Vodafone 2015 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our operating companies are generally subject to regulation governing

the operation of their business activities. Such regulation typically

takes the form of industry specic law and regulation covering

telecommunications services and general competition (antitrust)

law applicable to all activities.

The following section describes the regulatory frameworks and the

key regulatory developments at the global and supranational level

and in selected countries in which we have signicant interests during

the year ended 31 March 2015. Many of the regulatory developments

reported in the following section involve ongoing proceedings

or consideration of potential proceedings that have not reached

a conclusion. Accordingly, we are unable to attach a specic level

of nancial risk to our performance from such matters.

European Union (‘EU’)

The new European Commission, led by Jean-Claude Juncker,

was appointed in 2014 and will be in place up until 1 November

2019, with Andrus Ansip, the former Estonian Prime Minister the

Vice-President for the Digital Single Market and with Günther Oettinger

as the Commissioner for Digital Economy and Society.

In September 2013, the European Commission (“the Commission”)

delivered major regulatory proposals aimed at building a telecoms

single market and delivering a “Connected Continent”. These proposals

had their rst reading in March 2014 and have since been amended

by the European Parliament and a compromise text has been

produced on behalf of the European Council. From January 2015 the

Latvian Presidency continued discussions with Member States to nd

a common European Council position on the “Connected Continent”

regulatory proposals which are now focused on the abolition of retail

roaming and the introduction of net neutrality regulation.

In May 2016, the European Commission published the Digital Single

Market strategy, aimed at producing a true digital single market.

The strategy is arranged around three pillars: better access for

consumers and businesses to online e-goods and services across

Europe, creating the right conditions for digital networks and services

to ourish and maximising the growth potential of the European digital

economy. As part of this, the Telecoms reform review will start in 2016,

intending to deliver a level playing eld for all market players with

a consistent approach of the rules and to provide economies of scale

for efcient network operators and service providers with an effective

regulatory institutional framework, including a single market approach

to spectrum policy and management. It will also include for the

protection of consumers and the incentivising investment in high speed

broadband networks.

EU recommendations on relevant markets

In October 2014, the EU recommendation to remove ex ante regulation

for voice wholesale markets as they were deemed to be competitive

came into force. (However, these markets can still be reviewed if market

failures occur.) This has seen a reduction in the number of regulated

markets from seven to the following four – xed network access,

business connectivity access and the termination of calls to both mobile

and xed networks.

Fixed network regulation

In May 2014, a Directive on reducing Next Generation Access broadband

deployment costs was passed. It will make it easier and cheaper to roll

out high-speed electronic communications networks by promoting

the joint use of infrastructure, such as electricity, gas, sewage pipes and

existing civil infrastructure of telecoms operators. It has to be transposed

in each member state no later than 1 July 2016. This regulation applies

to all owners of infrastructure whether they are dominant or not.

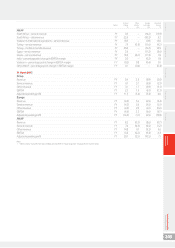

Europe region

Germany

In January 2015, the national regulator, the Federal Network Authority

(‘BNetzA’) published its nal decision on the auction of 700MHz,

900MHz, 1500MHz, and 1800MHz spectrum. The auction is expected

to be held in May 2015.

BNetzA has approved new Mobile Termination Rates (‘MTRs ‘)

on a preliminary basis, and submitted them to the EU (consolidation

proceedings). BNetzA will release the nal rate decisions with

retrospective effect. From 1 December 2014 to 30 November 2015

the MTR is set at 1.72 eurocents per minute which then reduces to 1.66

eurocents per minute from 1 December 2015 until 30 November 2016.

In July 2014, the vectoring register opened for operators to submit their

plans to deploy VDSL vectoring equipment in Deutsche Telekom’s (‘DT’)

cabinets. The operator that obtains the right to deploy VDSL at the

cabinet level must offer wholesale access to the other operators.

In February 2015, DT led a request to BNetzA to gain approval

for deployment of VDSL vectoring in “near range street cabinets”

preventing other operators from deploying their own VDSL equipment

at the exchange. To offset this DT has proposed to offer a “Layer-2” bit-

stream service on a wholesale basis. BNetzA’s decision on DT’s request

is not expected until June 2015.

Italy

The investigation into an alleged competition issue involving

Vodafone Italy, Telecom Italia and Wind, prompted by a complaint

lodged by an Italian MVNO in 2012, was closed at the end of 2014.

The Antitrust Authority (‘AGCM’) reached the conclusion that there was

no ground for the investigation to be carried on and dismissed the case

against Vodafone, while both Telecom Italia and Wind were required

to implement their proposed changes.

The AGCM is investigating if Telecom Italia has been playing a signicant

role in forcing the companies providing maintenance services of the

xed network to keep their prices articially high to the detriment of the

other licensed operators. AGCM’s decision is expected by June 2016.

In May 2014, the Regional Administrative Tribunal upheld the AGCM

decision which found that Telecom Italia had abused its dominant

position in the xed broadband market. Telecom Italia subsequently

paid the imposed ne of €104 million and led an appeal before the

Council of State. Vodafone Italy’s €1 billion claim against Telecom Italia

is based on this ruling. The Council of State heard the appeal in April and

the ruling is due by July 2015.

In May 2014, the Administrative Tribunal found in favour of Vodafone

Italy, overturning the national regulator’s (‘AGCOM’) injunction that had

required them to adopt all the measures required under the Roaming

Regulation in relation to domestic tariffs.

In July 2014, Vodafone Italy extended its 900MHz and 1800MHz

licences from 1 February 2015 to 30 June 2018.

In February 2015, AGCOM opened the public consultation on the

auction rules for L Band assignment from which the Italian Government

is aiming to raise €700 million.

In March 2015, AGCOM closed its public consultation that will determine

the regulatory guidelines for the mobile termination market over the

next three years. The proposal aims to delete the MTR asymmetry

between operators currently favouring Hutchison 3G Limited; reducing

MTRs on a three year glide path to 0.92 eurocents per minute by 2017

and to dene asymmetrical rates for MVNOs. A nal decision is expected

to be announced and then adopted by July 2016.

Overview Strategy review Performance Governance Financials Additional

information Vodafone Group Plc

Annual Report 2015

195

Regulation

Unaudited information