Vodafone 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

47

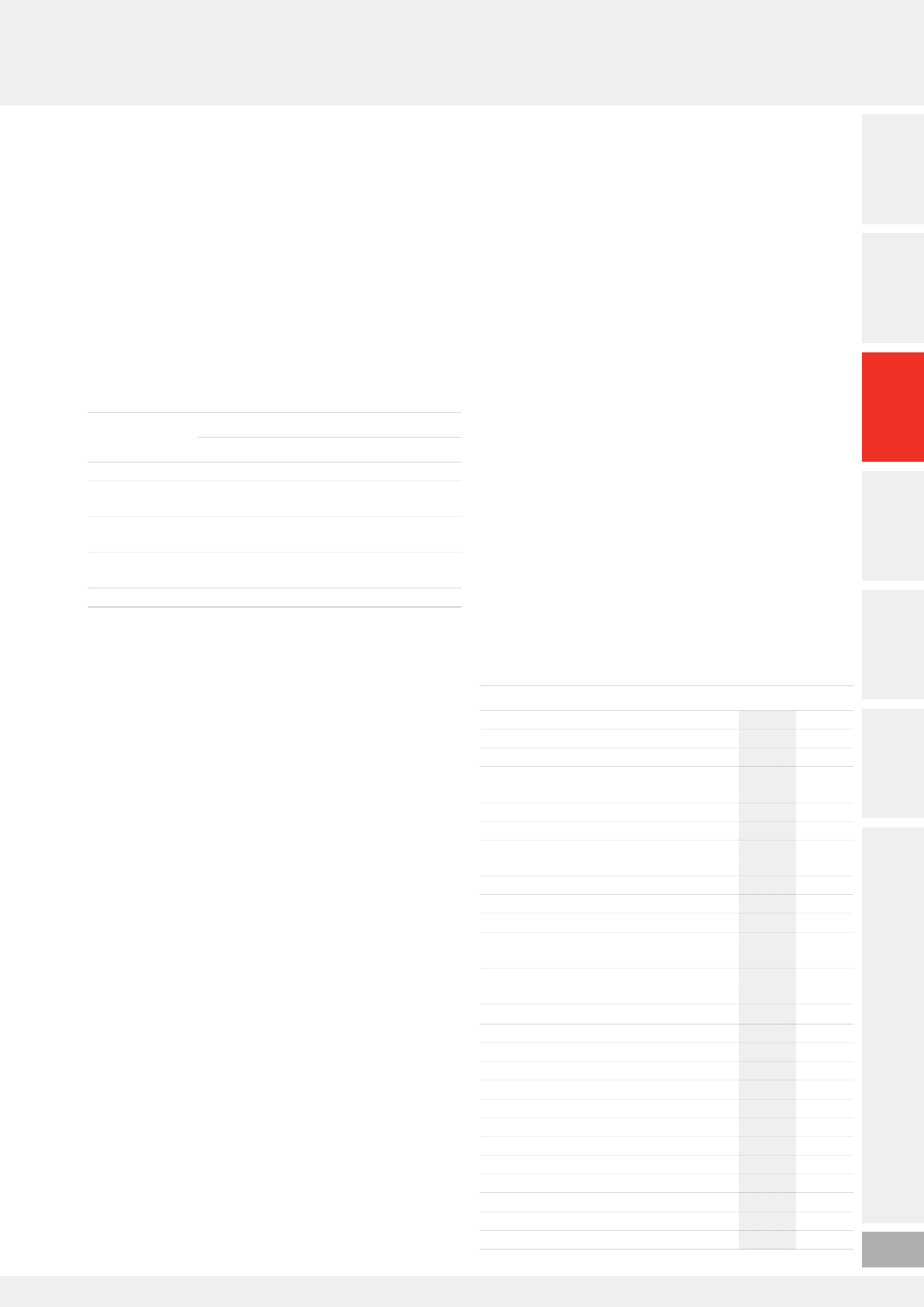

Contractual obligations and commitments

A summary of our principal contractual nancial obligations and

commitments is shown below.

