Vodafone 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

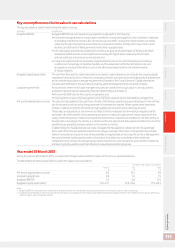

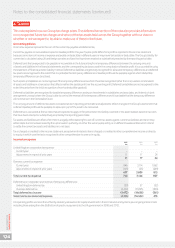

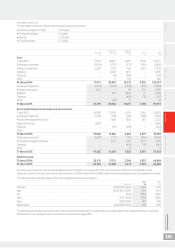

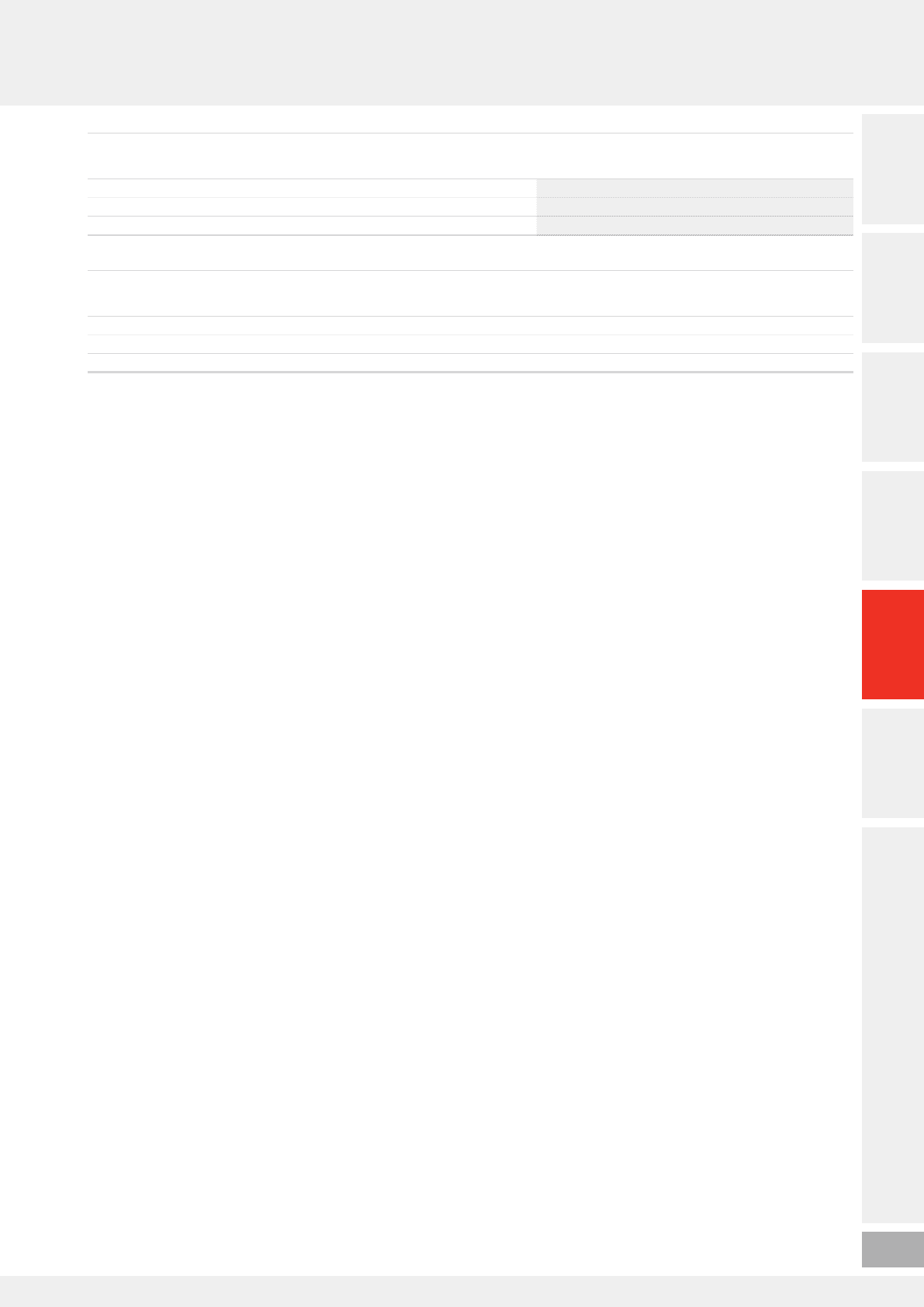

At 31 March 2015, the gross amount and expiry dates of losses available for carry forward are as follows:

Expiring Expiring

within within

5 years 6–10 years Unlimited Total

£m £m £m £m

Losses for which a deferred tax asset is recognised 104 64 87,246 87,414

Losses for which no deferred tax is recognised 1,124 543 16,084 17,751

1,228 607 103,330 105,165

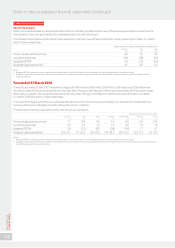

At 31 March 2014, the gross amount and expiry dates of losses available for carry forward are as follows:

Expiring Expiring

within within

5 years 6–10 years Unlimited Total

£m £m £m £m

Losses for which a deferred tax asset is recognised 274 461 79,115 79,850

Losses for which no deferred tax is recognised 1,281 519 26,318 28,118

1,555 980 105,433 107,968

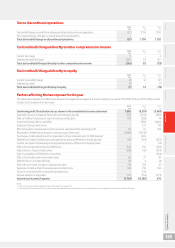

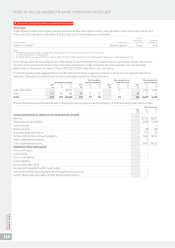

Deferred tax assets on losses in Luxembourg

Included in the table above are losses of £70,576 million (2014: £73,734 million) that have arisen in Luxembourg companies, principally as a result

of revaluations of those companies’ investments for local GAAP purposes. These losses do not expire.

