Vodafone 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

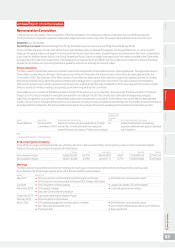

Long-term incentive (‘GLTI’) award vesting in July 2015 (audited)

The 2013 long-term incentive (‘GLTI’) awards which were made in July 2012 will lapse in full in July 2015. The performance conditions for the three

year period ending in the 2015 nancial year are as follows:

TSR outperformance

Adjusted free cash ow measure £bn

0%

(Up to median)

4.5%

(65th percentile equivalent)

9%

(80th percentile equivalent)

Below threshold <15.4 0% 0% 0%

Threshold 15.4 50% 75% 100%

Target 17.9 100% 150% 200%

Maximum 20.4 150% 225% 300%

TSR peer group

BT Group Telecom Italia

Deutsche Telekom Telefónica

Orange

Emerging market composite (consists of the average

TSRperformance of Bharti, MTN and Turkcell)

Adjusted free cash ow for the three year period ended on 31 March

2015 was £14.8 billion which compares with a threshold of £15.4 billion

and atarget of £17.9 billion.

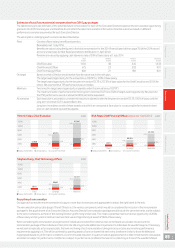

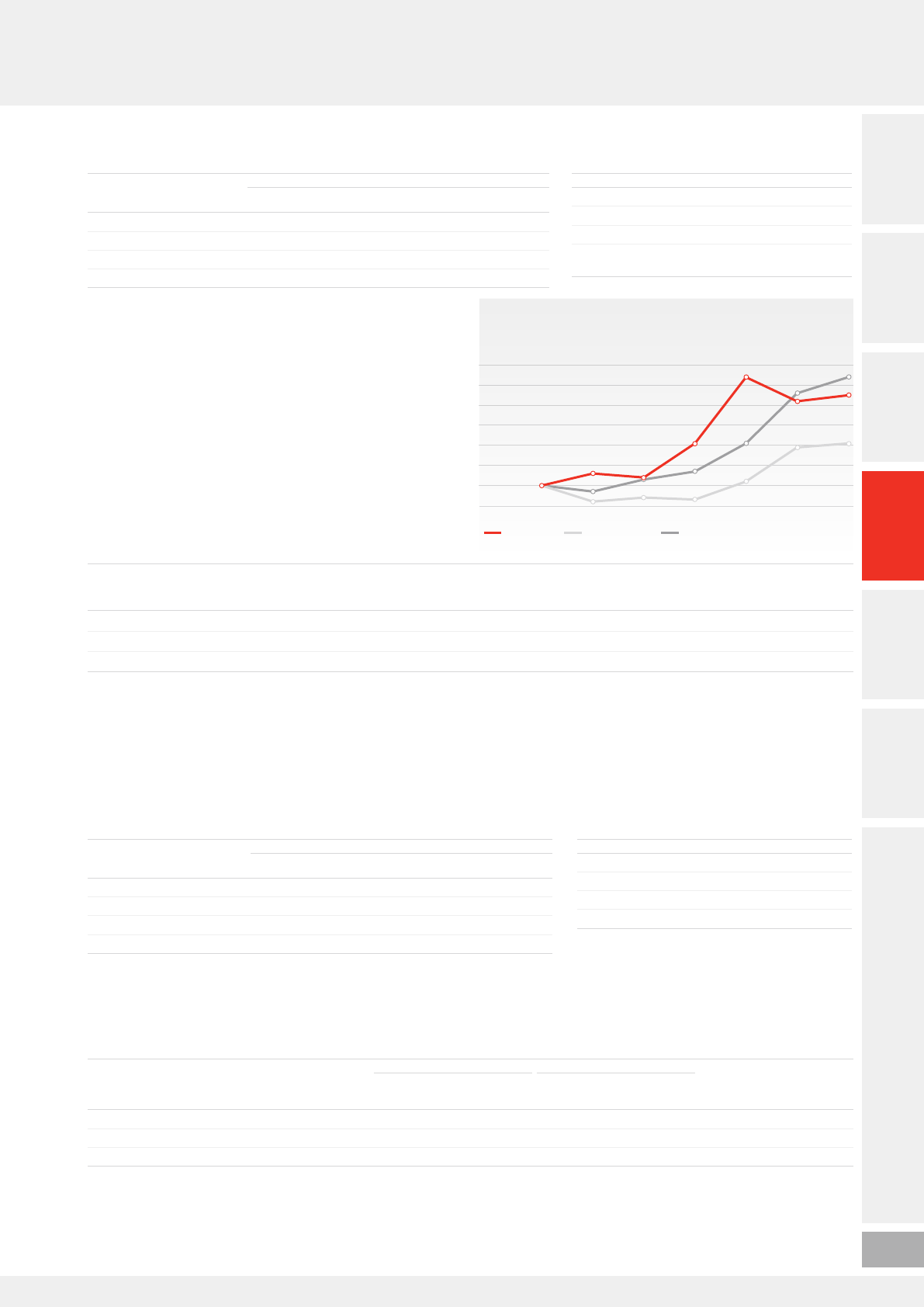

The chart to the right shows that our TSR performance against our peer

group for the same period resulted in an outperformance of the median

by 6.5% a year.

