Vodafone 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216

|

|

Notes to the consolidated nancial statements (continued)

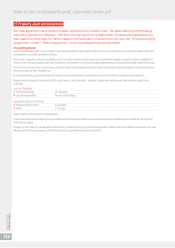

4. Impairment losses (continued)

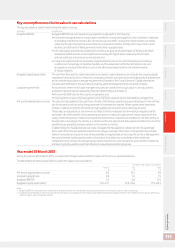

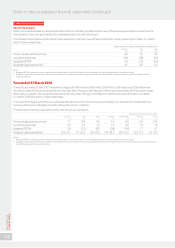

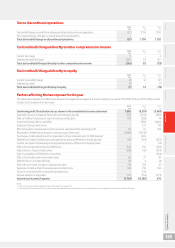

Sensitivity analysis

Other than as disclosed below, management believed that no reasonably possible change in any of the above key assumptions would cause the

carrying value of any cash-generating unit to exceed its recoverable amount.

The estimated recoverable amounts of the Group’s operations in Italy, Spain, Portugal and Greece were equal to, or not materially greater than, their

carrying values; consequently, any adverse change in key assumptions would, in isolation, have caused a further impairment loss to be recognised.

The estimated recoverable amounts of the Group’s operations in Germany and Romania exceeded their carrying values by approximately

£1,034 million and £184 million respectively.

Change required for carrying value

to equal the recoverable amount

Germany Romania

pps pps

Pre-tax risk adjusted discount rate 0.4 1.0

Long-term growth rate (0.5) (1.2)

Budgeted EBITDA1(0.7) (1.7)

Budgeted capital expenditure21.1 2.8

Notes:

1 Budgeted EBITDA is expressed as the compound annual growth rates in the initial ve years for all cash-generating units of the plans used for impairment testing.

2 Budgeted capital expenditure is expressed as the range of capital expenditure as a percentage of revenue in the initial ve years for all cash-generating units of the plans used for

impairment testing.

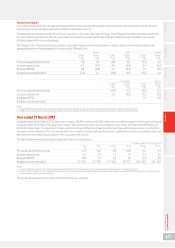

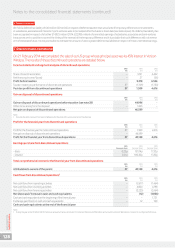

The changes in the following table to assumptions used in the impairment review would have, in isolation, led to an (increase)/decrease to the

aggregate impairment loss recognised in the year ended 31 March 2013:

Italy Spain Portugal

Increase Decrease Increase Decrease Increase Decrease

by 2pps by 2pps by 2pps by 2pps by 2pps by 2pps

£bn £bn £bn £bn £bn £bn

Pre-tax risk adjusted discount rate (1.4) 1.8 (0.7) –(0.3) –

Long-term growth rate 1.8 (1.3) –(0.7) –(0.3)

Budgeted EBITDA10.5 (0.5) –(0.1) –(0.1)

Budgeted capital expenditure2(0.9) 0.9 (0.6) –(0.2) –

Notes:

1 Budgeted EBITDA is expressed as the compound annual growth rates in the initial ve years for all cash-generating units of the plans used for impairment testing.

2 Budgeted capital expenditure is expressed as a percentage of revenue in the initial ve years for all cash-generating units of the plans used for impairment testing.

Vodafone Group Plc

Annual Report 2015

122