Vodafone 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

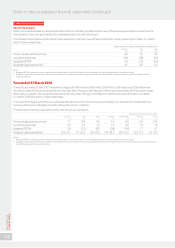

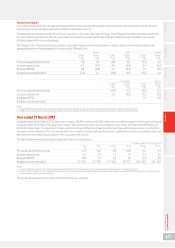

Notes to the consolidated nancial statements (continued)

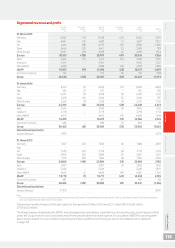

2. Segmental analysis

The Group’s businesses are managed on a geographical basis. Selected nancial data is presented on this

basisbelow.

The Group’s operating segments are established on the basis of those components of the Group that are evaluated regularly by the chief operating

decision maker in deciding how to allocate resources and in assessing performance. The Group has a single group of related services and products

being the supply of communications services and products. Revenue is attributed to a country or region based on the location of the Group

company reporting the revenue. Transactions between operating segments are charged at arm’s-length prices.

In the Annual Report for the year ended 31 March 2014, the discussion of our revenues and EBITDA by segment was performed under the

“management basis”, which included the results of our joint ventures on proportionate basis, as this was assessed as being the most insightful

presentation and was how the Group’s operating performance was reviewed internally by management. For the year ended 31 March 2015 the

discussion of our revenues and EBITDA by segment is performed on an IFRS basis. Following the disposal of our US Group whose principal asset

was its 45% interest in Verizon Wireless and the acquisition of a 100% interest in Vodafone Italy on 21 February 2014, this is now assessed as being

the most insightful presentation and reects how the Group’s operating performance was reviewed internally by management in the year ended

31 March 2015. Segmental information for the years ended 31 March 2014 and 31 March 2013 below has been restated accordingly.

Segment information is provided on the basis of geographic areas, being the basis on which the Group manages its worldwide interests, with each

country in which the Group operates treated as an operating segment. The aggregation of operating segments into the Europe and AMAP regions

reects, in the opinion of management, the similar economic characteristics within each of those regions as well the similar products and services

offered and supplied, classes of customers and the regulatory environment. In the case of the Europe region this largely reects membership

of the European Union, while for the AMAP region this largely includes emerging and developing economies that are in the process of rapid growth

and industrialisation.

Certain nancial information is provided separately within the Europe region for Germany, Italy, the UK and Spain and within the AMAP region for

India and Vodacom, as these operating segments are individually material for the Group.

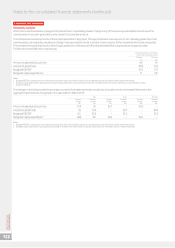

Accounting policies

Revenue

Revenue is recognised to the extent the Group has delivered goods or rendered services under an agreement, the amount of revenue can

be measured reliably and it is probable that the economic benets associated with the transaction will ow to the Group. Revenue is measured at the

fair value of the consideration receivable, exclusive of sales taxes and discounts.

The Group principally obtains revenue from providing the following telecommunication services: access charges, airtime usage, messaging,

interconnect fees, data services and information provision, connection fees and equipment sales. Products and services may be sold separately

or in bundled packages.

Revenue for access charges, airtime usage and messaging by contract customers is recognised as services are performed, with unbilled revenue

resulting from services already provided accrued at the end of each period and unearned revenue from services to be provided in future periods

deferred. Revenue from the sale of prepaid credit is deferred until such time as the customer uses the airtime, or the credit expires.

Revenue from interconnect fees is recognised at the time the services are performed.

Revenue from data services and information provision is recognised when the Group has performed the related service and, depending on the

nature of the service, is recognised either at the gross amount billed to the customer or the amount receivable by the Group as commission for

facilitating the service.

Customer connection revenue is recognised together with the related equipment revenue to the extent that the aggregate equipment and

connection revenue does not exceed the fair value of the equipment delivered to the customer. Any customer connection revenue not recognised

together with related equipment revenue is deferred and recognised over the period in which services are expected to be provided to the customer.

Revenue for device sales is recognised when the device is delivered to the end customer and the signicant risks and rewards of ownership have

transferred. For device sales made to intermediaries, revenue is recognised if the signicant risks associated with the device are transferred to the

intermediary and the intermediary has no general right to return the device to receive a refund. If the signicant risks are not transferred, revenue

recognition is deferred until sale of the device to an end customer by the intermediary or the expiry of any right of return.

In revenue arrangements including more than one deliverable, the arrangements are divided into separate units of accounting. Deliverables are

considered separate units of accounting if the following two conditions are met: (i) the deliverable has value to the customer on a stand-alone basis

and (ii)there is evidence of the fair value of the item. The arrangement consideration is allocated to each separate unit of accounting based on its

relative fair value. Revenue allocated to deliverables is restricted to the amount that is receivable without the delivery of additional goods or services.

This restriction typically applies to revenue recognised for devices provided to customers, including handsets.

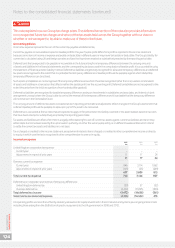

Commissions

Intermediaries are given cash incentives by the Group to connect new customers and upgrade existing customers.

For intermediaries who do not purchase products and services from the Group, such cash incentives are accounted for as an expense. Such cash

incentives to other intermediaries are also accounted for as an expense if:

a the Group receives an identiable benet in exchange for the cash incentive that is separable from sales transactions to that intermediary; and

a the Group can reliably estimate the fair value of that benet.

Cash incentives that do not meet these criteria are recognised as a reduction of the related revenue.

Vodafone Group Plc

Annual Report 2015

114