Using the combined payout matrix above, this performance resulted

in a payout of 0.0% of target.

The combined vesting percentages are applied to the target number

of shares granted as shown below.

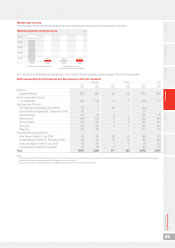

2013 GLTI award: TSR performance (growth in the value of

a hypothetical US$100 holding over the performance period,

six month averaging)

160

150

130

140

120

110

100

90 03/12 09/12 03/13 09/13 03/14 09/14 03/15

Vodafone Group Median of peer group Outperformance of median of 9% p.a.

100 103

106

97

92 94

121

107

93

154

121

102

142

146

119

145

154

121

104

2013 GLTI performance share awards vesting in July 2015

Maximum

number

of shares

Target

number

of shares

Adjusted free cash

ow performance

payout

% of target TSR multiplier

Overall vesting

% of target

Number of

shares vesting

Value of

shares vesting

(‘000)

Vittorio Colao 4,511,080 1,503,693 0.0% 1.7 times 0.0% 0£0

Stephen Pusey 2,072,397 690,799 0.0% 1.7 times 0.0% 0£0

Nick Read11,880,086 626,695 0.0% 1.7 times 0.0% 0£0

Notes:

1 Nick Read was appointed to the Board on 1 April 2014. His award in the table above reects a grant made prior to his appointment to the main Board.

These share awards will lapse on 3 July 2015. Specied procedures are performed by PricewaterhouseCoopers LLP over the adjusted free cash ow

to assist with the Committee’s assessment of performance. The performance assessment in respect of the TSR outperformance of the peer group

median is undertaken by Towers Watson. Details of how the plan works can be found on pages 78to 80.

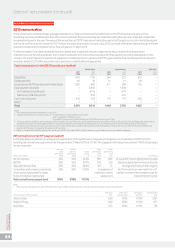

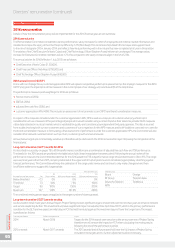

Long-term incentive (‘GLTI’) awarded during the year (audited)

The 2015 long-term incentive awards made in June 2014 under the Global Long-Term Incentive Plan (‘GLTI’). The performance conditions are

a combination of adjusted free cash ow and TSR performance as follows:

TSR outperformance

Adjusted free cash ow measure £bn

0%

(Up to median)

5%

(65th percentile equivalent)

10%

(80th percentile equivalent)

Below threshold <3.4 0% 0% 0%

Threshold 3.4 50% 75% 100%

Target 5.1 100% 150% 200%

Maximum 6.8 125% 187.5% 250%

TSR peer group

Bharti Orange

BT Group Telecom Italia

Deutsche Telekom Telefónica

MTN

The combined vesting percentages are applied to the target number of shares granted. The adjusted free cash ow gures shown above are

considerably lower than prior years as they include the impact of Project Spring. When considered on a like-for-like basis with previous years (i.e.

excluding the impact of Project Spring) the adjusted cash ow target is £12.3 billion.

In order to participate fully in this award, executives had to co-invest personal shares worth 100% of salary. The resulting awards to Executive

Directors were as follows:

2015 GLTI performance share awards made in June 2014

Number of shares awarded Face value of shares awarded1Proportion of

maximum award

vesting at minimum

performance

Performance

period end

Target

vesting level

(40% of max)

Maximum

vesting level

Target

vesting level

Maximum

vestinglevel

Vittorio Colao 1,340,004 3,350,011 £2,543,328 £6,358,321 1/5th 31 Mar 2017

Stephen Pusey 333,245 833,113 £632,449 £1,581,248 1/5th 31 Mar 2017

Nick Read 717,067 1,792,668 £1,360,993 £3,402,484 1/5th 31 Mar 2017

Note:

1 Face value calculated based on the share prices at the date of grant of 189.8 pence.

Dividend equivalents on the shares that vest are paid in cash after the vesting date.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

85