Vodafone 2015 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

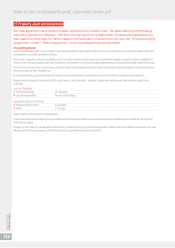

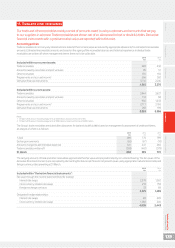

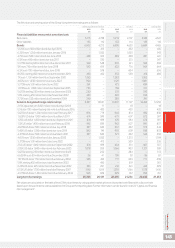

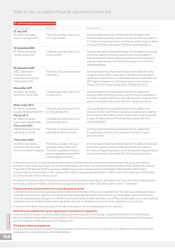

17. Provisions (continued)

Provisions have been analysed between current and non-current as follows:

31 March 2015

Asset

retirement Legal and

obligations regulatory Other Total

£m £m £m £m

Current liabilities 14 311 442 767

Non-current liabilities 452 523 107 1,082

466 834 549 1,849

31 March 2014

Asset

retirement Legal and

obligations regulatory Other Total

£m £m £m £m

Current liabilities 14 271 678 963

Non-current liabilities 471 286 89 846

485 557 767 1,809

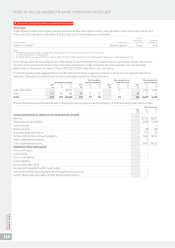

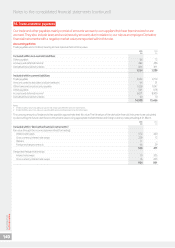

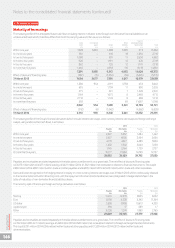

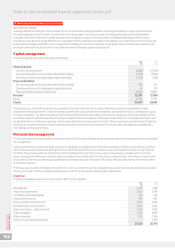

18. Called up share capital

Called up share capital is the number of shares in issue at their par value. A number of shares were allotted during

the year in relation to employee share schemes.

Accounting policies

Equity instruments issued by the Group are recorded at the proceeds received, net of direct issuance costs.

2015 2014

Number £m Number £m

Ordinary shares of 2020/21 US cents each allotted, issued and fully paid:1

1 April 28,811,923,128 3,792 53,820,386,309 3,866

Allotted during the year 863,970 –1,423,737 –

Consolidated during the year2– – (24,009,886,918) –

Cancelled during the year – – (1,000,000,000) (74)

31 March 28,812,787,098 3,792 28,811,923,128 3,792

Notes:

1 At 31 March 2015, the Group held 2,300,749,013 (2014: 2,371,962,907) treasury shares with a nominal value of £303 million (2014: £312 million). The market value of shares held was

£5,072 million (2014: £5,225 million). Duringthe year, 71,213,894 (2014: 103,748,921) treasury shares were reissued under Group share option schemes.

2 On 19 February 2014, we announced a “6 for 11” share consolidation effective 24 February 2014. This had the effect of reducing the number of shares in issue from 52,821,751,216 ordinary

shares (including 4,351,833,492 ordinary shares held in Treasury) as at the close of business on 18 February 2014 to 28,811,864,298 new ordinary shares in issue immediately after the share

consolidation on 24 February 2014.

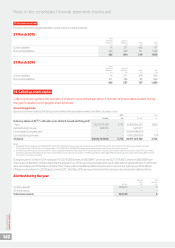

During the year to 31 March 2014, we issued 14,732,741,283 B shares of US$1.88477 per share and 33,737,176,433 C shares of US$0.00001 per

share as part of the Return of Value following the disposal of our US Group, whose principal asset was its 45% stake in Verizon Wireless. The B shares

were cancelled as part of the Return of Value. The C shares were reclassied as deferred shares with no substantive rights as part of the Return

of Value and transferred to LDC (Shares) Limited (‘LDC’). On 8 May 2015, we repurchased and then subsequently cancelled all deferred shares.

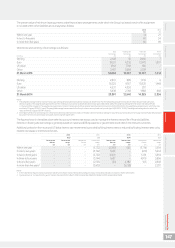

Allotted during the year

Nominal Net

value proceeds

Number £m £m

UK share awards 863,970 –2

US share awards –––

Total share awards 863,970 – 2

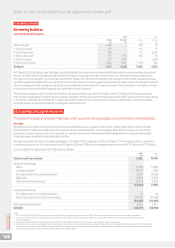

Notes to the consolidated nancial statements (continued)

Vodafone Group Plc

Annual Report 2015

142