Vodafone 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Where the industry

is heading

The pace of change in the industry is expected to remain signicant –

the demand for data is accelerating, there is an ongoing shift towards

xed and mobile bundles, networks are improving, and the market

environment is becoming more positive.

Growing importance of

data, emerging markets and

other new revenue areas

Traditional revenue sources – mobile voice

and texts – have reached maturity in a number

of markets. Therefore, to deliver future growth

opportunities, we are investing in newer

revenue areas such as data. It is estimated

that between 2014 and 2018 mobile data

revenue will grow by 18%, compared to a 7%

decline in voice revenue over the same

period. The demand for data will continue

to be driven by rising smartphone and tablet

penetration and usage, and improvements

in mobile network capability. Already 95%

of the world’s total trafc on mobile networks

is data. The data services most used are video

streaming and internet browsing which require

high speed networks. Therefore, operators

are investing more in 4G in European markets

and a combination of 4G and 3G in emerging

markets to provide much faster data speeds.

Emerging markets have signicant potential

for customer and revenue growth driven

by rising populations, strong economic

growth, lower mobile penetration and a lack

of alternative xed line infrastructure. By 2018

it is expected that there will be 1.5 billion new

mobile users in emerging markets, taking their

share of global users to 79%.

Other new revenue streams are being pursued

which extend the use of mobile beyond

everyday communication. These include

money transfers and payments using

a handset, and M2M services such as smart

metering and the location monitoring

of vehicles, through a SIM card embedded

in the vehicle.

Convergence of xed

and mobile into unied

communications

We expect a continued trend towards unied

communications or bundled mobile, xed and

TV services so that customers can use data

services wherever they are and on whatever

device they want.

Internet-based providers often offer “free

calls and texts” services, so mobile operators

increasingly sell unlimited voice and text

bundles, and combine this with a xed fee

for data usage. While we expect the level

of competition to remain robust, we have seen

some encouraging signs of consolidation

among European telecoms operators which

is supportive of further investment.

Improving business

environment in Europe

As Europe represents the majority of our

revenue, the environment is important to us.

The economic recession in Europe over the

last few years has been a key driver of the

declining revenue trends in the region for

many operators. However, the return to GDP

growth in 2014 bodes well for the future.

The regulatory environment in Europe

remains challenging, as a result of ongoing

cuts to regulated revenues such as roaming

and MTRs. The European Commission has

recently announced a new Digital Single

Market package of legislative measures.

While this emphasises the need to improve

the investment climate, it still needs

to translate into specic legislative measures

which – if rapidly adopted – would have

a positive impact.

Notes:

1 ITU Telecommunication Development Bureau.

2 Merrill Lynch.

3 Strategy analytics.

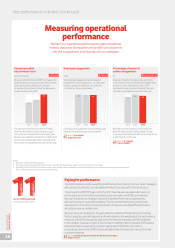

Share of industry %

mobile service revenue3

58 56 54 53

2014 2015 2016 2017 2018

52

42 44 46 47 48

0

80

60

40

20

100

Data/Text Voice

Share of industry mobile users3 %

76 77 78 78

2014 2015 2016 2017 2018

79

24 23 22 22 21

0

80

60

40

20

100

Mature markets Emerging markets

The demand for bundled services has

been a feature of the enterprise market for

several years and is becoming more visible

in the consumer market. We believe that

this demand, combined with technological

advances delivering easier connection

of multiple data devices, will support strong

data growth in the future. Therefore this will

need to be managed by access to next-

generation xed networks, principally cable

or bre, to support increased speed and meet

capacity requirements.

Continued network innovation

The pace of innovation and development

in the networks is increasing. For example,

4G, which we only launched in 2010 already

accounts for 30% of data trafc on Vodafone’s

European networks. Standard 4G provides

speeds of up to 150 Mbps, which is more than

three times the highest 3G speeds. The next

stage of 4G development is 4G+, which bonds

together multiple spectrum blocks to provide

typical peak speeds of up to 450 Mbps.

High-Denition voice is another new mobile

technology which provides customers with

crystal clear call quality. In the xed broadband

sector operators are investing more in

bre which provides data speeds typically

up to 300 Mbps to 1 Gbps, compared with

up to 24 Mbps on copper broadband.

Continued high level

of competition

The high level of competitive intensity

in the communications industry is expected

to continue between established MNOs,

MVNOs, xed operators and internet- based

services providers. MVNOs and smaller mobile

operators are often attractive to value seekers.

However, the high level of investment in 4G

and unied communications by larger MNOs,

such as Vodafone, enables differentiation

through higher network and service quality.

Fixed operators often bundle their services

with mobile, leading Vodafone to acquire xed

capability to bundle with mobile, through

investment in bre networks, acquisitions and

wholesale agreements.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

13