Vodafone 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the consolidated nancial statements (continued)

1. Basis of preparation (continued)

Translation differences on non-monetary nancial assets, such as investments in equity securities classied as available-for-sale, are reported as part

of the fair value gain or loss and are included in equity.

For the purpose of presenting consolidated nancial statements, the assets and liabilities of entities with a functional currency other than sterling

are expressed in sterling using exchange rates prevailing at the reporting period date. Income and expense items and cash ows are translated

at the average exchange rates for the period and exchange differences arising are recognised directly in equity. On disposal of a foreign entity,

the cumulative amount previously recognised in equity relating to that particular foreign operation is recognised in prot or loss.

Goodwill and fair value adjustments arising on the acquisition of a foreign operation are treated as assets and liabilities of the foreign operation and

translated accordingly.

In respect of all foreign operations, any exchange differences that have arisen before 1 April 2004, the date of transition to IFRS, are deemed to be nil

and will be excluded from the determination of any subsequent prot or loss on disposal.

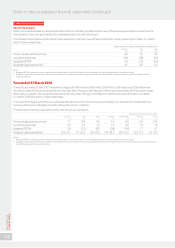

The net foreign exchange gain recognised in the consolidated income statement for the year ended 31 March 2015 is £273 million (31 March

2014: £1,688 million loss; 2013: £117 million loss). The net gains and net losses are recorded within operating prot (2015: £8 million charge;

2014: £16 million charge; 2013: £21 million charge), other income and expense and non-operating income and expense (2015: £1 million

credit; 2014: £1,493 million charge; 2013: £1 million charge), investment and nancing income (2015: £276 million credit; 2014: £180 million

charge; 2013: £91 million charge) and income tax expense (2015: £4 million credit; 2014: £1 million credit; 2013: £4 million charge). The foreign

exchange gains and losses included within other income and expense and non-operating income and expense arise on the disposal of interests

in joint ventures, associates and investments from the recycling of foreign exchange gains previously recorded in the consolidated statement

of comprehensive income.

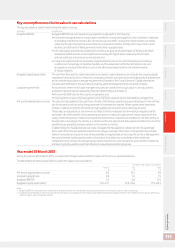

New accounting pronouncements adopted on 1 April 2014

On 1 April 2014 the Group adopted the following new accounting policies to comply with amendments to IFRS. The accounting pronouncements,

none of which are considered by the Group as signicant on adoption, are:

a Amendments to IAS 32 “Offsetting nancial assets and nancial liabilities”;

a Amendments to IAS 39 “Novation of derivatives and continuation of hedge accounting”;

a “Improvements to IFRS 2010–2012 cycle”. All the amendments were early adopted by the Group except an amendment to IFRS 8 “Operating

Segments”, which will be adopted on 1 April 2015; and

a IFRIC 21 “Levies”.

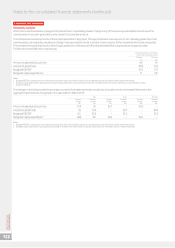

New accounting pronouncements to be adopted on 1 April 2015

The following pronouncements which are potentially relevant to the Group have been issued by the IASB are effective for annual periods beginning

on or after 1 July 2014 and have been endorsed for use in the EU:

a Amendments to IAS 19 “Dened Benet Plans: Employee Contributions”;

a “Improvements to IFRS 2010–2012 cycle” amendment to IFRS 8 “Operating Segments”; and

a “Improvements to IFRS 2011–2013 cycle”.

The Group’s nancial reporting will be presented in accordance with the new standards above, which are not expected to have a material impact

on the consolidated results, nancial position or cash ows of the Group, from 1 April 2015.

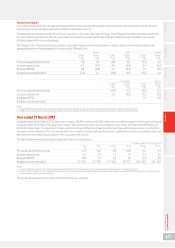

New accounting pronouncements to be adopted on or after 1 April 2016

On 1 April 2016 the Group will adopt “Accounting for Acquisitions of Interests in Joint Operations, Amendments to IFRS 11”, “Clarication

of Acceptable Methods of Depreciation and Amortisation, Amendments to IAS 16 and IAS 38”, “Sale or Contribution of Assets between an Investor

and its Associate or Joint Venture, Amendments to IAS 10 and IAS 28”, “Improvements to IFRS 2012–2014 Cycle” and “Disclosure Initiative,

Amendments to IAS 1” which are effective for accounting periods on or after 1 January 2016 and which have not yet been endorsed by the EU.

The Group is currently conrming the impacts of the above new pronouncements on its results, nancial position and cash ows, which are not

expected to be material.

Vodafone Group Plc

Annual Report 2015

112