Vodafone 2015 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

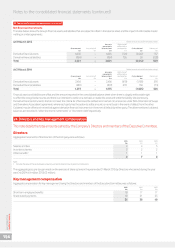

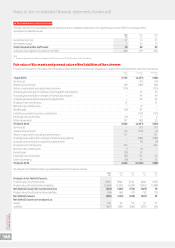

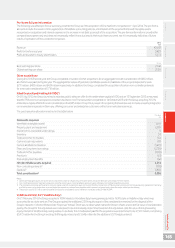

Pro-forma full year information

The following unaudited pro-forma summary presents the Group as if the acquisition of Ono had been completed on 1 April 2014. The pro-forma

amounts include the results of Ono, application of Vodafone accounting policies, amortisation of the acquired nite lived intangible assets

recognised on acquisition and interest expense on the increase in net debt as a result of the acquisition. The pro-forma information is provided for

comparative purposes only and does not necessarily reect the actual results that would have occurred, nor is it necessarily indicative of future

results of operations of the combined companies.

2015

£m

Revenue 42,603

Prot for the nancial year 5,829

Prot attributable to equity shareholders 5,673

Pence

Basic earnings per share 21.42

Diluted earnings per share 21.30

Other acquisitions

During the 2015 nancial year, the Group completed a number of other acquisitions for an aggregate net cash consideration of £265 million,

all of which was paid during the year. The aggregate fair values of goodwill, identiable assets and liabilities of the acquired operations were

£211 million, £483 million and £429 million respectively. In addition, the Group completed the acquisition of certain non-controlling interests

fora net cash consideration of £718 million.

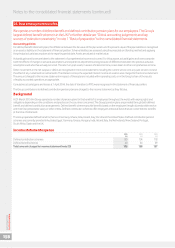

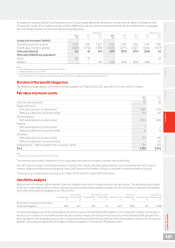

Kabel Deutschland Holding AG (‘KDG’)

On 30 July 2013, the Group launched a voluntary public takeover offer for the entire share capital of KDG and on 13 September 2013 announced

that the 75% minimum acceptance condition had been met. The transaction completed on 14 October 2013 with the Group acquiring 76.57%

of the share capital of KDG for cash consideration of £4,855 million. The primary reason for acquiring the business was to create a leading integrated

communications operator in Germany, offering consumer and enterprise customers unied communications services.

The purchase price allocation is set out in the table below:

Fair value

£m

Net assets acquired:

Identiable intangible assets11,641

Property, plant and equipment 4,381

Investment in associated undertakings 8

Inventory 34

Trade and other receivables 154

Cash and cash equivalents 619

Current and deferred taxation (1,423)

Short and long-term borrowings (2,784)

Trade and other payables (1,190)

Provisions (63)

Post employment benets (62)

Net identiable assets acquired 1,315

Non-controlling interests2(308)

Goodwill33,848

Total consideration44,855

Notes:

1 Identiable intangible assets of £1,641 million consisted of customer relationships of £1,522 million, brand of £18 million and software of £101 million.

2 Non-controlling interests have been measured using the net fair value of the identiable assets acquired, liabilities and contingent liabilities assumed.

3 The goodwill is principally attributable to cost and capital expenditure synergies expected to arise from the combination of the acquired business and the Group’s existing operations in Germany,

and further revenue synergies from cross-selling to the respective customer base, together with improved customer loyalty given the wider unied service offering.

4 Transaction costs of £17 million were charged in the Group’s consolidated income statement in the year ended 31 March 2014.

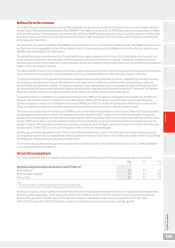

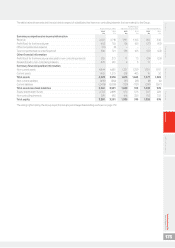

Vodafone Omnitel B.V. (‘Vodafone Italy’)

On 21 February 2014, the Group acquired a 100% interest in Vodafone Italy, having previously held a 76.9% stake in Vodafone Italy which was

accounted for as a joint venture. The Group acquired the additional 23.1% equity as part of the consideration received for the disposal of the

Group’s interests in Verizon Wireless (see “Disposals” below). There was no observable market for Verizon shares and so the fair value of consideration

paid by the Group for the acquisition was considered to be more reliably determined based on the acquisition-date fair value of Group’s existing

equity interest in Vodafone Italy. Using a value in use basis, the consideration paid for the acquisition was determined to be £7,121 million, comprising

£5,473 million for the Group’s existing 76.9% equity interest and £1,648 million for the additional 23.1% equity interest.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

165