Vodafone 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

41

Amortisation of intangible assets in relation to customer bases and

brands are recognised under accounting rules after we acquire

businesses and amounted to £1,269 million (2014: £551 million).

Amortisation charges increased in the year as a result of the acquisitions

of KDG, Vodafone Italy and Ono.

Other income and expense decreased by £0.6 billion due to the

inclusion in the prior year of £0.7 billion loss arising from our acquisition

of a controlling interest in Vodafone Italy.

Including the above items, operating prot increased to £2.0 billion from

a £3.9 billion loss primarily as a result of the £6.6 billion impairment

charge in the year ended 31 March 2014.

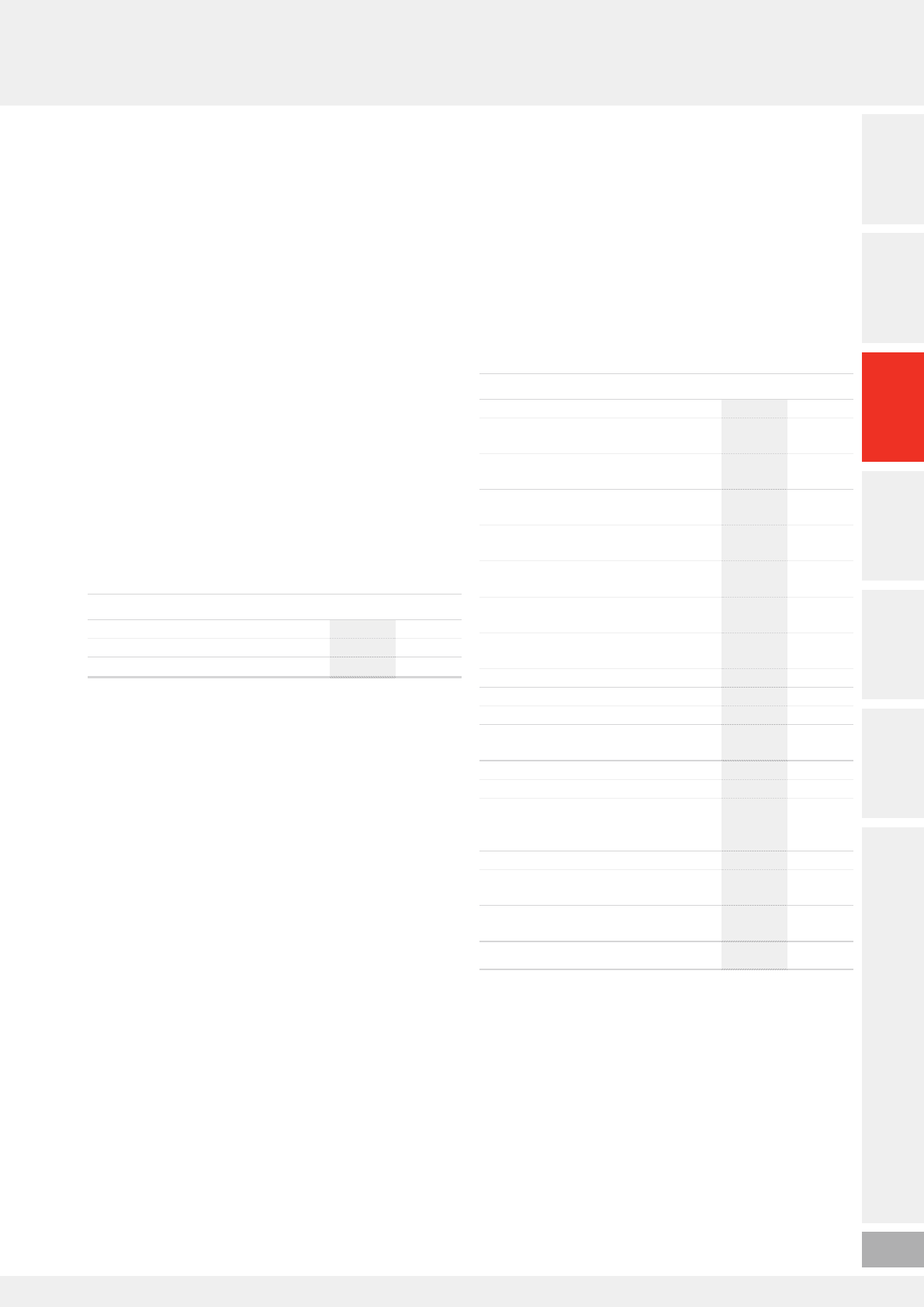

Net nancing costs

2015

£m

2014

£m

Investment income 883 346

Financing costs (1,736) (1,554)

Net nancing costs (853) (1,208)

Net nancing costs includes £526 million of foreign exchange gains

(2014: £21 million gain), £134 million of mark-to-market losses

(2014: £118 million gain) and in the prior year, a £99 million loss

on US bond redemption. Excluding these items, net nancing costs

decreased by 7.4% primarily due to the impact of lower average net

debt levels following the disposal of the Group’s investment in Verizon

Wireless and the acquisition of Ono.

Taxation

2015

£m

2014

£m

Income tax

Continuing operations before recognition

of deferred tax 703 2,736

Recognition of additional deferred tax –

continuing operations (5,468) (19,318)

Total income tax credit –

continuing operations (4,765) (16,582)

Tax on adjustments to derive adjusted

prot before tax 305 290

Recognition of deferred tax asset for losses

inGermany and Luxembourg 3,341 19,318

Deferred tax recognised on additional losses

in Luxembourg 2,127 –

Tax liability on US rationalisation

andreorganisation –(2,210)

Deferred tax on use of Luxembourg losses (439) 113

Adjusted income tax expense 569 929

Share of associates’ and joint ventures’ tax 117 173

Adjusted income tax expense for

calculating adjusted tax rate 686 1,102

Prot/(loss) before tax

Continuing operations 1,095 (5,270)

Adjustments to derive adjusted

prot beforetax (see earnings per share on

page 42) 1,122 8,450

Adjusted prot before tax 2,217 3,180

Share of associates’ and joint ventures’ tax

andnon-controlling interest 117 173

Adjusted prot before tax for calculating

adjusted effective tax rate 2,334 3,353

Adjusted effective tax rate 29.4% 32.9%