Vodafone 2015 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28. Acquisitions and disposals

We completed a number of acquisitions during the year including, most signicantly, the acquisition of Grupo

Corporativo Ono, S.A. (‘Ono’). The note below provides details of these transactions as well as those in the prior

year. For further details see “Critical accounting judgements and key sources of estimation uncertainty” in note 1

“Basis of preparation” to the consolidated nancial statements.

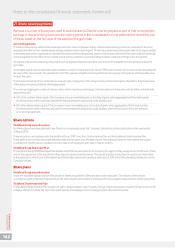

Accounting policies

Business combinations

Acquisitions of subsidiaries are accounted for using the acquisition method. The cost of the acquisition is measured at the aggregate of the fair values

at the date of exchange of assets given, liabilities incurred or assumed and equity instruments issued by the Group. Acquisition-related costs are

recognised in the income statement as incurred. The acquiree’s identiable assets and liabilities are recognised at their fair values at the acquisition

date. Goodwill is measured as the excess of the sum of the consideration transferred, the amount of any non-controlling interests in the acquiree

and the fair value of the Group’s previously held equity interest in the acquiree, if any, over the net amounts of identiable assets acquired and

liabilities assumed at the acquisition date. The interest of the non-controlling shareholders in the acquiree may initially be measured either at fair

value or at the non-controlling shareholders’ proportion of the net fair value of the identiable assets acquired, liabilities and contingent liabilities

assumed. The choice of measurement basis is made on an acquisition-by-acquisition basis.

Acquisition of interests from non-controlling shareholders

In transactions with non-controlling parties that do not result in a change in control, the difference between the fair value of the consideration paid

or received and the amount by which the non-controlling interest is adjusted is recognised in equity.

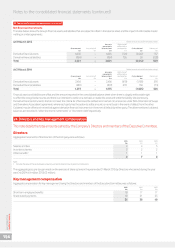

Acquisitions

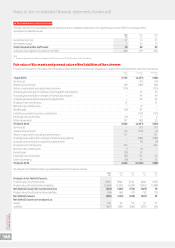

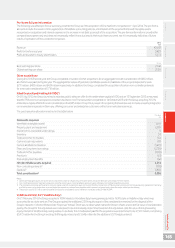

The aggregate cash consideration in respect of purchases of interests in subsidiaries, net of cash acquired, is as follows:

£m

Cash consideration paid:

Grupo Corporativo Ono, S.A. 2,945

Other acquisitions completed during the year 265

Fees paid in respect of acquisitions118

3,228

Net cash acquired (135)

3,093

Note:

1 Charged to other income and expense in the consolidated income statement.

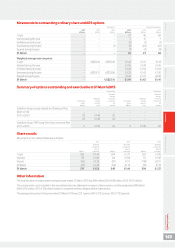

Total goodwill on acquisitions was £1,634 million and included £1,423 million in relation to Ono and £211 million in relation to other acquisitions

completed during the year. No amount of goodwill is expected to be deductible for tax purposes.

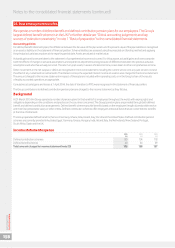

Grupo Corporativo Ono, S.A. (‘Ono’)

On 23 July 2014, the Group acquired the entire share capital of Ono for cash consideration of £2,945 million. The primary reason for acquiring the

business was to create a leading integrated communications operator in Spain, offering customers unied communication services. The results

of the acquired entity have been consolidated in the Group’s income statement from 23 July 2014 and contributed £691 million of revenue and

a loss of £313 million to the prot attributable to owners of the parent during the year.

The acquisition date fair values of the assets and liabilities acquired are provisional. These may be further adjusted as we gain a further understanding

of the business. The provisional purchase price allocation is set out in the table below:

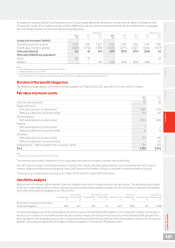

Fair value

£m

Net assets acquired:

Identiable intangible assets1777

Property, plant and equipment 3,272

Other investments 7

Trade and other receivables 156

Cash and cash equivalents 143

Current and deferred taxation 647

Short and long-term borrowings (3,001)

Trade and other payables (391)

Provisions (83)

Net identiable assets acquired 1,527

Non-controlling interests (5)

Goodwill21,423

Total consideration32,945

Notes:

1 Identiable intangible assets of £777 million consisted of customer contracts and relationships of £710 million, brand of £33 million and software of £34 million.

2 The goodwill arising on acquisition is principally related to the synergies expected to arise following the integration of the Ono business. These principally relate to synergies expected

to arise following integration of the respective networks, operating cost rationalisation and revenue synergies driven by the larger network footprint and incremental revenue streams from

integrated services.

3 Transaction costs of £11 million were charged in the Group’s consolidated income statement in the year ended 31 March 2015.

Vodafone Group Plc

Annual Report 2015

164

Notes to the consolidated nancial statements (continued)