Vodafone 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Project Spring

First communicated in detail in November

2013, Project Spring is our two-year, £19 billion

investment programme designed to place

Vodafone at the forefront of the growth

in mobile data and the increasing trend

towards the convergence of xed and mobile

services. The key elements of the Spring

infrastructure build are:

a building 4G to over 90% of the population

in our European markets and 3G to up to

95% of the population in targeted areas

of India;

a modernising our mobile network, with

high speed backhaul giving us the

capacity to provide a consistently good

network experience to our customers;

a making calls more reliable – still the

number one priority for most customers;

a upgrading our retail presence, to offer

customers modern shops focused

on service as well as sales;

a increasing our next-generation xed line

infrastructure in Spain, Italy and Portugal;

and

a enhancing our suite of Enterprise products

and services, and taking them into new

geographical areas.

We have made signicant progress on all

of these elements during the year, and are

on track to hit our key March 2016 targets.

Highlights of our progress include:

a extending our European 4G footprint

to 72% population coverage, up from 32%

in September 2013;

a adding a further 33,000 2G and 42,000 3G

sites, to deepen our existing coverage and

improve voice reliability;

a reaching 90% of the population

in targeted urban areas with 3G in India;

and

a covering an additional 3.9 million homes

across Europe with our own bre.

These investments have already seen the

customer experience improve signicantly,

with 88% of customers’ data sessions

in Europe now at 3 Mbps or better (the level

required to watch uninterrupted high-

denition video), and dropped call rates

in Europe falling by 34%.

Data

We have witnessed exceptional demand

for data this year, whether 4G in Europe

or 3G in emerging markets, with data growth

totalling 80% for the full year, and accelerating

every quarter in Europe. As video and music

services proliferate, and data coverage widens

and becomes more consistent, customers

are increasingly using their smartphones

and tablets for entertainment, work and

social interaction.

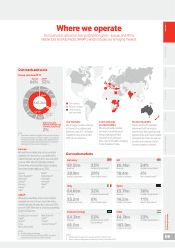

We now provide 4G services in 18 countries,

with a further four countries launched

during the year. Our 4G customer base has

quadrupled to 20.2 million. While progress

has been rapid, still only 13% of our

European customer base is on 4G, providing

us with a very substantial opportunity for

future growth.

With quicker network response times, better

in-building penetration and higher peak

speeds, 4G is stimulating signicant growth

in data, with usage typically doubling when

customers migrate from 3G to 4G. In addition,

our successful commercial approach

of bundling content packages with 4G

in a number of European markets is boosting

data consumption further, and enabling

us to introduce larger data bundles

to customers. Our ability to translate this

strong data demand into revenue growth will

be a key driver of our nancial performance

in the years ahead.

In emerging markets, the data story is equally

positive. In India, for example, we already have

19 million 3G customers (up from 7 million

a year ago), smartphone penetration in urban

areas is already 44%, and 3G data usage

per customer is at similar levels to Europe.

For many, their rst experience of the

internet will be on mobile, given the lack

of xed line infrastructure. Our rapid roll-out

of 3G networks this year is generating a rapid

payback, with 3G browsing revenues growing

at 140% during the year.

Unied communications

We are well on the way to becoming a full

service, integrated operator in our main

markets. Through organic investment

and acquisition, we now cover 28 million

households (and thousands of businesses)

across Europe with our own bre or cable

infrastructure. In addition, we can reach

a further 22 million households by accessing

the incumbent operators’ networks. In the

2015 nancial year, 25% of our service revenue

in Europe came from xed line, compared

to just 10% ve years ago. We now have

11.3 million broadband customers and

9.1 million TV customers in Europe.

During the year we completed the acquisition

of Ono, Spain’s number one cable operator

covering seven million homes. We made

strong progress on the integration of both Ono

and KDG in Germany, combining our xed and

mobile networks and beginning to migrate

Vodafone broadband customers to our

new infrastructure.

We are also demonstrating strong commercial

momentum. We increased our European

broadband customer base by over 850,000

(excluding acquisitions) during the year, with

revenue trends improving through the year.

In the coming weeks, we will launch our

consumer broadband proposition in the UK,

with TV to follow later in 2015, and as a result

will be offering integrated xed and mobile

services in all of our major European markets.

Chief Executive’s strategic review (continued)

Vodafone Group Plc

Annual Report 2015

16