Vodafone 2015 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

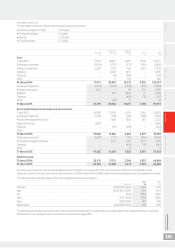

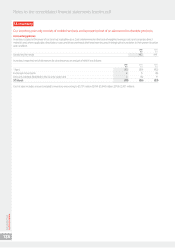

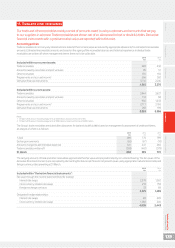

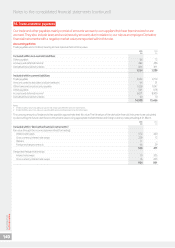

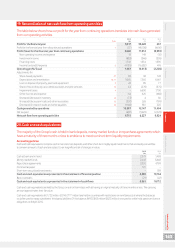

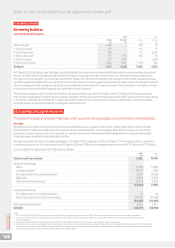

17. Provisions

A provision is a liability recorded in the statement of nancial position, where there is uncertainty over the timing

or amount that will be paid, and is therefore often estimated. The main provisions we hold are in relation to asset

retirement obligations, which include the cost of returning network infrastructure sites to their original condition

at the end of the lease, and claims for legal and regulatory matters. For further details see “Critical accounting

judgements” in note 1 “Basis of preparation” to the consolidated nancial statements.

Accounting policies

Provisions are recognised when the Group has a present obligation (legal or constructive) as a result of a past event, it is probable that the Group will

be required to settle that obligation and a reliable estimate can be made of the amount of the obligation. Provisions are measured at the Directors’

best estimate of the expenditure required to settle the obligation at the reporting date and are discounted to present value where the effect

is material.

Asset retirement obligations

In the course of the Group’s activities, a number of sites and other assets are utilised which are expected to have costs associated with

de-commissioning. Theassociated cash outows are substantially expected to occur at the dates of exit of the assets to which they relate,

whicharelong-term in nature, primarily in periods up to 25 years from when the asset is brought into use.

Legal and regulatory

The Group is involved in a number of legal and other disputes, including notications of possible claims. The Directors of the Company, after taking

legal advice, have established provisions after taking into account the facts of each case. The timing of cash outows associated with the majority

of legal claims are typically less than one year, however, for some legal claims the timing of cash ows may be long-term in nature. For a discussion

of certain legal issues potentially affecting the Group see note 30 “Contingent liabilities” to the consolidated nancial statements.

Other provisions

Other provisions comprises various provisions including those for restructuring costs and property. The associated cash outows for restructuring

costs are primarily less than one year. The timing of the cash ows associated with property is dependent upon the remaining term of the

associated lease.

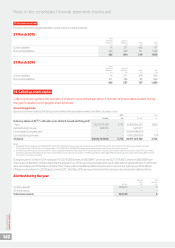

Asset

retirement Legal and

obligations regulatory Other Total

£m £m £m £m

1 April 2013 467 450 653 1,570

Exchange movements (14) (33) (27) (74)

Arising on acquisition 62 92 5159

Amounts capitalised in the year 14 – – 14

Amounts charged to the income statement –140 374 514

Utilised in the year − payments (26) (35) (186) (247)

Amounts released to the income statement –(32) (61) (93)

Other (18) (25) 9(34)

31 March 2014 485 557 767 1,809

Exchange movements (34) (18) (47) (99)

Arising on acquisition –26 59 85

Amounts capitalised in the year 58 – – 58

Amounts charged to the income statement –277 270 547

Utilised in the year − payments (13) (51) (385) (449)

Amounts released to the income statement (30) (100) (96) (226)

Other –143 (19) 124

31 March 2015 466 834 549 1,849

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

141