Vodafone 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our strategy (continued)

Unied

Communications

Our customers increasingly expect to connect to friends, information and

entertainment wherever they are, irrespective of the underlying technology.

We are growing our next-generation xed capability to meet their needs.

What is unied

communications?

More and more customers are consuming

bundled xed and mobile services which

often provide better value for money,

and increasingly, one single bill and one single

point of contact. To meet this evolving demand

requires seamless high speed connectivity

through the integration of multiple

technologies such as 3G, 4G, WiFi, cable and

bre – which we call “unied communications”.

The market opportunity

We are well established in mobile, with

a market share in Europe of over 20%.

In the xed market, where we are building

our presence, our share is currently around

10%, giving us a real opportunity to grow

in this space.

The bundling of xed and mobile services has

been a feature of the enterprise market for

several years and it is becoming increasingly

important for consumers too. In a number

of key European markets, a large share

of households already take combined xed

and mobile bundles – including 50% in Spain

and 25% in Portugal – and we see clear signs

of this expanding to other countries.

During the year our competitors launched

new convergent offers in several key European

markets and we started to respond with

our own offers. Therefore, it is critical for

us to continue to develop xed broadband

services alongside our established mobile

assets so that we can compete in this

growing segment.

Our xed strategy

Our goal is to secure access to high speed

xed broadband infrastructure in all our

major European markets. We will continue

to do this either through building our own

bre, wholesaling (renting) from incumbent

xed operators or acquisitions. We decide

which approach to adopt on a market-by-

market basis, taking into account the cost

of building our own bre, the economics of the

wholesale terms on offer, the speed of market

development, and the availability of good

quality businesses to acquire.

We have made good progress on our strategy.

During the year we completed the purchase

of two xed companies – Ono, Spain’s largest

cable company, and Hellas Online, a leading

provider of xed telecom services in Greece.

We are progressing well on the building of our

own bre networks in Italy, Spain and Portugal,

with preparations underway in Ireland.

Context

a Customers increasingly want access

to their content – photos, videos,

music, internet – wherever they are,

and on whatever device they are using –

phone, tablet, laptop or TV screen

a Customers are agnostic about using xed

or mobile networks – the most important

requirement is a reliable connection

a We are seeing a growing demand for both

combined xed and mobile bundles and

pay TV and broadband packages

a The growing demand for data requires

a strong backhaul network with high

speed xed bre or microwave capability

linked to the mobile radio network

Where we are going

a We expect xed revenue to become

more important to us over time as we aim

to increase our market share

a We aim to increase the number of xed

broadband users

a We expect to pass more households with

high speed bre or cable

a We aim to have the best in class

converged services including TV and all

services on one single bill

Project Spring achievements

a Increasing our next-generation xed line

infrastructure to 28 million households

a Increasing xed broadband customers

to 12 million

a Providing ve million customers with

high speed bre or cable broadband

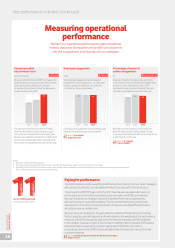

220%

of service revenue from xed services

Fixed service revenue %

percentage of total service revenue

12

2013 2014 2015

16

20

0

15

10

5

20

Fixed broadband and million

TV customers

0.2

6.9

2013 2014 2015

9.2 8.3

12.1

9.1

0

10

5

15

Fixed broadband customers TV customers

Vodafone Group Plc

Annual Report 2015

24