Vodafone 2015 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

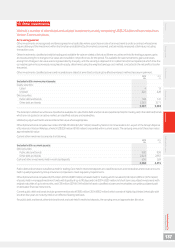

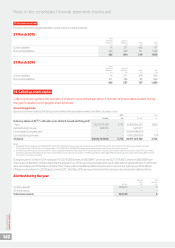

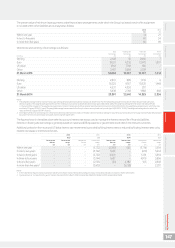

15. Trade and other receivables

Our trade and other receivables mainly consist of amounts owed to us by customers and amounts that we pay

to our suppliers in advance. Trade receivables are shown net of an allowance for bad or doubtful debts. Derivative

nancial instruments with a positive market value are reported within this note.

Accounting policies

Trade receivables do not carry any interest and are stated at their nominal value as reduced by appropriate allowances for estimated irrecoverable

amounts. Estimated irrecoverable amounts are based on the ageing of the receivable balances and historical experience. Individual trade

receivables are written off when management deems them not to be collectible.

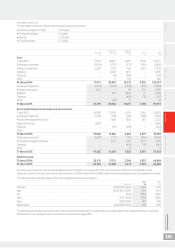

2015 2014

£m £m

Included within non-current assets:

Trade receivables 288 232

Amounts owed by associates and joint ventures 85 51

Other receivables 190 150

Prepayments and accrued income1566 592

Derivative nancial instruments 3,736 2,245

4,865 3,270

Included within current assets:

Trade receivables 3,944 3,627

Amounts owed by associates and joint ventures 133 68

Other receivables 930 1,233

Prepayments and accrued income22,777 3,760

Derivative nancial instruments 269 198

8,053 8,886

Notes:

1 31 March 2015 amount includes prepayments of £566 million and accrued income of £nil.

2 31 March 2015 amount includes prepayments of £938 million and accrued income of £1,839 million.

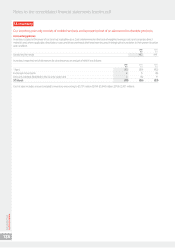

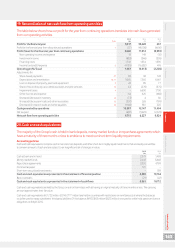

The Group’s trade receivables are stated after allowances for bad and doubtful debts based on management’s assessment of creditworthiness,

an analysis of which is asfollows:

2015 2014 2013

£m £m £m

1 April 589 770 799

Exchange movements (60) (67) (10)

Amounts charged to administrative expenses 541 347 360

Trade receivables written off (268) (461) (379)

31 March 802 589 770

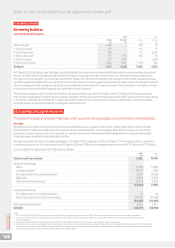

The carrying amounts of trade and other receivables approximate their fair value and are predominantly non-interest bearing. The fair values of the

derivative nancial instruments are calculated by discounting the future cash ows to net present values using appropriate market interest rates and

foreign currency rates prevailing at 31 March.

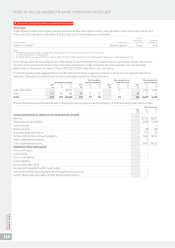

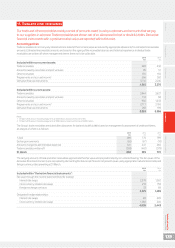

2015 2014

£m £m

Included within “Derivative nancial instruments”:

Fair value through the income statement (held for trading):

Interest rate swaps 2,378 1,262

Cross currency interest rate swaps 218 158

Foreign exchange contracts 33 68

2,629 1,488

Designated hedge relationships:

Interest rate swaps 88 609

Cross currency interest rate swaps 1,288 346

4,005 2,443

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

139