Vodafone 2015 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2015 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

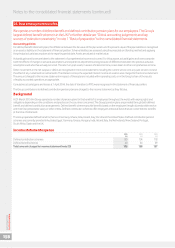

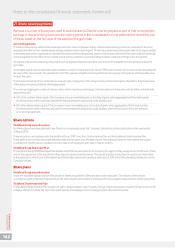

30. Contingent liabilities

Contingent liabilities are potential future cash outows, where the likelihood of payment is considered more than

remote, but is not considered probable or cannot be measured reliably.

2015 2014

£m £m

Performance bonds1766 442

Other guarantees and contingent liabilities22,539 2,500

Notes:

1 Performance bonds require the Group to make payments to third parties in the event that the Group does not perform what is expected of it under the terms of any relatedcontracts

or commercial arrangements.

2 Other guarantees principally comprise Vodafone Group Plc’s guarantee of the Group’s 50% share of an AUD 1.7 billion loan facility and a US$3.5 billion loan facility of its joint venture, Vodafone

Hutchison Australia Pty Limited.

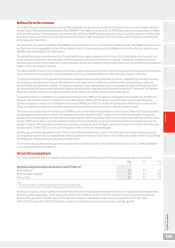

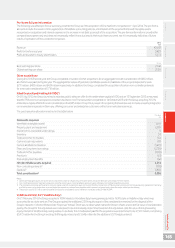

UK pension schemes

At the start of the year, the Group had two main UK dened benet schemes being the Vodafone UK Group Pension Scheme (‘Vodafone UK plan’)

and the Cable & Wireless Worldwide Retirement Plan (‘CWWRP’). On 6 June 2014, all assets and liabilities of the Cable & Wireless Worldwide

Retirement Plan were transferred into a new section of the Vodafone Group Pension Scheme. The Cable & Wireless Retirement Plan was then

wound up. There are now two segregated sections of the Vodafone UK Group Pension Scheme, the Vodafone Section and the CWW Section.

The Group has covenanted to provide security in favour of the Vodafone UK Group Pension Scheme – Vodafone Section whilst there is a decit

in this section. The decit is measured on a prescribed basis agreed between the Group and Trustee. In 2010 the Group and Trustee agreed security

of a charge over UK index linked gilts (‘ILG’) held by the Group. In December 2011, the security was increased by an additional charge over further ILG

due to a signicant increase in the decit at that time.

In April 2014, the security was reduced following a reduction in the decit following the results of the 2013 valuation and a £325 million company

contribution to the Scheme. The Scheme retains security over £264.5 million (notional value) 2017 ILGs and £38 million (notional value) 2016 ILGs.

The security may be substituted either on a voluntary or mandatory basis. As and when alternative security is provided, the Group has agreed that

the security cover should include additional headroom of 33%, although if cash is used as the security asset the ratio will revert to 100% of the

relevant liabilities or where the proposed replacement security asset is listed on an internationally recognised stock exchange in certain core

jurisdictions, the Trustee may decide to agree a lower ratio than 133%. The Company has also provided two guarantees to the Vodafone Section

of the scheme for a combined value up to £1.25 billion to provide security over the decit under certain dened circumstances, including insolvency

of the employers. The Company has also agreed a similar guarantee of up to £1.25 billion for the CWW Section. An additional smaller UK dened

benet scheme, the THUS Plc Group Scheme, has a guarantee from the Company for up to £110 million.

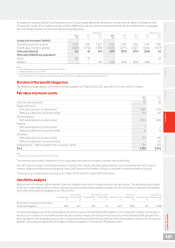

Legal proceedings

The Company and its subsidiaries are currently, and may from time to time become involved in a number of legal proceedings including inquiries

from, or discussions with, governmental authorities that are incidental to their operations. However, save as disclosed below, the Company and

its subsidiaries are not currently involved in (i) any legal or arbitration proceedings (including any governmental proceedings which are pending

or known to be contemplated) which may have, or have had in the 12 months preceding the date of this report, a signicant effect on the nancial

position or protability of the Company and its subsidiaries; or (ii) any material proceedings in which any of the Company’s Directors, members

of senior management or afliates are either a party adverse to the Company or its subsidiaries or have a material interest adverse to the Company

or its subsidiaries. Due to inherent uncertainties, no accurate quantication of any cost, or timing of such cost, which may arise from any of the legal

proceedings outlined below can be made.

Telecom Egypt arbitration

In October 2009 Telecom Egypt commenced arbitration against Vodafone Egypt in Cairo alleging breach of non-discrimination provisions

in an interconnection agreement as a result of lower interconnection rates paid to Vodafone Egypt by Mobinil. Telecom Egypt also sought

to join Vodafone International Holdings BV (‘VIHBV’), Vodafone Europe BV (‘VEBV’) and Vodafone Group Plc to the arbitration. In January 2015,

the arbitral tribunal issued its decision. It held unanimously that it had no jurisdiction to arbitrate the claim against VIHBV, VEBV and Vodafone

Group Plc. The tribunal also held by a three to two majority that Telecom Egypt had failed to establish any liability on the part of Vodafone Egypt.

Telecom Egypt has applied to the Egyptian court to set aside the decision.

Indian tax case

In August 2007 and September 2007, Vodafone India Limited (‘VIL’) and VIHBV respectively received notices from the Indian tax authority

alleging potential liability in connection with an alleged failure by VIHBV to deduct withholding tax from consideration paid to the Hutchison

Telecommunications International Limited group (‘HTIL’) in respect of HTIL’s gain on its disposal to VIHBV of its interests in a wholly-owned subsidiary

that indirectly holds interests in VIL. In January 2012 the Indian Supreme Court handed down its judgement, holding that VIHBV’s interpretation

of the Income Tax Act 1961 was correct, that the HTIL transaction in 2007 was not taxable in India, and that consequently, VIHBV had no obligation

to withhold tax from consideration paid to HTIL in respect of the transaction. The Indian Supreme Court quashed the relevant notices and demands

issued to VIHBV in respect of withholding tax and interest. On 20 March 2012 the Indian Government returned VIHBV’s deposit of INR 25 billion and

released the guarantee for INR 85 billion, which was based on the demand for payment issued by the Indian tax authority in October 2010, for tax

of INR 79 billion plus interest.

On 28 May 2012 the Finance Act 2012 became law. The Finance Act 2012 is intended to tax any gain on transfer of shares in a non-Indian company,

which derives substantial value from underlying Indian assets, such as VIHBV’s transaction with HTIL in 2007. Further it seeks to subject a purchaser,

such as VIHBV, to a retrospective obligation to withhold tax.

Vodafone Group Plc

Annual Report 2015

168

Notes to the consolidated nancial statements (continued)