Vodafone 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

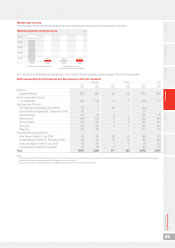

Our audit approach

Overview

Audit scope

Materiality

Areas of

focus

Overall Group materiality: £220 million which represents 5% of a three year average

of adjusted operating prot (‘AOP’). We used a three year average given the impact of

Project Spring investment (refer to pages 6 to 7 in the Annual Report) in the current year

toensure that the measure is more durable over a period of time.

We identied eight local operations which, in our view, required an audit of their complete

nancial information, either due to their size or their risk characteristics including UK,

Spain, Italy, India, Germany and Vodacom Group Limited. The scope of work in Spain

and Germany included an audit of the complete nancial information of Ono and Kabel

Deutschland, which were acquired in the current and prior year respectively.

Further specic audit procedures over central functions and areas of signicant

judgement, including taxation, goodwill, treasury and material provisions and contingent

liabilities, were performed at the Group’s Head Ofce.

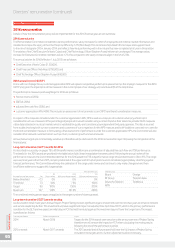

a Taxation matters including a provisioning claim for withholding tax in India and the

recognition and recoverability of deferred tax assets in Luxembourg and Germany.

a Carrying value of goodwill.

a Provisions and contingent liabilities.

a Revenue recognition – accuracy of revenue recorded given the complexity of systems.

a Signicant one-off transactions.

a Capitalisation and asset lives.

a IT systems and controls.

The scope of our audit and our areas of focus

We conducted our audit in accordance with International Standards on Auditing (UK and Ireland) (‘ISAs (UK and Ireland)’).

We designed our audit by determining materiality and assessing the risks of material misstatement in the nancial statements. In particular,

we looked at where the Directors made subjective judgements, for example in respect of signicant accounting estimates that involved making

assumptions and considering future events that are inherently uncertain. As in all of our audits, we also addressed the risk of management override

of internal controls, including evaluating whether there was evidence of bias by the Directors that represented a risk of material misstatement due

to fraud.

The risks of material misstatement that had the greatest effect on our audit, including the allocation of our resources and effort, are identied

as “areas of focus” in the table below. We have also set out how we tailored our audit to address these specic areas in order to provide an opinion

on the nancial statements as a whole, and any comments we make on the results of our procedures should be read in this context. This is not

a complete list of all risks identied by our audit.

Vodafone Group Plc

Annual Report 2015

98

Audit report on the consolidated and parent company nancial statements (continued)