Vodafone 2015 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

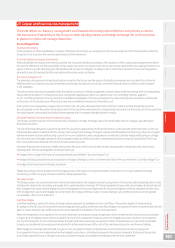

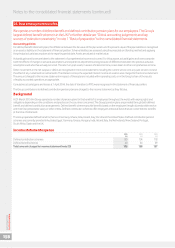

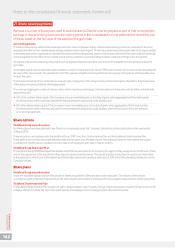

Dened benet schemes

At the start of the year, the Group had two main UK dened benet schemes being the Vodafone UK Group Pension Scheme (‘Vodafone UK plan’)

and the Cable & Wireless Worldwide Retirement Plan (‘CWWRP’). The Vodafone UK plan and the CWWRP plan closed to future accrual on 31 March

2010 and 30 November 2013 respectively. Until 30 November 2013 the CWWRP allowed employees to accrue a pension at a rate of 1/85th of their

nal salary for each year of service until the retirement age of 60 with a maximum pension of two thirds of nal salary. Employees contributed 5%

of their salary into the scheme.

On 6 June 2014, the assets and liabilities of the CWWRP were transferred into a new section of the Vodafone UK plan. The CWWRP was then wound

up. There are now two segregated sections of the Vodafone UK plan, the pre-existing assets and liabilities in the Vodafone Section and the former

CWWRP assets and liabilities in the CWW Section.

The dened benet plans are administered by Trustee Boards that are legally separated from the Group. The Trustee Board of each pension fund

consists of representatives who are employees, former employees or are independent from the Company. The Boards of the pension funds are

required by law to act in the best interest of the plan participants and are responsible for setting certain policies, such as investment and contribution

policies, and the governance of the fund.

The dened benet pension schemes expose the Group to actuarial risks such as longer than expected longevity of members, lower than expected

return on investments and higher than expected ination, which may increase the liabilities or reduce the value of assets of the plans.

The UK pensions environment is regulated by the Pensions Regulator whose statutory objectives are set out in legislation and include promoting

and improving understanding of the good administration of work-based pensions, protecting member benets and regulating occupational

dened benet and contribution schemes. The Pensions Regulator is a non-departmental public body established under the Pensions Act 2004

and sponsored by the Department for Work And Pensions, operating within a legal regulatory framework set by the UK Parliament. The Pensions

Regulator’s statutory objectives and regulatory powers are described on its website at thepensionsregulator.gov.uk.

The Vodafone UK plan is registered as an occupational pension plan with HMRC and is subject to UK legislation and oversight from the Pensions

Regulator. UK legislation requires that pension schemes are funded prudently and that valuations are undertaken at least every three years.

Separate valuations are required for the Vodafone Section and CWW Section. Within 15 months of each valuation date, the plan trustees and the

Group must agree any contributions required to ensure that the plan is fully funded over time on a suitably prudent measure.

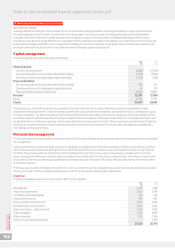

The most recent valuations for the Vodafone and CWWRP sections of the Vodafone UK plan were carried out as at 31 March 2013 by independent

actuaries appointed by the plan Trustees. These valuations revealed a total decit of £437 million on the schemes’ funding basis. Following the

valuation, the Group paid special one-off contributions totalling £365 million in April 2014 (£325 million into the Vodafone Section and £40 million

into the CWW Section). These lump sum contributions represented accelerated funding amounts that would otherwise have been due over the

period to 31 March 2020. No further contributions are therefore currently due for the Vodafone UK plan for the period to 31 March 2016. The next

valuation date is 31 March 2016, at which point the position of the scheme will be assessed again.

Funding plans are individually agreed for each of the Group’s dened benet pension schemes with the respective trustees, taking into account

local regulatory requirements. It is expected that ordinary contributions relating to future service of £39 million will be paid into the Group’s dened

benet pension schemes during the year ending 31 March 2016.

The Group has also provided certain guarantees in respect of the Vodafone UK plan; further details are provided in note 30 “Contingent liabilities”

to the consolidated nancial statements.

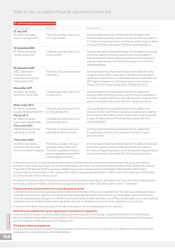

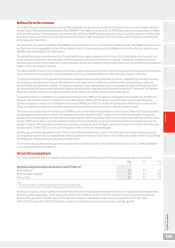

Actuarial assumptions

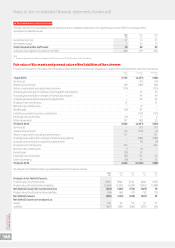

The Group’s scheme liabilities are measured using the projected unit credit method using the principal actuarial assumptions set out below:

2015 2014 2013

%% %

Weighted average actuarial assumptions used at 31 March1:

Rate of ination23.0 3.2 3.3

Rate of increase in salaries 2.8 3.1 3.8

Discount rate 3.0 4.2 4.3

Notes:

1 Figures shown represent a weighted average assumption of the individual schemes.

2 The rate of increase in pensions in payment and deferred payment is the rate of ination.

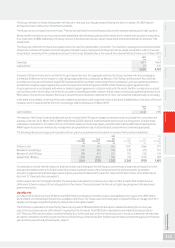

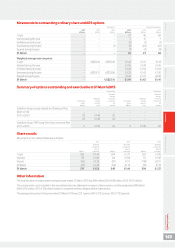

Mortality assumptions used are based on recommendations from the individual scheme actuaries which include adjustments for the experience

of the Group where appropriate. The Group’s largest scheme is the Vodafone UK plan. Further life expectancies assumed for the UK schemes

are24.5/25.8 years (2014: 23.3/24.7 years; 2013: 23.6/25.3 years) for a male/female pensioner currently aged 65 and 27.1/28.7 years

(2014: 25.9/27.5 years; 2013: 26.8/27.9 years) from age 65 for a male/female non-pensioner member currently aged 40.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

159