Vodafone 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

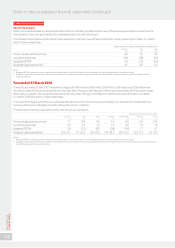

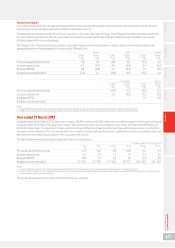

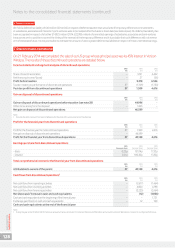

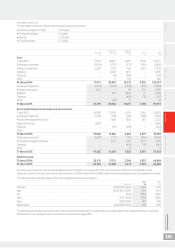

5. Investment income and nancing costs

Investment income comprises interest received from short-term investments, bank deposits, government bonds

and gains from foreign exchange contracts which are used to hedge net debt. Financing costs mainly arise from

interest due on bonds and commercial paper issued, bank loans and the results of hedging transactions used to

manage foreign exchange and interest rate movements.

2015 2014 2013

£m £m £m

Investment income:

Available-for-sale investments:

Dividends received –10 2

Loans and receivables at amortised cost 324 184 124

Fair value through the income statement (held for trading):

Derivatives – foreign exchange contracts –82 115

Other1559 70 64

883 346 305

Financing costs:

Items in hedge relationships:

Other loans 245 265 228

Interest rate and cross currency interest rate swaps (123) (196) (184)

Fair value hedging instrument (461) 386 (81)

Fair value of hedged item 418 (363) 112

Other nancial liabilities held at amortised cost:

Bank loans and overdrafts2842 557 584

Other loans3677 770 736

Interest credit on settlement of tax issues4(4) (15) (91)

Equity put rights and similar arrangements511 143 136

Fair value through the income statement (held for trading):

Derivatives – forward starting swaps and futures 131 1105

Other1– 6 51

1,736 1,554 1,596

Net nancing costs 853 1,208 1,291

Notes:

1 Amounts for 2015 include net foreign exchange gains of £526 million (2014: £21 million gain; 2013: £91 million loss) arising from net foreign exchange movements on certain

intercompany balances.

2 The Group capitalised £142 million of interest expense in the year (2014: £3 million; 2013: £8 million).

3 Amounts for 2015 include net foreign exchange losses of £250 million (2014: £201 million; 2013: £nil).

4 Amounts for 2015, 2014 and 2013 include a reduction of the provision for potential interest on tax issues.

5 Includes amounts in relation to the Group’s arrangements with its non-controlling interests.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

123