A deferred tax asset of £20,755 million (2014: £18,150 million) has been recognised in respect of these losses as we conclude it is probable that the

Luxembourg entities will continue to generate taxable prots in the future against which we can utilise these losses. The Luxembourg companies

income is derived from the Group’s internal nancing and procurement and roaming activities. We have reviewed the latest forecasts for the

Luxembourg companies, including their ability to continue to generate income beyond the forecast period under the tax laws substantively enacted

at the balance sheet date. The assessment also considered whether the structure of the Group would continue to allow the generation of taxable

income. Based on this, we conclude that it is probable that the Luxembourg companies will continue to generate taxable income in the future.

Based on the current forecasts the losses will be fully utilised over the next 55 to 65 years. A 5%–10% change in the forecast income in Luxembourg

would change the period over which the losses will be fully utilised by between two and four years. Any future changes in tax law or the structure

of the Group could have a signicant effect on the use of losses, including the period over which the losses are utilised.

During the current year we recognised an additional deferred tax asset of £3,341 million relating to the historic tax losses in Luxembourg

as a consequence of the nancing arrangements for the acquisition of Grupo Corporativo Ono, S.A. We also recognised an additional deferred tax

asset of £2,127 million arising from the revaluation of investments based upon the local GAAP nancial statements.

We also have £7,642 million (2014: £7,642 million) of Luxembourg losses in a former Cable & Wireless Worldwide Group company, for which

no deferred tax asset has been recognised as it is uncertain whether these losses will be utilised.

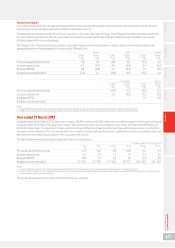

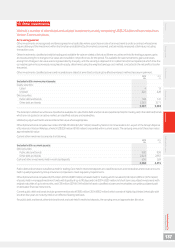

Deferred tax assets on losses in Germany

The Group has tax losses of £13,600 million (2014: £15,290 million) in Germany arising on the write down of investments in Germany in 2000.

The losses are available to use against both German federal and trade tax liabilities and they do not expire.

A deferred tax asset of £2,086 million (2014: £2,344 million) has been recognised in respect of these losses as we conclude it is probable that the

German business will continue to generate taxable prots in the future against which we can utilise these losses. We have reviewed the latest

forecasts for the German business which incorporate the unsystematic risks of operating in the telecommunications business (see pages 32 to 37).

In the period beyond the ve year forecast, we have reviewed the prots inherent in the value in use calculations and based on these and our

expectations for the German business, we believe it is probable the German losses will be fully utilised. Based on the current forecasts the losses will

be fully utilised over the next 10 to 15 years. A 5%–10% change in the prots of the German business would change the period over which the losses

will be fully utilised by up to one year.

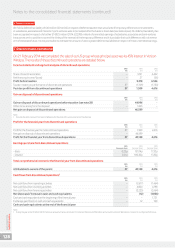

The recognition of the additional deferred tax assets in Luxembourg and Germany in the year ended 31 March 2014 was triggered by the agreement

to dispose of the US group whose principal asset was its 45% interest in Verizon Wireless, which removed signicant uncertainty over the future

structure of the Group including the continuation of future income streams in Luxembourg and the availability of the losses in Germany.

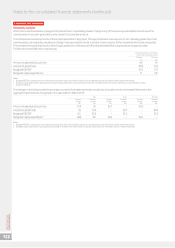

Other tax losses

During the year, the Group acquired Grupo Corporativo Ono, S.A. and which had tax losses of £2,375 million in Spain and which are available to offset

against the future prots of the Spanish business. The losses do not expire.

A deferred tax asset of £603 million (2014: £nil) has been recognised in respect of these losses as we conclude it is probable that the Spanish

business will continue to generate taxable prots in the future against which we can utilise these losses. We have reviewed the latest forecasts for

the Spanish business which incorporate the unsystematic risks of operating in the telecommunications business (see pages 32 to 37). In the period

beyond the ve year forecast, we have reviewed the prots inherent in the value in use calculations and based on these and our expectations for the

Spanish business, we believe it is probable the losses will be fully utilised. Based on the current forecasts the losses will be fully utilised over the next

eight to ten years. A 5%–10% change in the prots of the Spanish business would not signicantly alter the utilisation period.

We have losses amounting to £6,735 million (2014: £6,651 million) in respect of UK subsidiaries which are only available for offset against future

capital gains and since it is uncertain whether these losses will be utilised, no deferred tax asset has been recognised. We recognised a deferred tax

asset (2014: £442 million) of these losses in the prior year.

The remaining losses relate to a number of other jurisdictions across the Group. There are also £310 million (2014: £339 million) of unrecognised

other temporary differences.

Overview Strategy review Performance Governance Financials Additional information Vodafone Group Plc

Annual Report 2015

127