Vodafone 2015 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

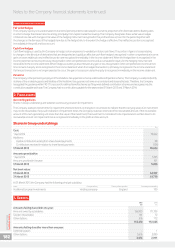

7. Share-based payments

Accounting policies

The Group operates a number of equity-settled share-based compensation plans for the employees of subsidiaries using the Company’s equity

instruments. The fair value of the compensation given in respect of these share-based compensation plans is recognised as a capital contribution

to the Company’s subsidiaries over the vesting period. The capital contribution is reduced by any payments received from subsidiaries in respect

of these share-based payments.

The Company currently uses a number of equity settled share plans to grant options and shares to the Directors and employees of its subsidiaries.

At 31 March 2015, the Company had 25 million ordinary share options outstanding (2014: 27 million) and no ADS options outstanding (2014:nil).

The Company has made capital contributions to its subsidiaries in relation to share-based payments. At 31 March 2015, the cumulative capital

contribution net of payments received from subsidiaries was £93 million (2014: £131 million). During the year ended 31 March 2015, the total capital

contribution arising from share-based payments was £88 million (2014: £103 million), with payments of £126 million (2014: £177 million) received

from subsidiaries.

Full details of share-based payments, share option schemes and share plans are disclosed in note 27 “Share-based payments” to the consolidated

nancial statements.

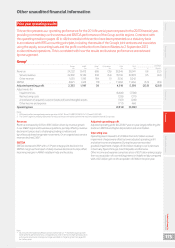

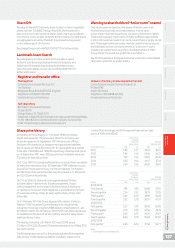

8. Reserves and reconciliation of movements in equity shareholders’ funds

Share Own Prot Total equity

Share premium Capital Other shares and loss shareholders’

capital account1reserve1reserves1held2account3 funds

£m £m £m £m £m £m £m

1 April 2014 3,792 16,109 88 758 (7, 289) 33,900 47, 358

Allotment of shares – 2– – 142 – 144

Loss for the nancial year – – – – – (934) (934)

Dividends – – – – – (2,930) (2,930)

Capital contribution given relating to share-based payments – – – 88 – – 88

Contribution received relating to share-based payments – – – (126) – – (126)

Other movements – – – – – (4) (4)

31 March 2015 3,792 16,111 88 720 (7,147) 30,032 43,596

Notes:

1 These reserves are not distributable.

2 Own shares relate to treasury shares which are purchased out of distributable prots and therefore reduce reserves available for distribution.

3 The Company has determined what is realised and unrealised in accordance with the guidance provided by ICAEW TECH 2/10 and the requirements of UK law. In accordance with UK Companies

Act 2006 s831(2), a public company may make a distribution only if, after giving effect to such distribution, the amount of its net assets is not less than the aggregate of its called up share capital

and non-distributable reserves as shown in the relevant accounts.

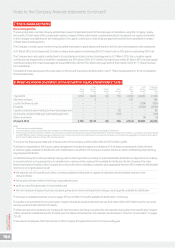

The loss for the nancial year dealt with in the accounts of the Company is £934 million (2014: £10,970 million prot).

The Board is responsible for the Group’s capital management including the approval of dividends. This includes an assessment of both the level

of reserves legally available for distribution and consideration as to whether the Company would be solvent and retain sufcient liquidity following

any proposed distribution.

As Vodafone Group Plc is a Group holding company with no direct operations, its ability to make shareholder distributions is dependent on its ability

to receive funds for such purposes from its subsidiaries in a manner which creates prots available for distribution for the Company. The major

factors that impact the ability of the Company to access prots held in subsidiary companies at an appropriate level to full its needs for distributable

reserves on an ongoing basis include:

a the absolute size of the prot pools either currently available for distribution or capable of realisation into distributable reserves in the

relevant entities;

a the location of these entities in the Group’s corporate structure;

a prot and cash ow generation in those entities; and

a the risk of adverse changes in business valuations giving rise to investment impairment charges, reducing prots available for distribution.

The Group’s consolidated reserves set out on page 107 do not reect the prots available for distribution in the Group.

The auditor’s remuneration for the current year in respect of audit and audit-related services was £2.0 million (2014: £0.9 million) and for non-audit

services was £2.0 million (2014: £3.5 million).

The Directors are remunerated by the Company for their services to the Group as a whole. No remuneration was paid to them specically in respect

of their services to Vodafone Group Plc for either year. Full details of the Directors’ remuneration are disclosed in “Directors’ remuneration” on pages

75 to 91.

There were no employees other than directors of the Company throughout the current or the preceding year.

Vodafone Group Plc

Annual Report 2015

184

Notes to the Company nancial statements (continued)