Vodafone 2015 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the consolidated nancial statements (continued)

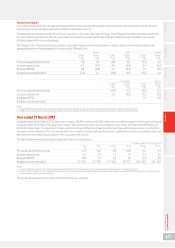

4. Impairment losses

Impairment occurs when the carrying value of assets is greater than the present value of the net cash ows they

are expected to generate. We review the carrying value of assets for each country in which we operate at least

annually. For further details on our impairment review process see “Critical accounting judgements and key

sources of estimation uncertainty” in note 1 “Basis of preparation” to the consolidated nancial statements.

Accounting policies

Goodwill

Goodwill is not subject to amortisation but is tested for impairment annually or whenever there is an indication that the asset may be impaired.

For the purpose of impairment testing, assets are grouped at the lowest levels for which there are separately identiable cash ows, known as cash-

generating units. If the recoverable amount of the cash-generating unit is less than the carrying amount of the unit, the impairment loss is allocated

rst to reduce the carrying amount of any goodwill allocated to the unit and then to the other assets of the unit pro-rata on the basis of the carrying

amount of each asset in the unit. Impairment losses recognised for goodwill are not reversible in subsequent periods.

The recoverable amount is the higher of fair value less costs to sell and value in use. In assessing value in use, the estimated future cash ows are

discounted to their present value using a pre-tax discount rate that reects current market assessments of the time value of money and the risks

specic to the asset for which the estimates of future cash ows have not been adjusted.

The Group prepares and approves formal ve year management plans for its operations, which are used in the value in use calculations. In certain

developing markets the fth year of the management plan may not be indicative of the long-term future performance as operations may not have

reached maturity. For these operations, the Group may extend the plan data for an additional ve year period.

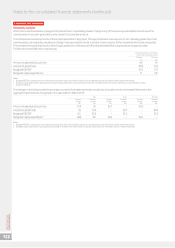

Property, plant and equipment and nite lived intangible assets

At each reporting period date, the Group reviews the carrying amounts of its property, plant and equipment and nite lived intangible assets

to determine whether there is any indication that those assets have suffered an impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent, if any, of the impairment loss. Where it is not possible to estimate the recoverable

amount of an individual asset, the Group estimates the recoverable amount of the cash-generating unit to which the asset belongs.

If the recoverable amount of an asset or cash-generating unit is estimated to be less than its carrying amount, the carrying amount of the asset

or cash-generating unit is reduced to its recoverable amount and an impairment loss is recognised immediately in the income statement.

Where an impairment loss subsequently reverses, the carrying amount of the asset or cash-generating unit is increased to the revised estimate of its

recoverable amount, not to exceed the carrying amount that would have been determined had no impairment loss been recognised for the asset

or cash-generating unit in prior years and an impairment loss reversal is recognised immediately in the income statement.

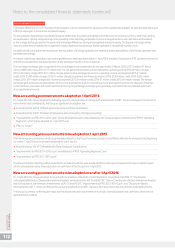

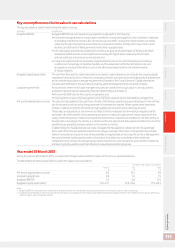

Impairment losses

Following our annual impairment review no impairment charges were recorded in respect of the Group’s goodwill balances during the year ended

31 March 2015. The impairment losses recognised in the consolidated income statement within operating prot in respect of goodwill in the years

ended 31 March 2014 and 31 March 2013 are stated below. The impairment losses were based on value in use calculations.

2015 2014 2013

Cash-generating unit Reportable segment £m £m £m

Germany Germany –4,900 –

Italy Italy – – 4,500

Spain Spain –800 3,200

Portugal Other Europe –500 –

Czech Republic Other Europe –200 –

Romania Other Europe –200 –

–6,600 7,700

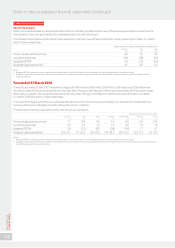

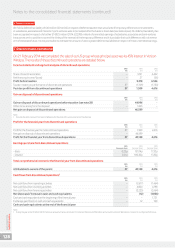

Goodwill

The remaining carrying value of goodwill at 31 March was as follows:

2015 2014

£m £m

Germany 9,019 10,306

Italy 2,641 3,017

Spain 2,755 1,662

14,415 14,985

Other 8,122 8,330

22,537 23,315

Vodafone Group Plc

Annual Report 2015

118