Vodafone 2015 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

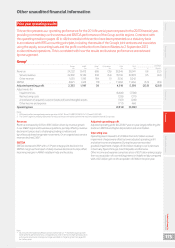

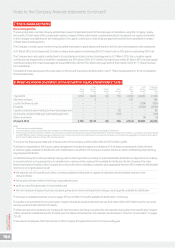

EBITDA declined 18.2%*, with a 4.3* percentage point decline

in EBITDA margin, driven by lower service revenue and increased

customer investment.

The roll-out of 4G services continued with a focus on urban areas, with

overall outdoor population coverage of 70% at 31 March 2014, which

combined with our ongoing network enhancement plan has resulted

in a signicant improvement in voice and data performance in the

second half of the year.

Following its acquisition on 14 October 2013, KDG contributed

£702 million to service revenue and £297 million to EBITDA in Germany.

The domination and prot and loss transfer agreement was registered

on 14 March 2014 and the integration of Vodafone Germany and KDG

began on 1 April 2014.

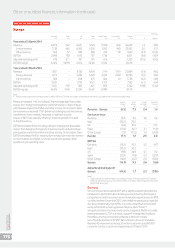

Italy

Service revenue for the year declined 17.3% on a local currency basis

driven by the effect of the summer prepaid price war penetrating the

customer base and the negative impact of MTR cuts effective from

January and July 2013. Mobile in-bundle revenue grew 15.5% on a local

currency basis driven by the take-up of integrated prepaid plans.

Vodafone Red, which had nearly 1.5 million customers at 31 March

2014, continues to penetrate further into the base leading to improving

churn in the contract segment.

Enterprise revenue growth, while still negative, showed signs

of improvement during the year thanks to the success of “Zero”.

Prepaid experienced a steep ARPU decline as a result of the market

move to aggressive bundled offers. 4G services are now available

in 202 municipalities and outdoor coverage has reached 35%.

Fixed line revenue for the year declined 3.0% on a local currency basis

as a result of declining xed voice usage, partly offset by continued

broadband revenue growth supported by 77,000 net broadband

customer additions during the year. Vodafone Italy now offers bre

services in 37 cities and is progressing well on its own bre build plans.

EBITDA for the year declined 24.9% on a local currency basis, with

a 4.7percentage point decline in the local currency EBITDA margin,

primarily driven by the lower revenue, partially offset by strong

efciency improvements delivered on operating costs which fell

6.9%on a local currency basis.

UK

Service revenue decreased 4.4%*, principally driven by declines

in enterprise and prepaid and a 1.9 percentage point impact from MTR

cuts, partially offset by consumer contract service revenue growth.

Mobile in-bundle revenue increased 0.6%* as the positive impact

of contract customer growth and greater penetration of Vodafone

Red plans into the customer base, with nearly 2.7 million customers

at 31 March 2014, offset pricing pressures. Mobile out-of-bundle

declined 7.2%*, primarily driven by lower prepaid revenue.

The activity to integrate the UK operations of CWW was accelerated

successfully and we continue to deliver cash and capex synergies

as planned. The sales pipeline is now growing, which we expect

to materialise into revenue increases in the 2015 nancial year.

The roll-out of 4G services continued following the launch in August

2013, with services now available in 14 cities and over 200 towns,

with over 637,000 4G enabled plans (including Mobile Broadband)

at 31 March 2014. We are making signicant progress in network

performance, particularly in the London area.

EBITDA declined 9.8%*, driven by lower revenue and a 1.0*

percentage point decline in the EBITDA margin as a result of higher

customer investment.

Spain

Service revenue declined 13.4%*, as a result of intense convergence

price competition, macroeconomic price pressure in enterprise and

an MTR cut in July 2013. Service revenue trends began to improve

towards the end of the year. As a result of a stronger commercial

performance and lower customer churn from an improved customer

experience, the contract customer base decline slowed during the

year and the enterprise customer base remained broadly stable.

Mobile in-bundle revenue declined 0.4%* driven by the higher

take-up of Vodafone Red plans, which continue to perform well,

with over 1.2 million customers at 31 March 2014. We had 797,000

4G customers at 31 March 2014 and services are now available in all

Spanish provinces, 227 municipalities and 80 cities.

Fixed line revenue declined 0.2%* as we added 216,000 new

customers during the year and added 276,000 homes to our joint bre

network with Orange. On 17 March 2014 we agreed to acquire Grupo

Corporativo Ono, S.A. (‘Ono’), the leading cable operator in Spain and

the transaction is, subject to customary terms and conditions including

anti-trust clearances by the relevant authorities, expected to complete

in calendar Q3 2014.

EBITDA declined 23.9%*, with a 3.4* percentage point decline in EBITDA

margin, primarily driven by the lower revenue, partly offset by lower

commercial costs and operating cost reductions of 9.4%*.

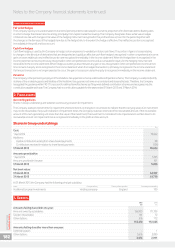

Other Europe

Service revenue declined 7.1%* as price competition and MTR cuts

resulted in service revenue declines of 5.6%*, 8.4%* and 14.1%* in the

Netherlands, Portugal and Greece respectively. However, Hungary and

Romania returned to growth in H2, and all other markets apart from

Portugal showed an improvement in revenue declines in Q4.

In the Netherlands mobile in-bundle revenue increased by 3.4%*, driven

by the success of Vodafone Red plans. In Portugal, the broadband

customer base and xed line revenues continued to grow as the bre

roll-out gained momentum in a market moving strongly towards

converged offers, whilst in Greece the customer base grew due

to the focus on data. In Ireland, contract growth remained good

in a declining market.

EBITDA declined 14.0%*, with a 2.1* percentage point reduction

in the EBITDA margin, driven by lower service revenue, partly offset

by operating cost efciencies.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

177