Vodafone 2015 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

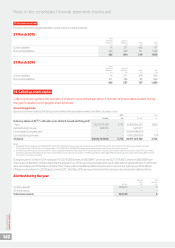

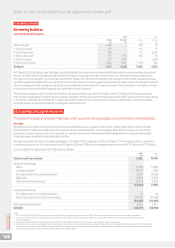

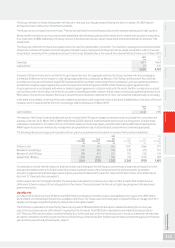

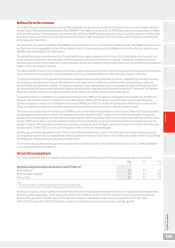

At 31 March 2015 we had £6,882 million of cash and cash equivalents which are held in accordance with the counterparty and settlement risk limits

of the Board approved treasurypolicy. The main forms of liquid investment at 31 March 2015 were managed investment funds, money market

funds, UK index linked government bonds, tri-party repurchase agreements and bankdeposits.

The cash received from collateral support agreements mainly reects the value of our interest rate swap and cross currency interest rate swap

portfolios which are substantially netpresent value positive. See note 23 for further details on these agreements.

Commercial paper programmes

We currently have US and euro commercial paper programmes of US$15 billion and £5 billion respectively which are available to be used to meet

short-term liquidity requirements. At 31 March 2015 amounts external to the Group of €3,928 million (£2,839 million) were drawn under the euro

commercial paper programme and US$3,321 million (£2,237 million) were drawn down under the US commercial paper programme, with such

funds being provided by counterparties external to the Group. At 31 March 2014 amounts external to the Group of €731 million (£604 million)

were drawn under the euro commercial paper programme and US$578 million (£346 million) were drawn down under the US commercial paper

programme, with such funds being provided by counterparties external to the Group.

The commercial paper facilities were supported by US$3.9 billion (£2.6 billion) and €3.9 billion (£2.8 billion) of syndicated committed bank facilities

(see “Committed facilities” below). No amounts had been drawn under either bank facility.

Bonds

We have a €30 billion euro medium-term note programme and a US shelf programme which are used to meet medium to long-term funding

requirements. At 31 March 2015 the total amounts in issue under these programmes split by currency were US$14.6 billion, £1.7 billion and

€7.8 billion.

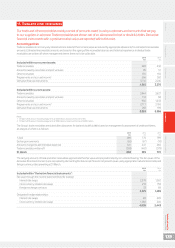

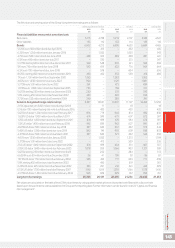

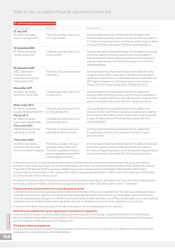

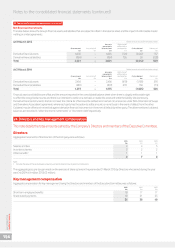

At 31 March 2015 we had bonds outstanding with a nominal value of £17,153 million (2014: £16,979 million). In the year ended 31 March 2015 bonds

with a nominal value equivalent of £2.2 billion were issued under the US shelf. The bonds issued in the year were:

Nominal amount Sterling equivalent

Date of bond issue Maturity of bond €m £m

11 September 2014 11 September 2020 1,750 1,265

11 September 2014 11 September 2025 1,000 723

1 December 2014 1 December 2034 332 240

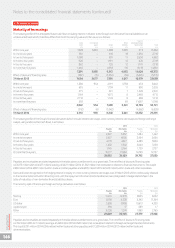

Own shares

The Group held a maximum of 2,371,948,109 of its own shares during the year which represented 8.2% of issued share capital at that time.

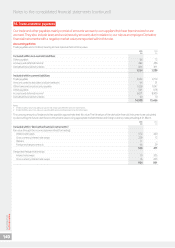

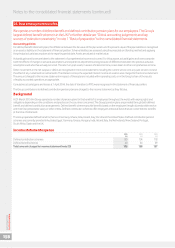

Committed facilities

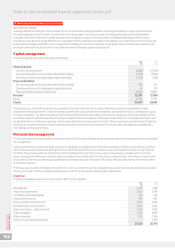

In aggregate we have committed facilities of approximately £10,991 million, of which £6,620 million was undrawn and £4,371 million was drawn

at 31 March 2015. The following table summarises the committed bank facilities available to us at 31 March 2015.

Committed bank facilities Amounts drawn Terms and conditions

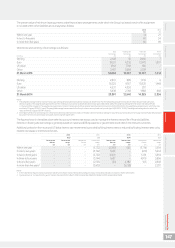

28 March 2014

€3.9 billion syndicated revolving

credit facility, maturing

28 March 2020.

No drawings have been made against

this facility. The facility supports our

commercial paper programmes and

may be used for general corporate

purposes including acquisitions.

Lenders have the right, but not the obligation, to cancel their

commitments and have outstanding advances repaid no sooner than

30 days after notication of a change of control. This is in addition to

the rights of lenders to cancel their commitment if we commit an event

of default; however, it should be noted that a material adverse change

clause does not apply.

The facility matures on 28 March 2020, with each lender having the

option to extend the Facility for a further year prior to the second

anniversary of the Facility, if requested by the Company.

27 February 2015

US$3.9 billion syndicated

revolving credit facility,

maturing 27 February 2020.

No drawings have been made against

this facility. The facility supports our

commercial paper programmes and

may be used for general corporate

purposes including acquisitions.

Lenders have the right, but not the obligation, to cancel their

commitments and have outstanding advances repaid no sooner than

30 days after notication of a change of control. This is in addition to

the rights of lenders to cancel their commitment if we commit an event

of default; however, it should be noted that a material adverse change

clause does not apply.

The facility matures on 27 February 2020, with each lender having

the option to (i) extend the Facility for a further year prior to the rst

anniversary of the Facility and should such extension be exercised, to

(ii)extend the Facility for a further year prior to the second anniversary

ofthe Facility, in both cases if requested by the Company.

27 November 2013

£0.5 billion loan facility,

maturing 12 December 2021.

This facility was drawn down in full in

euros, as allowed by the terms of the

facility, on 12 December 2014.

As the syndicated revolving credit facilities with the addition that, should

our UK and Irish operating companies spend less than the equivalent of

£0.9 billion on capital expenditure, we will be required to repay the drawn

amount of the facility that exceeds 50% of the capital expenditure.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

149