep the calibration of the range under review and continue to only make changes where there

is sufcient evidence to suggest this is appropriate.

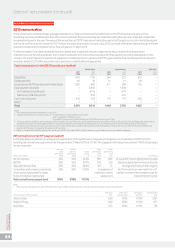

Adjusted free cash ow measure

TSR outperformance

£bn

0%

(Up to median)

4.5%

(65th percentile equivalent)

9%

(80th percentile equivalent)

Below threshold <7.3 0% 0% 0%

Threshold 7.3 50% 75% 100%

Target 9.0 100% 150% 200%

Maximum 10.7 125% 187.5% 250%

TSR peer group

Bharti Orange

BT Group Telecom Italia

Deutsche Telekom Telefónica

MTN

The combined vesting percentages are applied to the target number of shares granted.

Long-term incentive (‘GLTI’) awards vesting

As discussed in detail in last year’s Annual Report, Project Spring involves signicant organic investment over the next two years to enhance network

and serviceleadership further. This investment will have a signicant impact on adjusted Free Cash Flow (‘FCF’), which is the primary performance

condition for the GLTI and we expect an initial drop in FCF that will then build again as the investment pays off over the longer term. The impact

is predicted as follows:

Financial year of award Performance period end Impact

2014 March 2016 Targets for the 2014 awards were set prior to the announcement of Project Spring

therefore we will remove the impact on FCF when calculating the vesting results

following the end of the performance period.

2015 onwards March 2017 onwards The 2015 awards (and all future years) will have the full impact of Project Spring

included in the targets and no further adjustments will be necessary.

Vodafone Group Plc

Annual Report 2015

90

Directors’ remuneration (continued)