Vodafone 2015 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

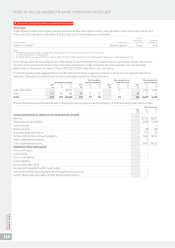

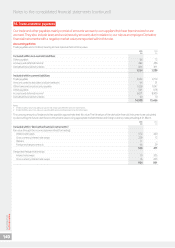

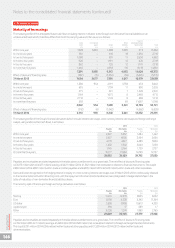

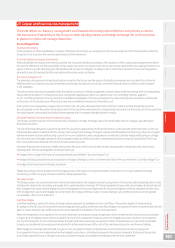

21. Borrowings (continued)

Maturity of borrowings

The maturity prole of the anticipated future cash ows including interest in relation to the Group’s non-derivative nancial liabilities on an

undiscounted basis which, therefore, differs from both the carrying value and fair value, is as follows:

Loans in

Bank Commercial Other designated hedge

loans paper Bonds liabilities relationships Total

£m £m £m £m £m £m

Within one year 1,928 5,092 1,588 3,885 873 13,366

In one to two years 831 – 610 18 1,256 2,715

In two to three years 1,090 – 831 11 2,650 4,582

In three to four years 920 – 1,191 12 626 2,749

In four to ve years 862 – 135 12 1,101 2,110

In more than ve years 1,660 – 4,958 115 8,118 14,851

7,291 5,092 9,313 4,053 14,624 40,373

Effect of discount/nancing rates (287) (15) (1,332) (36) (3,645) (5,315)

31 March 2015 7,004 5,077 7,981 4,017 10,979 35,058

Within one year 1,286 954 2,191 3,758 453 8,642

In one to two years 695 – 1,709 11 890 3,305

In two to three years 375 – 591 71,228 2,201

In three to four years 1,164 – 1,075 82,468 4,715

In four to ve years 2,710 – 1,724 8668 5,110

In more than ve years 592 – – 69 11,087 11,748

6,822 954 7,290 3,861 16,794 35,721

Effect of discount/nancing rates (912) (4) (1,042) – (4,562) (6,520)

31 March 2014 5,910 950 6,248 3,861 12,232 29,201

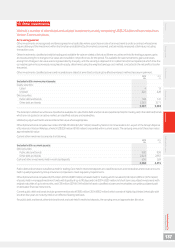

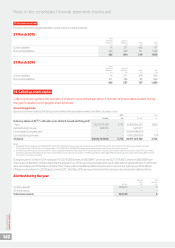

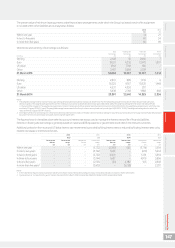

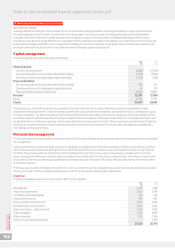

The maturity prole of the Group’s nancial derivatives (which include interest rate swaps, cross currency interest rate swaps and foreign exchange

swaps), using undiscounted cash ows, is as follows:

2015 2014

Payable Receivable Payable Receivable

£m £m £m £m

Within one year 2,647 3,537 1,284 1,442

In one to two years 5,457 4,005 2,454 3,656

In two to three years 4,179 4,617 4,489 3,920

In three to four years 1,430 1,942 5,040 3,138

In four to ve years 1,145 2,164 1,729 2,137

In more than ve years 13,177 17,864 14,799 12,737

28,035 34,129 29,795 27,030

Payables and receivables are stated separately in the table above as settlement is on a gross basis. The net effect of discount/nancing rates

is £3,073 million (2014: £4,327 million), leaving a £3,021 million (2014: £1,562 million) net receivable in relation to nancial instruments. This is split

£984 million (2014: £881 million) within trade and other payables and £4,005 million (2014: £2,443 million) within trade and other receivables.

Gains and losses recognised in the hedging reserve in equity on cross currency interest rate swaps as at 31 March 2015 will be continuously released

to the income statement within nancing costs until the repayment of certain bonds classied as loans designated in hedge relationships in the

table of maturities of non-derivative nancial liabilities above.

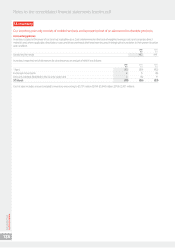

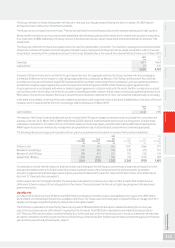

The currency split of the Group’s foreign exchange derivatives is as follows:

2015 2014

Payable Receivable Payable Receivable

£m £m £m £m

Sterling 11, 4 61 12,578 8,955 9,222

Euro 8,158 6,228 5,342 11,364

US dollar 5,598 9,908 10,613 4,330

Japanese yen 594 17 589 17

Other 3,238 1,374 1,880 2,765

29,049 30,105 27,379 27,698

Payables and receivables are stated separately in the table above as settlement is on a gross basis. The net effect of discount/nancing rates

is £192 million (2014: £7 million), leaving a £1,248 million (2014: £326 million) net receivable in relation to foreign exchange nancial instruments.

This is split £291 million (2014: £246 million) within trade and other payables and £1,539 million (2014: £572 million) within trade and

other receivables.

Notes to the consolidated nancial statements (continued)

Vodafone Group Plc

Annual Report 2015

146