Payments due by period

£m

Contractual obligations and

commitments1Total < 1 year 1–3 years 3–5 years >5 years

Borrowings2 40,373 13,366 7, 297 4,859 14,851

Operating lease

commitments3 6,378 1,339 1,627 1,205 2,207

Capital

commitments3,4 4,957 2,769 322 426 1,440

Purchase

commitments5 8,302 4,064 3,692 234 312

Total 60,010 21,538 12,938 6,724 18,810

Notes:

1 This table includes commitments in respect of options over interests in Group businesses

held by non-controlling shareholders (see “Potential cash outows from option agreements

and similar arrangements” on page 150) and obligations to pay dividends to non-controlling

shareholders (see “Dividends from associates and to non-controlling shareholders”

on page 151). The table excludes current and deferred tax liabilities and obligations under

post employment benet schemes, details of which are provided in notes 6 “Taxation”

and 26 “Post employment benets” respectively. The table also excludes the contractual

obligations of associates and joint ventures.

2 See note 21 “Borrowings”.

3 See note 29 “Commitments”.

4 Primarily related to spectrum and network infrastructure.

5 Primarily related to device purchase obligations.

Dividends

We provide returns to shareholders through equity dividends and

historically have generally paid dividends in February and August

in each year. The Directors expect that we will continue to pay dividends

semi-annually.

The £2.9 billion equity dividend in the current year comprises

£2.0 billion in relation to the nal dividend for the year ended 31 March

2014 and £0.9 billion for the interim dividend for the year ended

31 March 2015. This has decreased from total dividends of £5.1 billion

in the prior year following the “6 for 11” share consolidation effective

from 24 February 2014.

The interim dividend of 3.60 pence per share announced by the

Directors in November 2014 represented an 2.0% increase over last

year’s interim dividend. The Directors are proposing a nal dividend

of 7.62 pence per share. Total dividends for the year increased by 2.0 %

to 11.22 pence per share.

At 31 March 2015, Vodafone Group Plc had prots available for

distribution of approximately £20 billion. Further disclosures in relation

to prots available for distribution are set out on page 184.

Liquidity and capital resources

Our liquidity and working capital may be affected by a material decrease

in cash ow due to a number of factors as outlined in “Principal

risk factors and uncertainties” on pages 32 to 37. We do not use

non-consolidated special purpose entities as a source of liquidity or for

other nancing purposes.

In addition to the commentary on the Group’s consolidated

statement of cash ows below, further disclosure in relation to the

Group’s objectives, policies and processes for managing its capital;

its nancial risk management objectives; details of its nancial

instruments and hedging activities; and its exposures to credit risk

and liquidity risk can be found in “Borrowings”, “Liquidity and capital

resources” and “Capital and nancial risk management” in notes 21, 22

and 23 respectively to the consolidated nancial statements.

Cash ows

A reconciliation of cash generated by operations to free cash ow,

a non-GAAP measure used by management shown on pages 202 and

203. The reconciliation to net debt is shown below.

2015

£m

2014

£m

EBITDA 11, 915 11, 0 8 4

Working capital (883) 1,181

Other 88 92

Cash generated by operations (excluding

restructuring and other costs)111,120 12,357

Cash capital expenditure (8,435) (5,857)

Capital expenditure (9,197) (6,313)

Working capital movement in respect

of capital expenditure 762 456

Disposal of property, plant and equipment 178 79

Operating free cash ow12,863 6,579

Taxation (758) (3,449)

Dividends received from associates

andinvestments 224 2,842

Dividends paid to non-controlling

shareholders insubsidiaries (247) (264)

Interest received and paid (994) (1,315)

Free cash ow11,088 4,393

Licence and spectrum payments (443) (862)

Acquisitions and disposals (7,040) 27, 372

Equity dividends paid (2,927) (5,076)

Special dividend –(14,291)

Purchase of treasury shares –(1,033)

Foreign exchange 895 2,423

Income dividend from Verizon Wireless –2,065

Other2(144) (3,337)

Net debt (increase)/decrease (8,571) 11,654

Opening net debt (13,700) (25,354)

Closing net debt (22,271) (13,700)