Vodafone 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

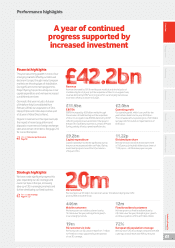

The Board continues to consider the ordinary

dividend to be the core element of shareholder

returns, and believes in a consistent dividend

policy. This year we raised the dividend

per share by 2.0%, and we intend to raise

it annually hereafter.

A major economic

contributor

We have always invested at a high level

to ensure we are a leader in the quality

of service we deliver to customers.

With Project Spring we are reinforcing that

position, not only in Europe but across many

emerging markets too.

However, macroeconomic decline in Europe,

combined with the consequences of past

regulatory policies, has brought about a sharp

reduction in return on capital over recent

years. This has been exacerbated by market

structures which remain fragmented both

between and within member states.

This year, we published a report highlighting

our overall economic impact across the

12EU countries in which we operate.

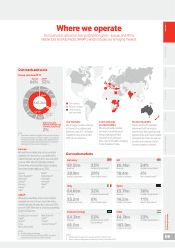

In 2013/14 Vodafone contributed €23.7 billion

to the EU economy (measured in GVA or Gross

Value Added). In addition, Vodafone:

a provided employment for 170,000 people

across its direct workforce and European

supplier base, as of 31 March 2014;

a paid €2.4 billion to EU governments in direct

taxation, spectrum costs and other fees,

and an additional €4.4 billion in indirect tax

payments in 2013/14; and

a since 2000, has paid EU governments a total

of €20.8 billion for access to spectrum to roll

out 3G and 4G networks across Europe.

The new European Commission has identied

as a priority the need to reboot Europe’s digital

strategy. We encourage the Commission

to prioritise measures intended to ensure fair

and sustainable competition based on a level

playing eld for all companies.

It will also be important for the Commission

to pursue harmonisation of rules on spectrum,

data protection, copyright and other areas,

as well as to adopt a principles-based approach

to the open internet to support future

innovation and investment.

Our economic impact in emerging markets

is no less strongly felt, yet there too we face

continued pressures from regulatory and

scal intervention. In South Africa, for example,

the signicant mobile termination rate (‘MTR’)

cuts of the last year had a material nancial

impact on our business.

While India represents an excellent long

term investment opportunity, the present

regulatory challenges are hampering

economic development. Spectrum auction

structures combined with the piecemeal

release of new spectrum, leaves less capital

available for investment in bringing high

quality services to more of the country,

and this is exacerbated by other ongoing

regulatory challenges.

Changes to the Board

In January, Stephen Pusey informed

the Board of his intention to step down

as Group CTO. His many achievements

over eight years include the international

expansion of Vodafone’s 3G services,

the launch of 4G in 18 countries and the

development of global IT, procurement and

cyber security functions. More recently,

he has led the Project Spring investment

programme, and has also played a leading

role in developing the Group’s convergence

strategy. Stephen’s successor, Johan Wibergh,

was previously Executive Vice President and

Head of the Networks segment at Ericsson.

During the year there were a number

of changes to the non-executive team and

these are set out in my Governance statement

on page 50.

Gerard Kleisterlee

Chairman

Over the last two years, our move into unied

communications has taken signicant

steps forward, both through acquisition and

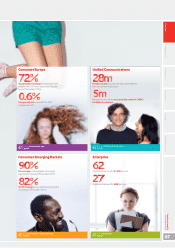

organic investment. 25% of European service

revenue now comes from xed line services,

and we have 12 million xed broadband

customers across the Group.

On 4G we have more than doubled our

footprint in Europe in the last 18 months,

to 72% population coverage. In India, we now

provide 3G services in over 90% of our target

urban areas. Data trafc across the Group grew

80% during the year.

These investments benet businesses

as much as consumers. Building on the Cable

& Wireless Worldwide acquisition, which

brought us global bre infrastructure and

points of presence in 62 countries, we are

taking new services into new geographical

areas to deepen customer relationships and

grow revenue.

Aligning management

pay to value creation and

customer perception

Our remuneration policies continue to focus

on rewarding long term value creation.

The annual bonus this year was slightly

higher than last year, reecting improved

performance against targets; but the failure

to meet the three year threshold on free cash

ow resulted in a zero pay-out on the long-

term incentive plan.

We have also made a number of changes

to management incentives in recent years

to limit total pay, such as the reduction of the

maximum achievable pay-out on the long-

term scheme and the payments made in lieu

of pension contributions.

This year we have made a signicant

change to the criteria for the annual bonus

(‘GSTIP’)scheme.

The substantial investments in networks

need to be supported by a clear step up in the

customer experience and satisfaction, and the

Board wants this to be reected in short

term incentives. 40% of the total GSTIP

assessment will now be based on Customer

Appreciation measures.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

03